Label Forum shows Japan’s strength

The Label Forum was opened by Yu Tanaka, president of the Japan Label Federation, and Hiroyuki Nishio, CEO of event sponsor Lintec. Nishio spoke of the growing importance of Asia-Pacific in the world label market, now representing 43 percent of global consumption. This is expected to rise to 46 percent by 2019, growing at twice the rate of Europe and North America.

Corey Reardon, president and CEO of consultancy AWA, said that shrink sleeves are now the second biggest primary product label technology – after wet-glue – in Asia-Pacific, representing over 41 percent of the market by square meters. PS accounts for 22 percent. In European and North American markets, by contrast, PS and shrink sleeve have roughly equal shares of around 23 percent. Reardon stressed that these figures do not include VIP materials, which account for almost half of PS consumption worldwide.

Japan, with its high consumption of shrink sleeve labels, very largely accounts for the difference between the Asia-Pacific and Western markets in terms of material types. Worldwide, shrink sleeves remain the fastest-growing label segment at 8 percent a year.

‘This represents a growing opportunity for pressure-sensitive labels in Japan and for sleeves outside Japan,’ said Reardon. He noted IML is growing in some segments, though its overall market share has changed little.

Widening his field of vision to competitive decoration technologies, Reardon noted that in Asia-Pacific many products are in sachets rather than the rigid packs. ‘Flexibles are growing at twice the rate of rigid containers, particularly in the food, household and pet care market segments.’

Letterpress dominates

Natuski Uchida, executive planner in the editorial department of Label Shimbun, looked in more detail at trends in the Japanese label market. He noted that letterpress is by far the dominant technology for PS label production in Japan, with flexo still a long way behind. He also drew attention to the structure of the Japanese industry, with the few bigger companies growing faster than the mass of smaller converters.

Uchida said the biggest threat to these converters is coming from companies outside the label sector: ‘They are better at leveraging digital printing and are taking business

away from established players. They are better at making a full range of proposals to customers.’

These ‘outside’ companies are also buying presses for commercial and flexible packaging work.

Takashi Yamamoto of Lintec Corporation gave the company’s perspective on the Japanese economy and label industry. He said label shipments, both film and paper, have finally exceeded pre-financial crisis levels despite the additional shock of the Tohoku earthquake. This recovery has been supported by the supply-side economics (‘Abenomics’) pursued by the Japanese government. Total label shipments now stand at almost 120m sqm/month.

The Japanese label industry is looking forward to a major boost from the 2020 Tokyo Olympics/Paralympics and the 2025 Osaka world exposition. ‘Our aim is to help brands use new technologies to fully exploit their marketing strategies.’

On the innovation front, Yamamoto explained Lintec’s new technology for eliminating bubbles when PS labels are applied: by embossing grooves onto the liner, allowing trapped air to escape. The company has also developed specialist adhesive technology to ensure labels adhere to an oily surface without needing to clean it rst. The oily substance is actually absorbed into the adhesive.

Ra Albo, founder and CEO of SEG Marketing, looked at how products connected to the web are creating a new category – ‘onlife’ marketing, or ‘one-to-one connected packaging which adapts to the person consuming the product’. Personalized overlays are delivered via a user’s smart device triggered by embedded codes.

Jim Anzai, managing director Asia for CCL Industries, continued this theme when explaining CCL’s acquisition of security labeling and systems specialist CheckPoint. This has given CCL access to ‘Internet of Things’ technologies which link objects to integrated hardware, software and Cloud computing systems. Providing brands with global product traceability is a key strategic goal for the group.

Kazuo Matsuyama, president and CEO of Japanese converter Sato Holding Corporation, agreed that IoT and arti cial intelligence, transformed by Cloud networking, will have a much bigger impact on the label industry than barcoding, and converters have to start offering these solutions to end users.

UPM Raflatac’s Jari Haavisto looked at sustainability issues, noting that ‘in emerging markets there is still growth and time to make it more sustainable.’ UPM’s ‘Sustainable by Design’ program looks to reduce waste along the supply chain. Haavisto reported on efforts to replace solvent adhesives, with UV adhesive technology now growing at up to 6 percent a year. He gave as an example UPM Ra atac’s RC adhesive for wet wipes. The company’s Label Life LCA shows energy reduced (on a standard PP with paper liner) by 14 percent, water usage by an astonishing 98 percent and CO2 emissions by 5 percent.

An interesting development is PSA labeling of beverage cans after lling, which UPM Ra atac calls Vanish. ‘This means a reduction in warehousing space for pre-printed cans, increased cash ow and more ef cient logistics, as well as the possibility of launching small batches of new premium products cost effectively – particularly for the craft beer market.’

Aluminum beverage cans labeled with the ultra-thin PET Vanish labels can now be recycled in Europe. ‘Novelis, the world’s largest recycler of aluminum cans, con rms that the Vanish label is light enough in order not to affect the quality of recycled aluminum,’ said Haavisto.

