KBA benefits from focus on packaging as results show strategy is 'paying off'

KBA’s strategy to focus its activities on key growth markets is ‘paying off’, according to Claus Bolza-Schünemann, the company’s president and CEO, as it reported a 22.3 percent increase in group revenue in the first nine months of the year, when compared to 2015.

Group revenue stood at 831.4 million EUR (906.2 million USD) on September 30 this year, versus 679.7 million EUR (740.7 million USD) on the same date in 2015. Revenue growth was recorded in all three segments, although its Digital & Web segment saw the biggest jump, up 74.6 percent year-on-year to 110 million EUR (120 million USD). Revenue in the Special segment was reported at 338.2 million EUR (368.5 million USD) for the nine months to the end of September, up 22.3 percent. Sheetfed segment revenue was up 17.5 percent to 443.8 million EUR (483.5 million USD).

At 85.2 percent, the export level remained at the previous year’s high level, with Europe, excluding Germany, contributing 30.5 percent, North America 14 percent, Asia/Pacific 29.2 percent, and Latin America and Africa 11.5 percent to group revenue.

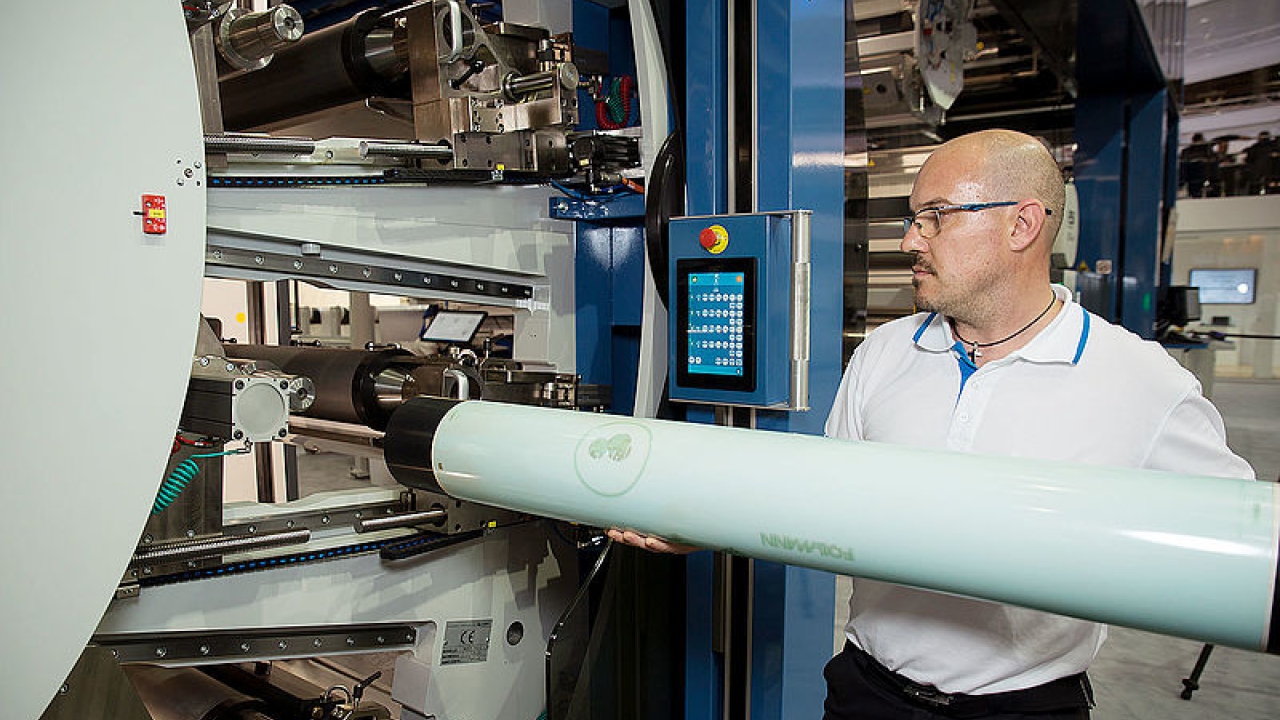

Special segment order intake raced ahead during the nine-month period to 384.3 million EUR (418.5 million USD), a 29.9 percent increase on last year, with Digital & Web up also by 11.2 percent. Sheetfed order intake during the first three quarters of 2016 was down 16.8 percent against 2015’s figure. In the growing market for flexible packaging, KBA-Flexotecnica received substantially more new orders for its CI flexo printing presses in 2016 than in 2015

Against the backdrop of the economic slowdown in China and other export markets, the order intake of 429.8 million EUR (468 million USD) in the Sheetfed segment fell short of the previous year’s figure in line with expectations, according to KBA. New printing press business was also dampened by workload-driven longer lead times and the necessary price discipline. Order intake in the Digital & Web segment grew owing to a number of orders for web offset presses, as well as further orders from HP for the inkjet web press assembled at the site in Würzburg. Increased business in security, metal, coding and flexible packaging caused order intake in the Special segment to climb at the rate reported.

‘With underlying economic and political conditions still challenging, our heightened focus on the growth markets of packaging and digital printing, as well as service business, is paying off,’ commented Bolza-Schünemann. ‘Even more encouraging than the substantial revenue growth is the sizeable increase in earnings for the period under review underpinned by the high profit generated in the third quarter. With operating earnings (EBIT) of 39.2 million EUR (42.7 million USD) and earnings before taxes (EBT) of 34.9 million EUR (38 million USD), we were able to substantially outperform the first nine months of the previous year. All segments contributed to this performance with positive figures for the quarter and the first nine months.’

An order backlog total of 613.3 million EUR (667.7 million USD) ensures capacity utilization until spring 2017, KBA stated, although the reported figures reveal it was the Special segment that has ensured this, with an increase of 38.1 percent to 296.2 million EUR (322.5 million USD). Sheetfed and Digital & Web order backlog totals were down 16 and 22.5 percent to 268.9 million EUR (292.8 million USD) and 60.3 million EUR (65.7 million USD) respectively when measured against 2015.

KBA said this means that capacity utilization in the Special segment is assured ‘until well into next year’, while Sheetfed order backlog ensures good capacity utilization for KBA’s sheet-fed offset production facilities until well into the first quarter of 2017. Digital & Web segment order backlog remained at a satisfactory level.

KBA stated that it is feeling the effects of the damper being placed on the global economy by international conflicts, economic and financial problems and political uncertainty, as seen by the entire German mechanical engineering industry. However, on the strength of the group’s favourable business performance in the first nine months and the high capacity utilization that is secured until well into spring 2017, the executive board has raised its full-year earnings guidance for 2016. With group revenue expected to be between 1.1-1.2 billion EUR (1.2-1.3 billion USD), management now projects an EBT margin of up to five percent.

*currency conversions correct as of November 10, 2016 via xe.com/ucc

Stay up to date

Subscribe to the free Label News newsletter and receive the latest content every week. We'll never share your email address.