Applicators hold key to new PS technology advances

L&L investigated two promising technologies and spoke to applicator manufacturer Herma to see how these companies overcome end user hesitancy.

Actega’s Signite

Signite decorating technology, developed by Actega, essentially prints a label in reverse. The label substrate is printed as a spot or continuous coating. Process colors are then applied in reverse order, followed by an adhesive layer. These layers are all deposited on a reusable carrier with a release coating on the back to stop the adhesive sticking when the roll is wound up. Signite eliminates siliconized release liner and filmic face material, with no wastage from die-cutting and matrix removal, since all coating and print layers are deposited only on the image area.

Actega claims the technology can reduce label waste by over 50 percent – depending on the decoration design – compared to a similar footprint pressure-sensitive label, by eliminating matrix waste, reducing decoration thickness by around a third and eliminating substrate in non-print areas.

The technology is initially focused on glass cylinders, with plans to expand into aluminum and eventually asymmetrical containers.

“When brands have invested significant money and time in setting up a smoothly running production line, why would they want to invest in new equipment”

This promising new technology requires dedicated application equipment. Actega was in the unique position of controlling the engineering and development of the hardware applicator and as well as the coating technology. L&L spoke to Anthony Carignano, technical director of marketing for Signite at Actega North America Technologies, to learn more about Actega’s plans to overcome brand owner adoption hesitancy.

L&L: Who are you aiming to sell Signite applicator technology to: converters, brands, contract packers?

AC: At the moment, it is really all of the above. In addition, Covid has skewed a lot of the dynamics relating to the supply of packaging materials and willingness of brands to commercially scale new decorating processes. So, we have started to branch out to Signite application adjacencies. For example, we really see that there is a home for Signite in the candle industry with candle glass. There is a lot of pressure sensitive labeling used in candle glass and we think we have a very strong value proposition in this area.

L&L: Major technology advancements sometimes stall because of hesitancy to convert production lines with new applicators. Is this a concern and how do you plan to overcome it?

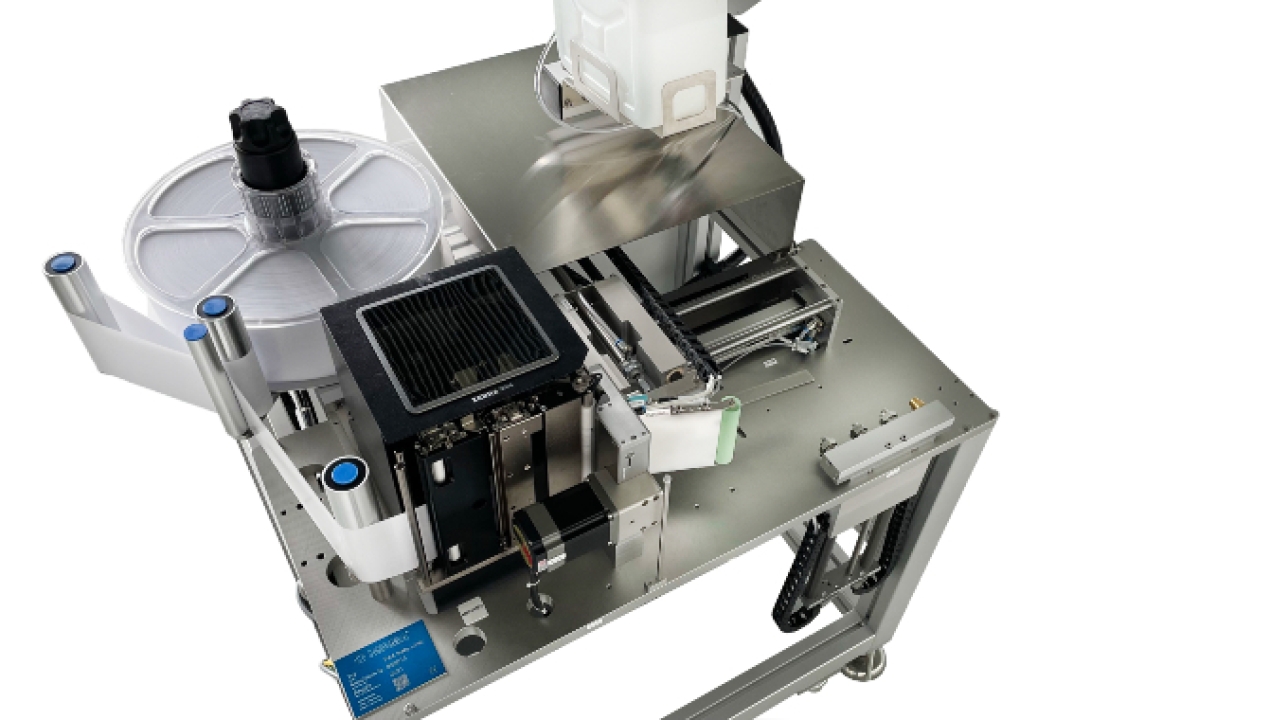

AC: Yes, absolutely it is a concern for us. The reality is that the best way of transferring an ultra-thin film, a polymeric decoration image, is by using our applicator hardware. We built a fleet of approximately 20 applicator hardware systems and are  in the process of placing them in relevant homes. We know that simply to say to somebody, ‘Here is the chemistry, here is how to print it, now you figure out how to put it on a bottles yourselves’, is just not practical. So, we decided to go ahead and make the investment in the hardware applicators to facilitate and make commercialization of Signite happen.

