Finat: Label demand showing signs of cool down

After last month’s report of slowing demand for self-adhesive label materials in 2018, Finat’s latest edition of the six-monthly market monitor, the Finat Radar, confirms signs of a cooling label market.

Last year’s consumption of self-adhesive label materials in Europe amounted to a total of just under 7.5 billion square meters, an increase of 1.4 percent on 2017. 2018 continued the signs of slowdown that became evident in the course of 2017, when the market grew by 4.7 percent, below the average 5 percent plus annual growth rates that had been recorded since the bottom of the last recession in 2011.

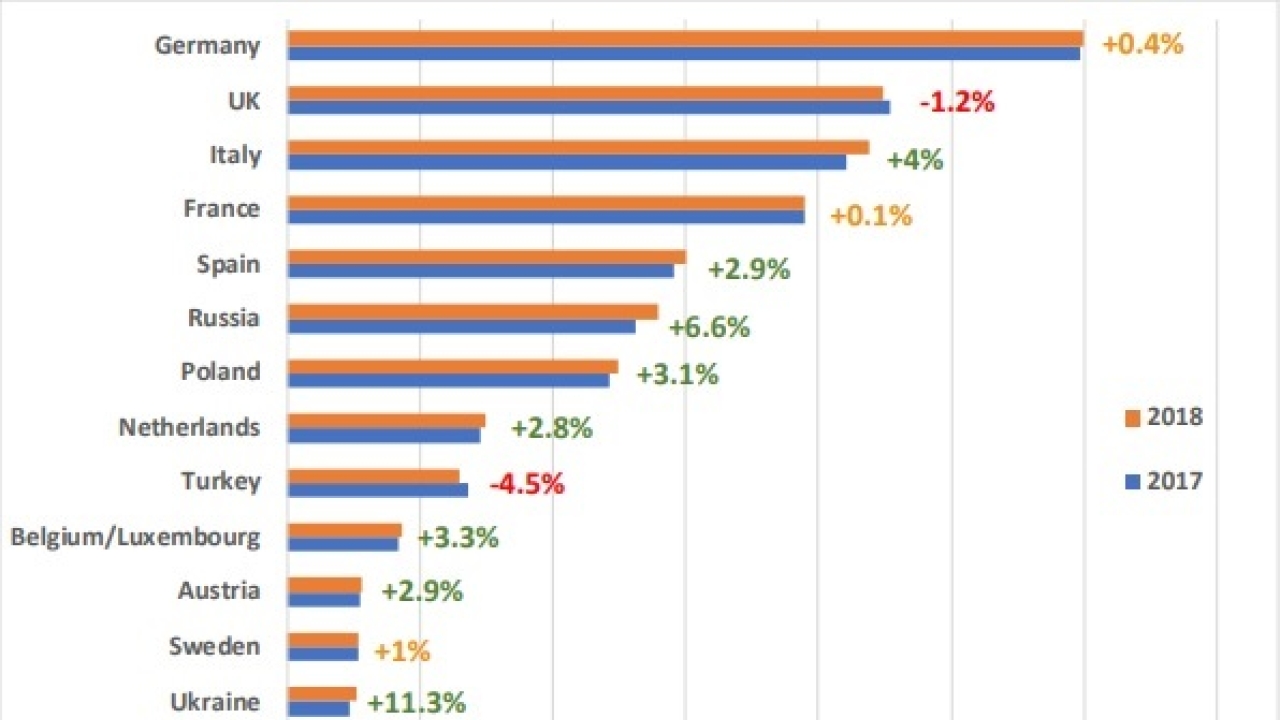

For the first time since the beginning of the decade, there was a mixed picture of label volume demand growth rates across Europe. While leading markets like Germany and France recorded modest growth rates below 0.5 percent, several southern and eastern EU markets continued to achieve above average growth rates between 2.5 percent and 4 percent, while emerging markets in Russia and Ukraine recorded strong growth numbers in excess of 6 percent.

By contrast, at opposite ends of the continent. The UK and Turkey recorded negative growth of more than 1 percent and 4.5 percent respectively, although towards the end of 2018 and beginning of 2019, this was a pre-Brexit stocking effect in the UK leading to a rebound of labelstock demand.

Given the strong historic correlation of labelstock demand and GDP development, the slowdown of the label industry is a significant indicator of economic uncertainty, after years of macro-economic recovery. Nevertheless, the prospects for the self-adhesive labels and narrow web packaging industry remain healthy.

In the past two decades, the European self-adhesive label market grew by a factor 2.5, led by the continuous maturing of label markets in eastern Europe, and by innovations in variable information printing technology and high-quality product decoration. Eastern Europe now accounts for almost one quarter of the European label market (almost a doubling of its market share in 15 years), while high-end filmic label materials are approaching the 30 percent benchmark of total label materials demand in Europe.

Edition 11 of the Finat Radar was based on a survey carried out among 80 label converters across the different regions in Europe. The results from the survey reflect the above picture, as year-over-year sales growth is down in most regions, and with 4.9 percent was the lowest since the survey’s base year 2013. There was also a remarkable shift between 2017 and 2018 in growth rates per top three end-use segment. While 2017 was the year of 'non-prime’ (VIP) label growth, 2018 showed a stronger performance in the prime labeling sectors (with the exception of industrial chemicals).

For the first time since start of Finat Radar, there were declines in some of the segments. Feedback from converters also shows that companies are exercising more caution in 2019, with only 10-15 percent of participating converters planning to purchase a conventional or digital press this year. Capital equipment purchasing projections are markedly higher for 2020, in case of continued unfavorable domestic and export economic conditions, converter caution may extend into the foreseeable future.

Looking at the short term however, the first quarter of 2019 appeared to indicate a rebound, with self-adhesive roll labelstock demand increasing by 4.2 percent compared to the first quarter of 2018.

Going beyond self-adhesive, it is interesting to note that 35 percent of the respondents indicated that they are currently already active in the area of flexible packaging. Also shrink sleeves and wraparound labels are part of the product portfolio of more than 25 percent of label printers’ portfolio. And the interest to diversify into other areas continues to grow, especially in areas like pouches and linerless labels.

Finat president Chris Ellison said: ‘One of the crucial elements for business development is the availability of up to date market information, and as we saw in Copenhagen during the European Label Forum, after successive years of above average growth since the early years of the decade, we are facing economic uncertainty that is resulting in a slowdown. The Radar reports prove an invaluable tool for our members to assess the specifics by region and vertical market segment, from the label converter perspective.’

For the first time, there is also a section to check the status of recycling inside our industry. Ellison continued: ‘As we saw during roundtables with label converters at the ELF, sustainability and recycling are at top of label business leaders’ agendas. The issues at stake (raising awareness through education and lobby, organizing the logistics and making sure that collection and recycling solutions become technically and commercially viable), are beyond the scope of individual companies and requires a collective approach involving all stakeholders.’

Stay up to date

Subscribe to the free Label News newsletter and receive the latest content every week. We'll never share your email address.