The brand protection market in China

Fundamental changes are taking place. Some had got underway prior to Covid-19, but have been accelerated by recent events. The impact of Covid-19 has resulted in paradigm shifts in the market: lockdowns, travel restrictions and a variety of important knock-on effects; some permanent and irreversible, some perhaps not.

Given the relentless growth of counterfeiting centered on China, demand for effective brand solutions has not slowed and has probably never been greater. Some kind of tipping point is required – this is largely in the hands of the Chinese themselves as to how hard they decide to push back on counterfeiting in their country in coming years.

Further ‘crackdowns’ by the Chinese government can act as a stimulus to brand owners and governments to invest further in brand protection on the assumption that incidents of counterfeiting of their products will be acted upon more robustly by the Chinese authorities. China will act in its own best interests, subject to a number of internal drivers as well as external pressure.

Companies that have developed effective integrated brand protection solutions and establish a presence in China (or close by) today will be better placed to meet the future needs of brand owners in China. Companies that do not prepare now and then try to react later may well find it more difficult to gain traction in the Chinese brand protection market.

The China landscape

China accounts for at least 80 percent of the world's internationally traded counterfeits, according to the OECD. But this is only part of the story. In addition, overall sales of Chinese-made counterfeits within China’s domestic market are estimated to be of significantly greater value than the counterfeit goods exported to international markets. The internal Chinese market for brand protection, therefore, is potentially huge, albeit subject to position of the Chinese government in relation to counterfeiting in the future.

China has some 1.445 billion people as of mid-2021, representing nearly 20 percent of the world’s population. China is set to become the world’s number one economy in the future.

The overall value of global counterfeiting is undoubtedly much higher than OECD estimates, which have been based on actual seizures by customs and law enforcement.

Overall figures for global counterfeits need to include those sold in the domestic Chinese market to Chinese consumers: both counterfeit versions of international brands created in China; and, increasingly, counterfeit versions of fast-growing high-quality Chinese brands, both sold locally and exported worldwide and thus undermining the image of Chinese brands abroad.

The new Vandagraf report argues that homegrown Chinese counterfeiting is increasingly having a negative impact on China itself, as well as the other countries suffering from Chinese exported counterfeits.

“China accounts for at least 80 percent of the world's internationally traded counterfeits, according to the OECD”

Brand protection technology providers operating in China need to tailor their solutions based on good insights into the Chinese situation.

The huge Chinese market cannot be viewed as homogenous, with both similarities to other cultures and differences that are unique to China. While there are certainly strong national traits, there are also big differences within the Chinese nation and its consumers, with quite different attitudes, behavior, preferences and loyalties, as well as budgets.

A number of dramatic and transformational changes have been taking place in the country over the last decade or so. From simply ‘made’ in China and created elsewhere, towards ‘conceived and created’ in China – no longer should China be simply viewed as a low-cost producer for international brands. Homegrown quality Chinese brands are today widely on sale in the local market and increasingly being exported internationally.

For a number of reasons, a new era of Chinese homegrown luxury brands is emerging:

• Continuous improvements in the quality of Chinese products

• Chinese brand owners tend to better understand the fast-changing needs and wants of local consumers (particularly younger demographics)

• Shorter supply chains, local presence, more agility and ability to respond quickly to shifting demands

• Strong patriotic purchasing trend

There are strong Chinese premium brands that are set for further growth, both in the Chinese market and also internationally.

E-commerce and Covid-19

The dramatic rise of e-commerce began prior to Covid-19, but was strongly accelerated by it. There are numerous implications in terms of counterfeiting and for consumers, brand owners and brand protection.

There has been a rapid take up of e-commerce in China, faster than many other countries, and this is resulting in permanent disruptive change. It greatly extends market reach, beyond tier one and two cities and potentially to the entire, connected Chinese population and worldwide. This creates awareness of luxury brands to many consumers that do not have access to authorized bricks and mortar stores. It stimulates new approaches to marketing and promotional initiatives – consumer engagement, analytics, data gathering – through connected packaging. It enables second-hand markets for high-value luxury products and collectibles. And online stores make it easier for illegal counterfeiters to hide and evade punishment.

Nonetheless, the bulk of consumer purchasing is still via offline channels, for the product categories covered in this report.

Nonetheless, the bulk of consumer purchasing is still via offline channels, for the product categories covered in this report.

Millennials (born 1980-1995) and GenZs (born 1995 to mid-early 2000s) have undergone big changes in their consumer habits, becoming the main consumer group of luxury brands.

According to McKinsey, the total consumption of luxury goods by people aged 19 to 30 (i.e. born between 1990 and 2000) in China increased from 45 percent in 2016 to over 50 percent in 2021.

Over the next five years, an estimated 70 percent of the increase in worldwide revenues from luxury goods is forecast to be in China. Platforms like WeChat enable Millennials and GenZs to share content online, while the importance of social media platforms is also growing. The use of smartphones is prevalent.

Chinese Millennials are accustomed to going online to seek products and then to purchase the products in bricks and mortar stores. This type of consumer behavior is known as ‘ROPO’: research online, purchase offline.