in the process of placing them in relevant homes. We know that simply to say to somebody, ‘Here is the chemistry, here is how to print it, now you figure out how to put it on a bottles yourselves’, is just not practical. So, we decided to go ahead and make the investment in the hardware applicators to facilitate and make commercialization of Signite happen.

We have also found out that for the short-term the best, most reliable way of transferring a Signite decoration over to a glass bottle is by using a flamed surface pre-treatment. We realize that not everybody considering adoption of Signite currently has flame pre-treatment capabilities in-house. So, in addition to supplying the Signite applicator machinery, we are working with some of our highest prospects to assist with procurement of flame pre-treatment equipment. Additionally, we are going to be integrating flame pre-treaters on the applicator machine so that it will be a lot easier for that brand or decoration house to use our technology.

L&L: What is convincing brands to take the time to convert their production lines?

AC: In certain cases, brands have signed a McArthur Foundation commitment for sustainability, and they need to show even with glass packaging that they are thinking about sustainability. Others, particularly within the cosmetic space that are leaders in sustainability, are saying: I want your technology because it demonstrates that I am thinking about how to reduce the amount of materials that are used and that are landfilled to decorate my containers.

Other brands will say, ‘We really like your technology but there is no way we can get one of your applicators, we don't have the footprint or the people to manage it. You are going to have to go out and find a bottle decoration house that’s willing to adopt your technology and do the decorating of the bottles for us.’

Additionally, we have actually opened a pilot line within our Rhode Island facility where we are open to decorating for smaller brands. We have set up our own pilot line workshop to do the decorating ourselves in East Providence. Given that we have a Mark Andy hybrid digital press, along with flame treatment and Signite hardware applicators, and a highly capable and multi-disciplinary team of chemist and engineers within our East Providence in-house start up, we decided that a working Signite demonstration center would be a novel way to show people how this technology is printed and applied. The hope is that the Signite demonstration center will allow us to seed brands with Signite so that it will take off.

In addition, we are willing to allow our in-line hardware application equipment to be used on location for several months before the equipment is invoiced and paid for. For contract decorators, co-packers and brands to gain Signite commercial traction, they need to have their salespeople go out into the market to evangelize the value of the technology before end customer adoption takes place. We know this process takes several months, and that is why we are willing to allow relevant placement locations to experiment with and become accustomed to the equipment, get product out in the field, and ultimately get brand owners interested in adopting Signite.

“What ultimately counts for a customer is overall equipment effectiveness, and that means keeping machine downtimes to a minimum”

L&L: What are you competing against in the glass decorating realm?

AC: We are competing against a few indirect and direct printing technologies but primarily against no-look pressure-sensitive labeling. However, we don't print onto a facestock; we print directly onto the carrier film. If you compare our technology against a conventional wash off, no-look pressure-sensitive label, we are saving at least 50 percent raw material because we don't use a facestock. In addition, we are drastically reducing the amount of chemistry that is required to form an image on a glass container. We also are competing against shrink sleeves, screen printing, and direct to object printing.

Ritrama’s Core Linerless

Ritrama previewed Core Linerless Solutions (CLS) back in 2013; the company developed the labeling platform in collaboration with ILTI (Italian Labelling Technology Industry) to target home, personal care, and beverage industries. At the time, as L&L reported, Ritrama regarded CLS as ‘an evolution of pressure-sensitive technology rather than a replacement’. As far as the converter is concerned, printing on a Core linerless web is exactly the same as printing on a conventional pressure-sensitive label web – the printed web is converted to a linerless web after printing on a specialist converting machine supplied by Omet.

The Core applicator built by ILTI, the Proper-LL, allowed for easy changeover in under a minute from conventional pressure-sensitive to linerless modules. This is an innovative and waste-reducing technology, but as Andy Thomas-Emans wrote in L&L issue 3, 2021, it still requires investment ‘in a dedicated applicator machine manufactured by ILTI, and this has limited the technology’s market penetration.’

In November 2019, South African Brewery, part of ABInBev, became the first company worldwide to adopt Ritrama's complete Core linerless system (CLS) to label its Flying Fish beer line before expanding to the full product portfolio. ABInBev estimated that changing to CLS reduced waste by 57 tons per year just for Flying Fish beer in South Africa.

L&L sat down with Sergio Veneziani, global product manager linerless, at Fedrigoni Self-Adhesive (part of Fedrigoni Group, which acquired Ritrama in 2020) to learn more about the project and the process of getting brands to adapt to new technologies and applicators.

