European flexible packaging market evolving through mergers

Consolidation within the European flexible packaging industry is changing the face of the sector with major regional and global groups meeting the needs of global brand owners, according to a new report from Applied Market Information (AMI).

The second edition of AMI’s Corporate performance and ownership among converted flexible packaging producers report estimates that the European flexible packaging industry consumed 3.8 million tonnes of substrates in 2012 in a business worth more than 21 billion EUR (28.5 billion USD).

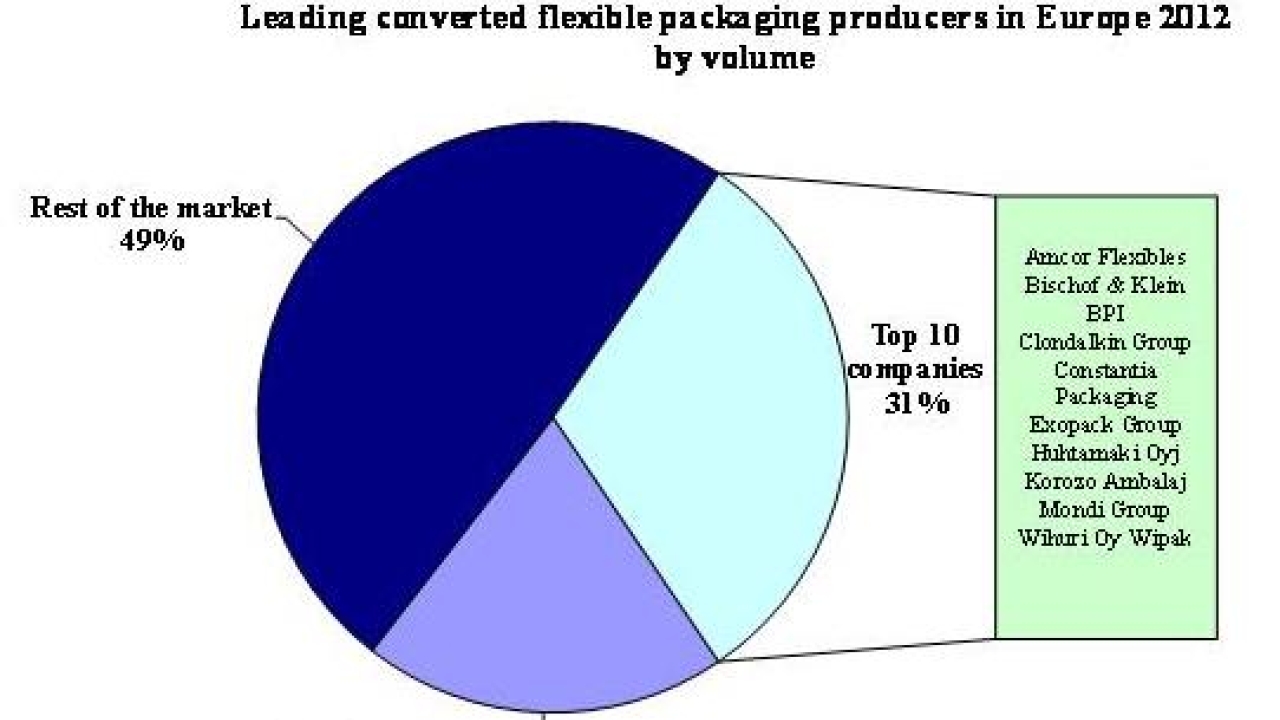

This valuation is based on analysis of 50 of the largest flexible packaging converters in Europe, and AMI said its report aims to provide analysis of the background, development and strategy of these companies. The 50 were selected on the basis of the value of their respective European converted flexible packaging sales for 2012, which it said accounted for more than half of the market by volume and value. Those featured include Amcor Flexibles, Clondalkin Group, Constantia, Bemis, Mondi and Sealed Air, along with significant regional players in Central and Eastern Europe, Turkey and major national companies in Western Europe.

AMI noted that, given the complexity of materials and combinations that can be used and the variety of converting processes that may be applied, the flexible packaging industry comprises a wide range of companies and business models, traditionally highly fragmented.

However, a number of major regional and global groups have emerged in recent times in Europe to meet the needs of the global brand owners, such as Coveris, formed by the merger of Exopack, Britton Group, PACCOR, Kobusch and Paragon Print & Packaging. This has created the sixth largest packaging company in the world.

As well as meeting the evolving supplier requirements of global brand owners, other drivers for such consolidation include rising costs, environmental concerns and the economic downturn.

AMI added that there is a greater emphasis on the emerging markets of Eastern Europe and Russia, along with moves to shift production to higher value products within West European operations or close them altogether.

‘As these leading European flexible packaging converters evolve and change, an understanding of their strategy and future direction is critical for all companies involved in the business,’ AMI said in a statement.

Stay up to date

Subscribe to the free Label News newsletter and receive the latest content every week. We'll never share your email address.