The market in North America

There’s more outside competition coming from commercial printers who are now seeing labels – once viewed as a niche market – as an attractive arena because of the sector’s continued growth. Consolidation continues to squeeze the market, the price for consumables continues to rise, lead times are getting shorter and converters are having difficulty finding skilled workers to operate their presses.

All of this is on top of less loyalty from brand owner to the label vendor. At L&L, we’ve reported a growing number of instances in which a brand owner or private label company took their label production in-house. And label procurement jobs have an extremely rapid turnover rate, meaning label converters must get to know their customers on average every 18 months, making it incredibly challenging to conduct business for many.

But it’s not all doom and gloom in the North American label market. It appears there is still plenty of work to go around.

While the overall print market is shrinking, labels and packaging is expected to grow by 2-5 percent through 2020, industry experts say.

Much of the work produced by label manufacturers in the US come from the food and beverage markets. Food and beverage remain the top end-use sectors in North America, accounting for 56 percent of the labels produced here, according to data by market research firm LPC. This is followed by health, beauty and personal care at seven percent; pharmaceutical and household chemical each account for six percent, rounding out the top five end-use sectors.

Future opportunities

In a recent survey, LPC found an increasing number of narrow web label converters entering the flexible packaging market. At 23.5 billion USD, the North American flexible packaging market makes up 23 percent of the global demand, according to the research division at Tarsus, Labels & Labeling’s parent company.

According to Tarsus research, demographic and lifestyle factors in North America include shrinking household sizes, the rise of dual-income families and the trend of snacking in place of meals all promote the demand for pouches in small or single-use sizes. All of this favors smaller format presses rather than traditional wide web CI flexo and gravure. That being said, Labels & Labeling has reported a number of label converters installing wider web presses to produce flexible packages.

LPC recently asked label converters what areas outside pressure-sensitive they were entering, and found 20 percent – or one in five label converters – have moved into flexible packaging, non-sleeves, in the past three years.

After flexible packaging, 17 percent said they were entering shrink sleeve market, and 12 percent said extended content labels was an area for opportunity.

Craft beer remains an attractive 23.5 billion USD market and the burgeoning legal marijuana market presents a massive new opportunity for label converters looking to take a piece of the 6.2 billion USD – and growing – pie.

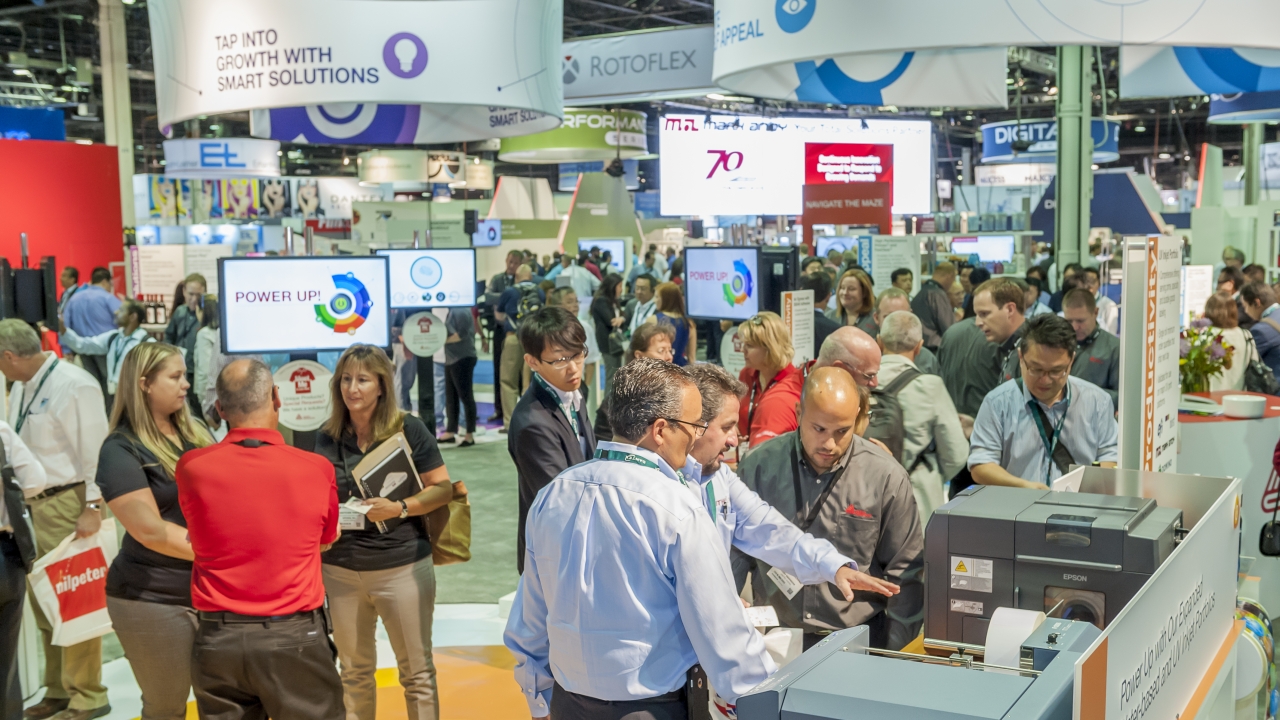

The label and packaging industry is sure to see many of these trends on display at Labelexpo Americas 2018, from September 25-28 in Rosemont, Illinois.

Stay up to date

Subscribe to the free Label News newsletter and receive the latest content every week. We'll never share your email address.