‘The technology was previewed in Labelexpo in 2013 when the former Ritrama organization presented the preview of the idea. At the time it was at a very preliminary stage, but they wanted to see the market reaction,’ says Veneziani. ‘Having seen that there was very big interest and a big reaction from the market, from both brand owners and converters, then a specific project with specific investments were made in order to complete the development of the platform. It took a while because we realized that in addition to the new label base materials, we needed specific partners to develop the label converting process; this part was covered by several partners, Omet for the lamination module, Spilker for the finishing module and Catchpoint for the microperforation.’

‘The technology was previewed in Labelexpo in 2013 when the former Ritrama organization presented the preview of the idea. At the time it was at a very preliminary stage, but they wanted to see the market reaction,’ says Veneziani. ‘Having seen that there was very big interest and a big reaction from the market, from both brand owners and converters, then a specific project with specific investments were made in order to complete the development of the platform. It took a while because we realized that in addition to the new label base materials, we needed specific partners to develop the label converting process; this part was covered by several partners, Omet for the lamination module, Spilker for the finishing module and Catchpoint for the microperforation.’

The biggest reason for brands to change their packaging and labeling is for sustainability benefits, according to Veneziani: ‘At least in Europe, sustainability is a top priority for all the big brand owners. In every discussion about new projects and new product packaging, all these discussions are characterized by a strong focus on sustainability. Practically all the big brands are trying to comply with the new regulations in terms of waste elimination and recyclability. This is how CLS is trying to position itself in the market, as a solution that addresses both of those sustainability concerns.’

Fedrigoni credits the modular design of the technology as creating a low barrier to entry for brands and converters adopting the technology. When it comes to convincing companies to adopt CLS, Veneziani says: ‘Brands are the ones initially showing more interest, of course. They are the ones having targets to achieve, and having the need to reduce process waste, and to offer more options for sustainable products to their consumers. It is the sustainability element that is the driving factor for brands to convert their production lines.’

He continues: ‘When there is a brand interested in exploring the technology, then we need a label converter on board to be able to produce the necessary sampling to allow the brand to touch and see the result.’

For converters, Veneziani says it just depends on their readiness to be innovative. ‘There are capital investments required for converters. We see some converters ready to make this investment only if there is an end user on the other side ready to commit to help them justify the investment. It’s a three-party game: we have the technology, we need the brand to make a pull, and then the converters will react.’

Herma

Switching from a technology focus to a dedicated applicator manufacturer, let’s look at Herma. The company manufacturers many different labeling applicator machines, including a recently launched linerless system called InNo-Liner. This system, which found success in the shipping label sector, can apply labels to shipping cases of different sizes fed to the applicator in any sequence. Herma says the use of linerless in these kinds of applications removes thousands of tons of siliconized paper liner from the waste disposal chain.

“If a new labeling technology reduces waste and increases sustainability, brands and converters are more likely to make the switch”

Christos Kaisoudis, head of sales for Herma Labeling Machines, has found that brands are agreeable to changing over production lines as long as the technology justifies the transition. ‘Customers actually find a whole range of new technical features so fascinating that it encourages the decision to invest precisely because these features deliver measurable time savings,’ said Kaisoudis. ‘What ultimately counts for a customer is overall equipment effectiveness, and that means keeping machine downtimes to a minimum.’

When it comes to convincing brands to switch to linerless, Kaisoudis credits sustainability and raw material shortages as key arguments.

‘Let’s start with sustainability: more and more companies are making intensive efforts to reduce their carbon footprint. If your company is sending a lot of parcels, you’ll need a lot of shipping labels. Previously, each mailing label required a piece of backing material of the same size, which was no longer of any use after the label was applied, and it needed to be disposed of in a time-consuming and sometimes costly manner. This backing paper is no longer needed in the Herma InNo-Liner system. The savings as well as the reduction of the carbon footprint can be calculated easily and persuasively.’

He continues: ‘We’re now also experiencing a strong push due to raw material shortages. The market for particularly tear-resistant glassine papers that can serve as siliconized backing material for labels is tight. This is turning into a problem in terms of space, especially when large quantities of labels are needed – mainly in shipping and logistics centers. A whole range of companies are keenly interested in solutions that no longer require paper substrates. These companies aren’t concerned with replacing the classic adhesive labels; instead, they want to quickly gain experience with the new technology so that they have multiple options in the future, in case bottlenecks occur.’

Conclusion

It is clear from these three interviews that brands can be persuaded to switch applicator technologies if a new technology can make significant and measurable improvements to the brand’s current pain points. For many, that is sustainability goals. With more and more companies signing environmental commitments, there is more pressure than ever to be a good steward of resources and reduce waste. If a new labeling technology reduces waste and increases sustainability, brands and converters are more likely to make the switch. To avoid companies getting cold feet when it comes to installing a new applicator machine, the hardware transition needs to be as seamless as possible for converters and the benefits need to be significant for the brands adopting the new technology.

Stay up to date

Subscribe to the free Label News newsletter and receive the latest content every week. We'll never share your email address.