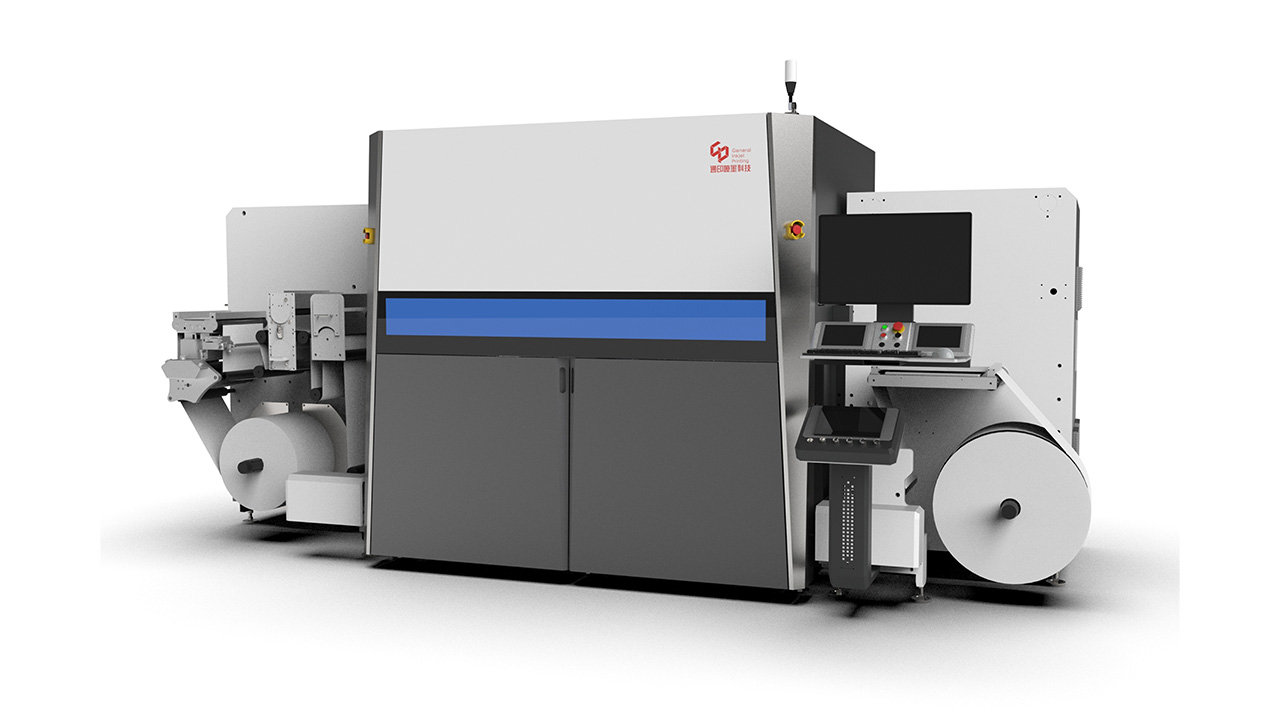

Japanese cutting plotter manufacturer Graphtec Corporation introduced the LCX1000 label creation system at the Japan Label Forum. The LCX1000 system consists of the DLP1000 electrophoto- graphic digital label printer and the DLC1000 finisher, which includes laminating, variable shape cutting, waste matrix removal, slitting

and rewinding. The DLP1000 prints at speeds up to 7.2m/min at a resolution of 600 x 2400 DPI. Key applications for the system include in-house production of product labels and GHS labels in small lots on demand.

Skill development

Japan is experiencing a skilled labor shortage, and one inspiring initiative – covered in a panel session – is a group of eleven regional label converters which have joined together to encourage young people into the print industry and support their skill development.

Christof Naier, VP sales and marketing at Gallus Ferd Ruesch, gave a fascinating insight into the development of the inkjet print engine for the Gallus LabelFire hybrid press.

The main issue to overcome in inkjet printing is potential ‘banding’ caused by failure of an inkjet nozzle. ‘There is a higher risk of blocked nozzle as the resolution gets higher and the nozzles smaller,’ Naier pointed out. The key breakthrough was developing an algorithm which forces the nozzles on either side of the blocked nozzle to print a bigger dot to cover the missing line of print. This also required advances in screening technology.’

Naier said the most efficient use of a hybrid press is to reduce the cost of the label by using screen or flexo for the main color. Gallus is seeing the number of flexo press sales rising, and the number of colors has grown from seven to an average of nine plus, so flexo is far from being killed off by digital.

Yasuhiro Morihara, manager of the color support center at DIC Graphics Corporation, gave a detailed account of an innovative project to color match between digital and conventional (offset) printing, based on Epson’s SurePress and DIC’s ColorCloud system. Trials start this year. DIC first creates a database on its Cloud site of 60 million reproducible colors in offset and gravure to which it then maps SurePress colors.

‘This allows parties to confirm an agreed color at an earlier date,’ said Morihara. The database will be LAB-based and include color data on multiple substrates.

Hidetaka Shimizu, senior manager digital communications at the marketing development department of Sapporo Breweries, looked at how the company has used customization to transform a traditional beer brand.

‘We departed from normal beer promotion practices to create a “viral chain” from gift giver to receiver and on to someone else. We called this “Photo, Beer and Smiles”. All our promotions were designed around the theme of the strength of ties between people and did not even mention the brand. This was because Sapporo appeals mainly to older men, and we wanted to target younger women.’

Sapporo redesigned its labels around the theme and introduced three-bottle sets ‘designed to be not too heavy for our target audience.’

Sharing themes which worked particularly well were weddings and pets. ‘We saw a big peak during festivals like Father’s Day and we had finally to stop further orders because we could not keep up with demand.’

Stay up to date

Subscribe to the free Label News newsletter and receive the latest content every week. We'll never share your email address.