UK firms unprepared for DPP

Research shows only 43 percent are ready for the EU compliance deadline.

UK manufacturers and wholesalers are largely unprepared for the EU's Digital Product Passport (DPP), with only 43 percent saying they are ready for the regulatory initiative set to begin in 2027, according to new research from Forterro.

The study found that fewer than half of UK industrial midmarket companies are aware of the DPP and what it entails, while around one in five were unsure whether their business would be affected at all, despite the regulation applying to any business exporting to the EU.

'The Digital Product Passport will be to product manufacturing what GDPR was to data,' said Claudia Schmidhäuser, senior principal, product management at Forterro. 'We saw what happened when companies weren't ready for GDPR, and too many UK midmarket firms are still unaware or underprepared.'

The main barriers to DPP readiness include the complexity of requirements, cited by 47 percent of respondents, a lack of suitable technology to manage compliance and insufficient internal compliance resources. UK firms expect to spend an average of 28,000 GBP on managing their DPP obligations over the next few years.

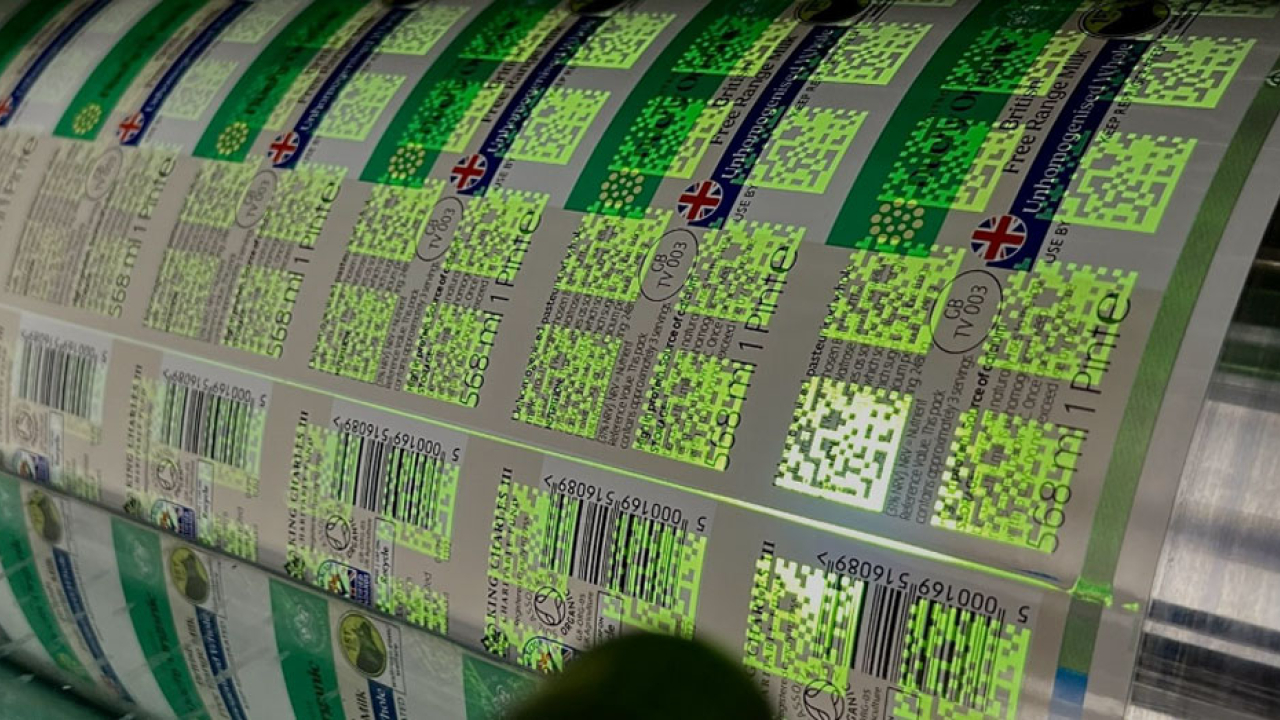

The DPP requires detailed digital records of a product's lifecycle, covering everything from materials sourcing to repair and recycling. Battery products are expected to begin compliance in 2027, followed by other categories, including textiles, iron and steel. When the regulation is in place, no product without a DPP will be able to be placed on the EU market.

Environmental regulation was seen as the area of compliance posing the greatest challenge for UK industrial midmarket firms, while 45 percent said that compliance influences their operational and technology purchasing decisions.

The research also revealed that adjusting to exports in light of recent US tariffs was cited as the main challenge by around one-third of respondents, followed by ongoing global economic and political uncertainty and protecting the supply chain.

The findings are part of Forterro's 2025 research, The Digital Future of the European Industrial Midmarket.

Stay up to date

Subscribe to the free Label News newsletter and receive the latest content every week. We'll never share your email address.