Trisan Printing strategizes growth

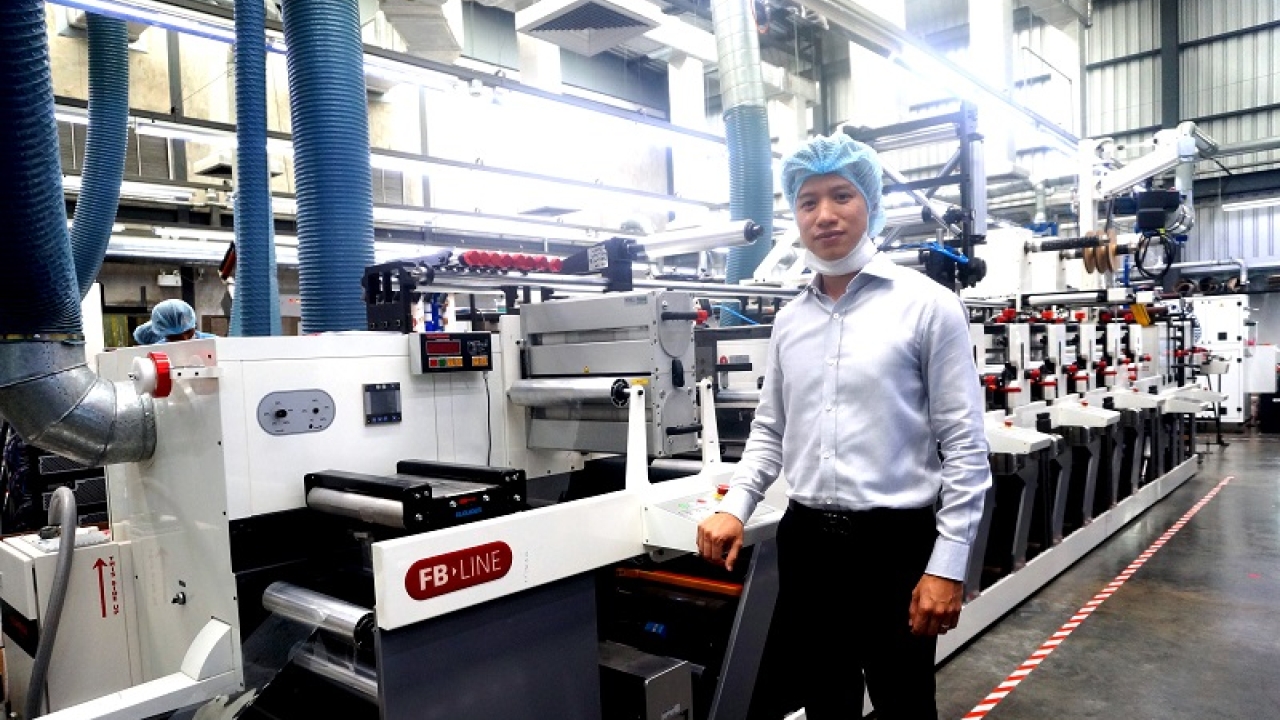

Bangkok, Thailand-based Trisan Printing is targeting a turnover of US$9 million after completing an expansion at its facility with a new Nilpeter flexo press in October 2017.

Managing director Piyapong Wongvorakul says: ‘We grew at 12 percent in 2017-18 fiscal. However, prior to that we were growing at more than 20 percent year-on-year because business started from a small base.’

Trisan Printing started operation in 2000 with one flatbed letterpress from Korea that produced barcode and text printed nutrition labels for local food companies for three years, before it decided to invest in Taiyo, a Japanese rotary press, in 2003 for printing color labels.

‘It was around 2003-04 when brand owners in Thailand started using label applicators to apply labels on containers,’ says Wongvorakul. ‘So, we had to invest in a roll-to-roll web press to cater to the changing requirements of the market. Moreover, letterpress ran efficiently for short run jobs but we could print jobs up to 20,000 linear meters using the Taiyo.’ Though the company sold the intermittent rotary press in 2017, it still runs a flatbed letterpress.

To remain competitive in the evolving market, Trisan Printing decided to invest in flexo technology with an Omet press in 2011. ‘We realized that the quality on a flexo press was great and there was less set-up time, compared to letterpress, also because it is a more automated machine. Though the initial cost was high, it saved us a lot of time and money in the medium to long term,’ says Wongvorakul.

