Private equity firm to buy Kodak flexographic packaging division

Eastman Kodak Company has entered into a definitive agreement to sell its flexographic packaging division to Montagu Private Equity.

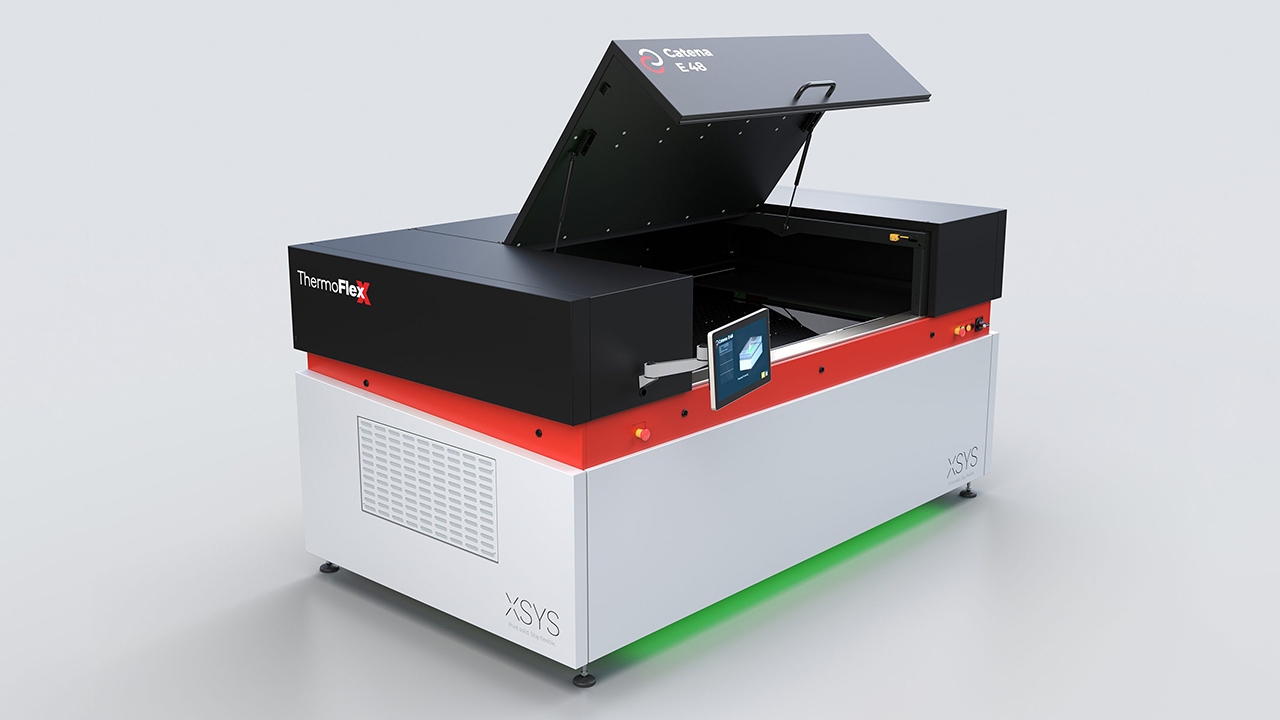

After closing, which is expected in the first half of 2019, the business will operate as a new standalone company that will develop, manufacture and sell flexographic products, including the flagship Kodak Flexcel NX System, to the packaging print segment.

Private equity firm Montagu’s self-defined mission statement is to, ‘focus exclusively on management buyouts where we can back strong incumbent CEOs who want to acquire the business they run, usually from a corporate owner or a founder. We invest and work in partnership with a company's management team so that, together, we can maximize the value of our investment by unlocking a business’ full potential.’

Ed Shuckburgh, director at Montagu, said: ‘We focus on the acquisition of companies producing products or services that would be badly missed if the business did not otherwise exist, and are delighted to be investing in Kodak’s flexo business, which has been very well established within Kodak and clearly meets our target profile.’

