The market in China

According to statistics from AWA, the Asian market consumes around 43 percent of the world’s total label volume; China accounts for 56 percent of this figure, more than half of the region’s consumption.

A stable social order, huge consumer potential and diversified consumption levels create favorable conditions for the smooth running of Labelexpo Asia 2017. By early November, there were more than 300 exhibitors registered, including 70 debutants, such as Cerm, Codimag, Domino, Fuji Xerox, Spande, Shanghai Inley, Zhongshan Sotech and more. The scene is set for the show to exceed all previous editions in terms of visitor and exhibitor numbers, floor space and product launches.

Since HP Indigo launched its first press in China a decade ago, more than 180 digital label machines have been installed. The pace is quickening too, with some 40 digital presses installed every year. The development of the local market is spurring more and more international suppliers to enter China. For example, Domino, Fuji Xerox and Xeikon all showed machinery at Labelexpo Asia. Domino displayed its N610i digital inkjet label press; Fuji Xerox showed the Durst Tau 330E digital UV inkjet label press and Xeikon showcased its 3500 mid web digital press.

In addition, the Gemini 330 color UV label press from Amica Systems made its first appearance in China, while TrojanJet also exhibited its latest equipment. Domestic companies, too, unveiled inkjet printing equipment and combined printing systems. Ningbo Vorey launched its latest digital label press, the Color DLP VP320C.

Flexo rebounds

In view of the ongoing tightening of environmental protection requirements by the Chinese government, flexo is increasingly being accepted by printers and end users. A survey showed that 41 percent of visitors to Labelexpo Asia in 2015 identified flexo as the process they were most interested in seeing at the show.

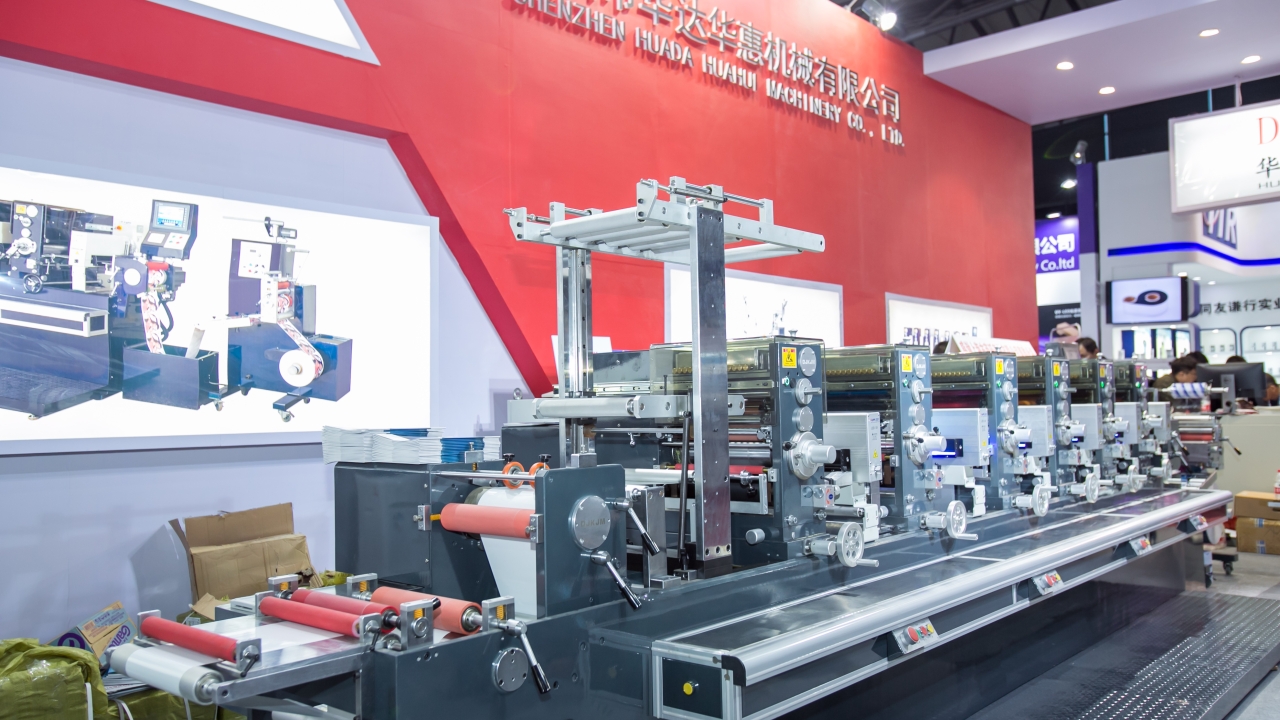

The Chinese label market is mainly focused on UV flexo printing technology, and this is reflected in the equipment on display at this year’s Labelexpo Asia. Omet exhibited for the 8th consecutive event, showing its Xflex X4 flexo press. Bobst showed the M5 UV flexo press.

The ZJR-330 flexo press from Zhejiang Weigang is driven by Rexroth-Bosch servo for tension control; its printing width is 330mm and it runs at up to 180m/min. More than 50 ZJR-330 flexo presses have been installed in China.

At the beginning of this year, Dowell Printing merged with Goss China and Shanghai Yoco Printing Machinery, and established Shanghai Uni Print Printing Technology (Uni Print). At Labelexpo Asia, Uni Print made its first appearance and showed its flexo press series. Ruian Jingda displayed a flexo press available with both solvent-based and water-based printing.

With regards flexo pre-press, Esko, Hangzhou Cron and Zhenghong Basch all showed their flexo CTP equipment. The combination of offset technology and label printing is full of Chinese characteristics. Highlights at Labelexpo Asia included intermittent offset equipment exhibited by Weigang, ZTM, Wanjie, and Kunshan Jinjian, among others.

Kunshan Jinjian showed the JJ380 waterless 6-color intermittent PS press, which is the first time waterless offset technology has been used in the domestic label industry.

French company Codimag, whose waterless offset technology is popular in the Chinese market, especially for wine label printing, made its Labelexpo Asia debut. Its unique Aniflo technology can control all the printing parameters without adjusting the balance of water and ink, thus reducing the variables of offset printing.

According to statistics from the Chinese state post office, domestic volume in 2016 reached 38.1 billion pieces, an increase of 50 percent over the previous year. A further 10 billion increase were expected to be added in 2017. The usage of 3-layer self-adhesive labels for these logistics applications was over 50 percent. At Labelexpo Asia, the whole industry supply chain for logistic labels, from raw material to application technology, was on show.

In a further demonstration of the development of the Chinese market, the show hosted a complete supply chain for RFID smart label production, including companies such as Shanghai Inley Link, Shanghai Point-link, Voyantic, Visualnet, DPS Innovations, ST Microelectronics and Thinkgo.

Read a full review of Labelexpo Asia 2017 in L&L issue 1, 2018

Stay up to date

Subscribe to the free Label News newsletter and receive the latest content every week. We'll never share your email address.