Backing linerless labels

Barry Hunt examines how sustainability issues are boosting interest in linerless labels

Linerless labels have a release coating on the face and an adhesive on the back. When wound in rolls the coating prevents the labels from sticking to each other, much like industrial tapes. Their most obvious benefits as an alternative to conventional laminates is that the elimination of paper or filmic liner, or backing, greatly reduces raw material costs as a percentage of a label's total production costs. There are also more finished labels per roll to reduce overall handling and transport costs. Waste reduction as an environmental issue is also important. After all, the liner has no further use once the label is applied to the pack or container, whereas a linerless label uses all the material through its life cycle.

Preventing this wastage was always a major aim of the early – and largely unsuccessful – schemes to introduce linerless technology. Today the improved techniques with current offerings have fortunately coincided with a greater awareness of so-called 'sustainability'. In a packaging context they reflect the increased awareness by retail chains and brand owners of the need to take environmental and social issues more seriously. There are now numerous initiatives around the world intended to encourage more packaging recycling schemes and so reduce landfill waste. Vocal support from consumers and environmental lobby groups also back these initiatives with the aim of minimizing the impact of packaging on the environment.

The renewed interest in linerless technologies also coincides with attempts to persuade converters to sign up to release liner recycling schemes. As one would expect, we are unlikely to see the demise of the release liner any time soon. Liners fulfill a useful role as a protective carrier for the pressure-sensitive adhesive, while acting like an anvil to facilitate accurate die cutting or perforating. However, in the wider scheme of things, annually dumping billions of tons of spent silicone-coated paper or filmic release liners in holes in the ground is the antithesis of good environmental practice. Even more so when one considers that siliconized glassine and kraft paper liners are made from high-quality wood fibers that are commercially suitable for recycling.

Finat, the label trade organization, supports several European recycling schemes. They begin with the free collection of spent liner from the converters' premises, and transportation to a repulping plant, using water that contains chemicals to release the silicones from the fibers. A flotation process follows of the type normally used for deinking/cleaning fibers of repulped printed papers. The same process removes the released small silicone particles, resulting in pulp suitable for making new products, such as fine and specialty papers – including release liner and facestocks.

Most siliconized filmic liners are made from polyester (PET) or polypropylene (PP) polymers for many prime-label applications. Spent liners are reground and granulated into plastic raw materials for a wide range of industrial and consumer products, as well as for new silicone film.

The more prominent recycling initiatives include partnerships between Avery Dennison and Morssinkhof Rymoplast for recycling PET liners in Europe; the film and paper recycling schemes in Europe and the USA run by Channeled Resources; paper liner recycling throughout Europe by Cycle4green (C4G) with Lenzing Papier as an Austrian papermaking partner; and the RafCycle scheme for recycling paper and PP liners from UPM Raflatac.

Interestingly, in the US Mitsubishi Polyester Films has developed Reprocess as a sustainable technology for recycling PET liner. It was beta tested as part of Spear’s global corporate program named Spear Earth. Release liner makes up about 30 percent of Spear’s product. Instead of being landfilled, the new technology allows cradle-to-cradle recycling of spent liner into new grades. Mitsubishi says it hopes Reprocess will eventually become an industry standard.

Linerless initiatives

Whether these and similar recycling initiatives will effect linerless usage is a moot point, but we do know where the current impetus is coming from says Yves Lafontaine, VP marketing for ETI Converting in Canada: ‘The pressure to adopt linerless technology is definitely coming from the end-users, not the converters. Initially, linerless didn't kick-in because of the limitations on both format sizes and die cut shapes, but that has been overcome.’