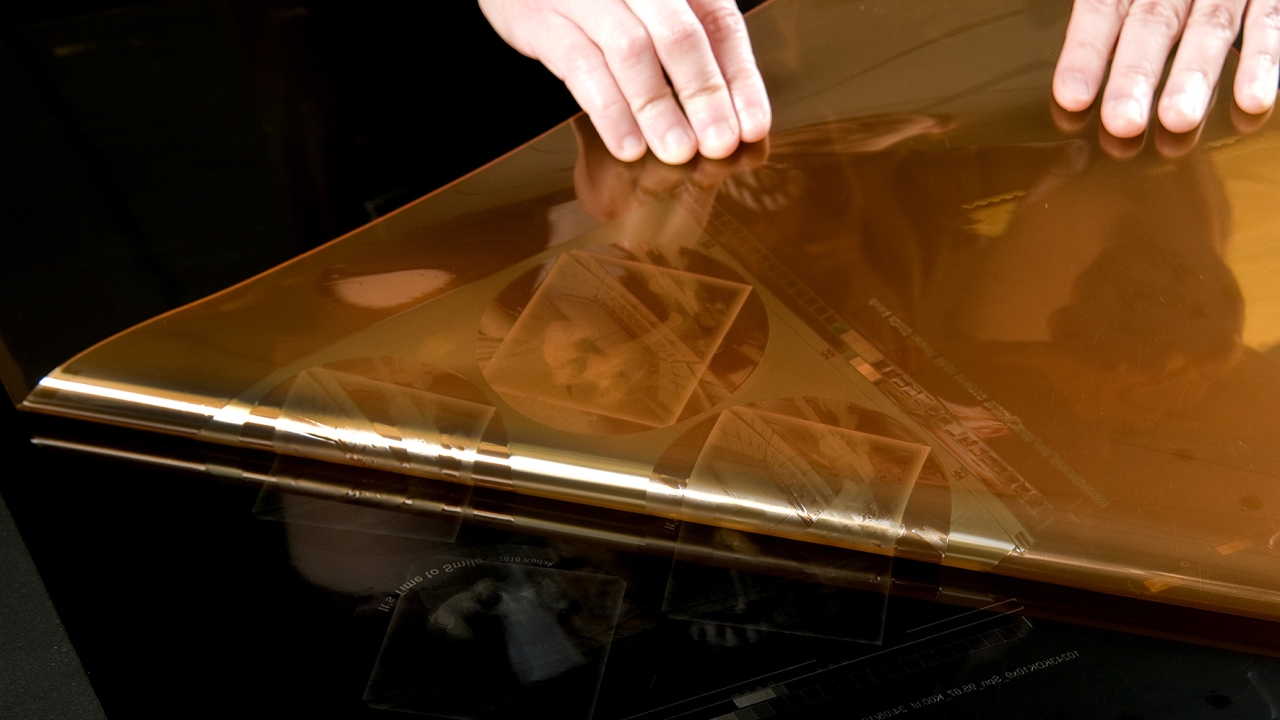

Christoph Leitner-Dietmaier, investment director at Montagu, added: ‘Kodak’s flexo business is well positioned to benefit from the exceptional growth in the packaging printing market. The company’s proprietary thermal imaging film technology enables it to offer a truly differentiated product that consistently produces high performing output. We are very much looking forward to working with the management as the business enters this next stage of its development.’

Under its new ownership, the business will have the same organizational structure, management team and growth culture that it has operated in recent years. Chris Payne, who has served as president of the flexographic packaging division for the last three years, will lead the new company as CEO.

Kodak expects to receive total value of up to US$390 million, comprised of: a base purchase price of US$340 million, subject to purchase price adjustments; potential earn-out payments of up to US$35 million over the period through 2020 based on achievement by the business of agreed-upon performance metrics; and US$15 million payable by Montagu to Kodak at the closing as a prepayment for various services and products to be provided by Kodak to the business post-closing pursuant to commercial agreements, subject to completion of certain pledge and collateral arrangements.

Kodak noted that it remains committed to the print industry and delivering products and services which meet the evolving needs of printers. Following this transaction, Kodak will continue to focus on the demonstrated growth areas of Sonora environmental plates, enterprise inkjet, workflow software and brand licensing.

Kodak CEO Jeff Clarke said: ‘This transaction is an important turning point in our transformation and is a significant, positive development for Kodak. The sale of the flexographic packaging division unlocks value for shareholders and strengthens our financial position by providing a meaningful infusion of cash which allows us to reduce debt, improving the capital structure of the Company and enabling greater flexibility to invest in our growth engines.’

Stay up to date

Subscribe to the free Label News newsletter and receive the latest content every week. We'll never share your email address.