The company had also shifted to its new factory in 2011, spread across an area of 2,200 sqm in Sinsakhon Industrial Estate on the outskirts of Bangkok. With enough space for future expansion, Trisan Printing invested in its second flexo press in 2012, this time a Nilpeter, followed by the second Nilpeter last year. With four machines running on the production floor, the company now prints pressure-sensitive, in-mold, wet-glue and booklet labels, mainly for the Thai market.

Wongvorakul, however, reveals that the growth of in-mold labels is slow in Thailand because most material gets imported from Turkey. ‘Therefore, it is more reasonable to get these labels printed outside Thailand. However, for blow molding, most printers use the same material which is expensive throughout the world. So, it’s cost effective to produce those locally as well,’ he says.

As for short run jobs, Trisan prints them mainly on its letterpress and a small table-top inkjet unit. Wongvorakul says, ‘We have been looking at ways to offer short run labels to customers at a better price because the market in Thailand is very competitive. We evaluated a digital label printing press, however we find that there are many inkjet printers here and a digital press cannot compete with their price.’

Equipped with ISO certifications, Trisan Printing has mainly catered to the food market since its inception but is now foraying into pharmaceutical and cosmetics. It has been certified with Good Manufacturing Practices (GMP) certificate that will enable it to cater to new industries.

‘Companies in these new segments want printers to offer them a complete package including labels, leaflets and a box. We are fully geared to cater to their requirements with a 6-color Komori press equipped with in-line inspection system and a 2-color Heidelberg press. We also have in-line inspection and workflow system on the Omet and one of the two Nilpeter presses,’ Wongvorakul says. For finishing, the company uses one slitter rewinder each from Web Control and Grafotronic.

Turning to material costs, Wongvorakul says: ‘We don’t face a lot of price pressure from brand owners because our costs are in sync with market requirements and we are constantly working towards being more efficient. Moreover, the ink price has come down in the country over the years and substrate manufacturers have reduced prices too. Labelstock manufacturers change adhesive and use lighter grammage of material so the cost reduces but the performance of the label remains the same. Multinational and local labelstock manufacturers are very competitive in the market. However, the cost of logistics and wages have gone up for which we need automation and be more efficient in-house.’

Automation

Trisan started using enterprise resource planning (ERP) software in 2008 and is now in the process of implementing ERP from Microsoft. ‘It will enable us to get precise information from all departments and all data will be centrally located. It also automates a lot of repetitive and routine tasks that saves a lot of time, and simplifies human resources functions,’ says Wongvorakul.

Trisan is also adopting Manufacturing Execution System (MES) that allows machines to communicate with the ERP system. ‘Live data from presses, such as linear meters printed, number of stops, time the press started running, amongst others, is fed into the system which allows for better workflow,’ explains Wongvorakul. Due to automation, Trisan today has a workforce of 47 people as opposed to 70 last year.

With increasing automation and quality control systems, Wongvorakul is looking at increasing its export market share which currently stands at 0.2 percent of turnover. ‘We need a bigger sales and marketing team to reach our full potential. We want to cater to the Japanese market because it’s mature and customers offer good value for a quality product. Many Japanese companies have started business in Vietnam and Cambodia. However, we still need to study logistics so we can further reduce our shipping cost. Increase in turnover doesn’t necessarily translate to more profit without in-house efficiencies,’ he says.

Trisan has also started producing film without adhesive which can be used in the electronic labels sector. ‘It is a high growth potential segment for export and we need to diversify from printing only pressure-sensitive labels to be able to grow,’ says Wongvorakul.

Waste management

While growing the company, Trisan Printing is also making efforts to be more sustainable and environment friendly. Being in an industrial estate, the company follows standard regulations for waste disposal that include water treatment before disposal, managing chemical waste such as ink and varnish which is outsourced to a company with expertise, and recycling of labelstock.

While matrix waste is sent to a local company for landfill, liner waste, without adhesive and matrix, is sold to waste management companies for recycling. Each area has a designated collection truck that goes to every factory to pick up silicone liner, metal and other waste that can be recycled. Several truck-loads of waste are collected and sent to a company for recycling.

‘Though we know the amount of liner that gets wasted at a customer site and have the capability to collect and get it back to the factory, most brand owners prefer to sell it to waste management companies at their end and make money from it. Therefore, each manufacturing unit handles waste at their end in the industrial area,’ says Wongvorakul.

Stay up to date

Subscribe to the free Label News newsletter and receive the latest content every week. We'll never share your email address.