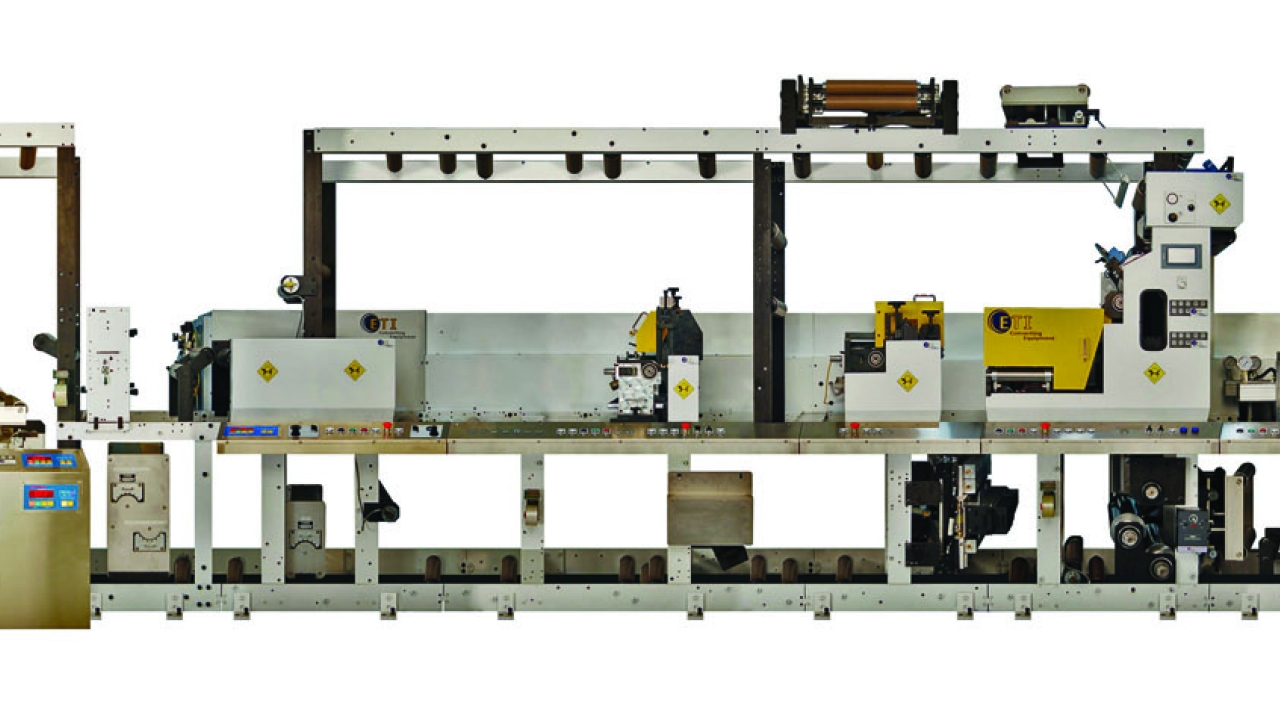

ETI's technology follows several years of developing a linerless version of its established Cohesio coating line, ostensibly developed for converters to manufacture labelstock in-house. The new linerless model comprises a single unwind (rather than two), UV flexo printing units, conventional die cutting modules, and individual coating units for the water-based silicone and hot-melt adhesive. Printed webs can be paper or biaxially-oriented polypropylene (BOPP) grades.

Lafontaine says that after several years of development, the company is going ahead in full gear to build its linerless business. ETI has already signed non-disclosure contracts with at least 10 major brand owners in North America. Interestingly, when researching the market the company found that roughly 36 percent of labels are applied manually. It is a common practise among international packers of soft fruit, where applying linerless labels by hand in the field eliminate the problem of dealing with unsightly and useless spent liners.

Other manufacturers of converting and finishing equipment have begun to notice the potential for linerless technology. These include Prati, which recently introduced a linerless version of its Saturn slitter/rewinder, complete with die cutting facilities and a large unwind diameter. On the substrate front, Gruppo Irplast, a maker of coated BOPP films, supplies a 60-micron matte film with guaranteed bar code readability. Innovia Films, a major UK-based manufacturer of BOPP and cellulose label and packaging films, recently introduced Rayoface NB in two linerless grades. The 92-micron version can replace carton board for sleeving food packs, while the 60-micron is suitable for conventional filmic labels and wraparounds.

Innovia’s partnership with Ravenwood Packaging offers some insights into a large-scale linerless operation. Founded in 2004, it is located in Bury St Edmunds, UK, with a US subsidiary in Georgia. The main products include the Comac 500 coater and slitter/rewinder. It converts pre-printed webs for use with Ravenwood's Nobac linerless label applicators. These include the Nobac 500 sleever for applying sleeves in five formats, such as C-wrap and full wrap, to packs for chilled foods and convenience meals. It handles up to 180 packs/minute. Users can specify optional thermal transfer overprinters. Its wide-edge presentation of labels to the pack is said to deliver more labels per reel with reduced downtime.

‘Linerless is ideal for this type of food packaging,’ says Paul Beamish, founder and managing director. ‘We also see a growing potential for linerless wraparounds for bottling applications. By targeting brand owners we intend to move slowly into other areas. Ultimately our business is based on developing specialized applicators, which must be as good as, or better than, conventional in-line applicators, and linking them with a commercially viable in-line coater.’

The Comac 500 uses specific glue heads for applying accurately monitored lines of hot-melt adhesive, from three mm to 25mm, on the reverse side of the label. The small amount of water-based silicone used for coating the front is nitrogen inert, which means deleterious oxygen has been flushed from it. The pre-printed labels are slit and rewound on a three-core turret rewinder. A narrower 300-mm wide version was introduced at a food trade show in March.

Ravenwood's European customers include Paragon Print & Packaging, based in Spalding in Lincolnshire, it is one of the UK's largest label converters, with specialities that include food packaging. It uses two Comac 500 coaters in its linerless division, using conventional UV flexo presses for printing the facestock. Reflex Labels, another large UK label converter/packager, also uses Ravenwood equipment for linerless labeling of small jars, drinks bottles and chilled food packs.

Generally speaking, the water-based silicone release coating also protects against exposure to UV, and resists moisture and chemicals, which add to a label's longevity. Also, linerless labels can be printed on both sides since the release coating and adhesive is applied after the label has been printed. Without the need for matrix waste stripping, flexo presses can usually run faster, while having just a single substrate can aid overall print quality.

Print-and-apply growth

One of the fastest growing linerless sectors relate to the various print-and-apply applications. Several systems are available, each boasting high productivity, fast reel changes and a choice of ribbon-based thermal transfer printers from OEM suppliers. The main demand is for linerless pallet labels, autoID labeling, and price-weigh labels where measuring devices are included as part of the system. They usually run with MS Windows operating software and the thermal transfer paper or filmic materials can include metalized grades to achieve special effects, perhaps with a corresponding metallic ribbon.

Recent examples include the new TT-PA Evo 150 from Transfer Trade, part of the Italian T-T Trade group. With an emphasis on easy reel handling, the machine runs with reels up to 400mm in diameter, dispensing three times as many labels as a similar size of pressure-sensitive labels. Furthermore the system allows label length changes on the fly. ALtech offers the new Alcode LL print-and-apply machine with an unwind, cutter and thermal transfer printer; applying labels with air or contact methods. Speeds vary between 20 to 80 labels/min depending on label size.

Tamper Technologies based in Derbyshire, UK, offers linerless technology for its range of tamper-evident labels. Users can apply them onto cardboard cartons, plastic containers and flexible packaging. Once applied the labels leave a clearly visible warning message ‘VOID OPENED’ for quick detection of attempted theft or attack. ‘The increase in roll capacity and reduction of shipping, carriage and storage costs make the linerless label a great option for our distributors and their customers. We are delighted with this product range as it makes sense. It costs less and is good for the environment too,’ says Chris Chiles, managing director. He adds that standard and bespoke linerless labels now account for nearly 60 percent of its global tamper-evident business. Current usage includes a variety of industries from logistics and transport, food, retail through to pharmaceutical and asset protection.

The specialized nature of linerless technology, with its requirement for dedicated applicators, has led to several licensing arrangements. With protected trademarks and patents, they resemble those in the extended text, leaflet-label applications. An example is the Catchpoint linerless system based on microperforations, now used widely for a variety of prime and print-and-apply applications.

Based near Leeds, in the UK, and with a US subsidiary in New Jersey, Catchpoint's partnerships include Label Aire, makers of vacuum-based systems, and AEW Delford, a global supplier of price-weigh machines with variable data overprinting. One of its largest projects aimed at global brand owners involves a partnership with WS Packaging Group, a founding licensee with 17 manufacturing locations in North America and Mexico. Catchpoint also has links with ILTI, an Italian maker of high speed rotary applicators.

At the time of its launch in 2005, Catchpoint claimed its technology would contribute to cost and environmental savings across a broad spectrum of solutions, with no adverse effect on production efficiencies or shelf appeal. Furthermore, creative brand managers could additionally exploit the change to meet consumers’ demand for less packaging waste. As the company's publicity points out, no other packaging component wastes over 50 percent of input materials.

Seven years on it would appear that manufacturers of fast-moving consumer goods are catching up in the name of sustainability. Many have introduced packaging designs with much smaller environmental footprints. A notable example of what is happening in this fast-changing scenario comes from the international drinks giant Diageo. Its Sustainable Packaging Guidelines refers to all aspects of its huge packaging spend. It has the ambitious goal of ensuring 100 percent of its packaging designs are reusable, recyclable or suitable for waste management practices within individual countries by 2015.

Linerless technology would appear to tick many of the sustainability boxes. With improved coating technology and advanced applicator equipment, it could make a big impact in several key prime label sectors, especially food packaging areas. It is also poised to make further inroads into the labeling of glass bottles and jars, while building on existing thermal transfer print-and-apply growth in the logistics, and data labeling sectors. Combined with any expansion of the various spent liner recycling schemes, the latest linerless technology could make a big contribution towards helping self-adhesive labeling clean up its act.

Pictured: ETI’s linerless version of its Cohesio coating line

This article was published in L&L issue 2, 2012

Stay up to date

Subscribe to the free Label News newsletter and receive the latest content every week. We'll never share your email address.