This reinforces the essential nature today for brands (both international and Chinese) of adopting an ‘omnichannel’ approach.

Since the outbreak of Covid-19 in Wuhan, China, in late 2019, the world has had to adjust, which has significantly affected trends in the trade of counterfeit branded products.

Covid-19 has severely impacted both the supply and demand sides of economies around the world. On the supply side, the entire luxury goods industry shut down for some time. Premium goods brand owners had to close production factories in Europe. Sub-contractors have also been affected. On the demand side, restricted travel heavily impacted Duty Free sales, while in China retailers have also been shut down and consumers have been confined indoors.

In order to limit the spread of Covid-19, China introduced a nationwide lockdown in January 2020, with this resulting most non-essential bricks and mortar retailers being forced to close.

As the situation improved some Chinese retailers began to reopen their stores, although often with reduced operating hours and measures to control the amount of in-store traffic. China was one of the first markets to exit lockdown following the outbreak.

Although restrictions were largely lifted in most cities from May and June 2020, offline sales of luxury products were still down on the same period in the previous year.

As retailers and brands looked to adapt to the situation there was a strong shift online, with e-commerce platforms like JD.com and Tmall seeing spikes in sales.

In addition to expanding their online offer, some manufacturers and retailers also launched cloud-based and live-streaming events as well as developing WeChat communities to help build consumer interest around new branded products.

“There are strong Chinese premium brands that are set for further growth, both in the Chinese home market and also internationally”

Pre-Covid, many consumers in China often purchased luxury apparel and footwear while travelling, in some cases travel plans revolving around shopping for these items. Lockdowns have driven dramatic (and sudden) increase in online shopping, greatly facilitating the growth of counterfeiting.

With Chinese consumers forced to stay at home, this benefited e-commerce. Premium brands, both international and Chinese, that have been agile and responded quickly have tended to benefit.

A number of brands saw dynamic growth in 2020 in the Chinese premium markets despite lockdown and travel restrictions, as Chinese consumers switched to purchasing international luxury brands within China rather than overseas while travelling.

Many of the world’s economies have suffered declines in GDP due to Covid. Overall, China has weathered the storm better than most, and in terms of GDP growth the impact of Covid is not expected to change the long-term upward trend of China’s economy.

The decline is mainly due to lockdown and social distancing norms imposed by various countries and economic slowdown across countries owing to the outbreak and the measures to contain it.

In 2020, the Chinese economy recovered faster than in many countries – nevertheless, some market decline was the norm for the majority of product categories, which showed negative growth during this year in China.

Some Chinese markets continued to show growth in 2020, most notably in beauty and personal care as well as fast fashion and sports footwear.

International transport

In recent years, there has been a major shift from relatively few high-value big shipments by sea to ever increasing volumes of small packages by mail/courier, facilitated by e-commerce, going directly to single domestic and foreign buyers, eliminating middlemen and traceable shipping containers.

This has big ramifications for detection and law enforcement and customs. While risk of detection for sea transport is low, individual cargoes were a big prize. With small packages the risk of detection is higher, but individual losses are small.

Traditionally, law enforcement would typically intercept a shipping container or a warehouse full of counterfeits, whereas counterfeiters are now often shipping a single item at a time out of China. And products ordered online can more readily evade existing counterfeit detection systems.

Two of the more important parties involved with such small shipments are national postal authorities, and express and courier services. All with the active support of retail platforms such as Alibaba, Amazon and eBay.

Such packages delivered direct to individual consumers tend to be quite small, easily fitting in bubble wrap letter packets or small cartonboard parcel boxes.

The simplified information that is available through ship manifests and the like, and the supporting role of customs brokers, are absent and generally provided in paper form, and therefore not available electronically.

It is generally only available to customs authorities in destination countries at the time a shipment arrives and is not typically verified, creating broad scope for both legitimate errors as well as fraud.

Efforts are being made by authorities to enhance the use of electronic forms in the post, in order to provide information to customs in destination countries in advance of arrival of shipments, although problems associated with incomplete, misleading, incorrect or fraudulent information would persist.

A growing number of brands (e.g. sportswear) are adapting to the changing retail environment triggered by the rapid rise of e-commerce by moving to DTC (direct to consumer) sales.

In this way, some leading brands are aiming to reduce their reliance on distributors by changing their business models from wholesale to self-operation, cutting out the middleman.

Going forward, bricks and mortar mono-brand and authorized dealer stores will continue to account for over half of sales of premium products in China.

Dynamic market for second-hand luxury goods

This dynamic new marketplace, enabled by e-commerce, has created a whole new requirement and market for product authentication – suddenly, various durable/collectible product categories with value have become more liquid and can be readily traded, such as apparel, footwear (sneakers), women’s handbags, watches, jewelry and more. So authentication requirements are increasingly going to need to include provision for change of ownership – unique IDs and proof of authenticity and provenance.

Second-hand markets are still relatively small in 2021 compared to primary markets of new products, but as attitudes towards ownership and sustainability continue to evolve, the momentum of second-hand markets is set to continue to grow rapidly.

Brand owners are finding that they need to take notice of this phenomenon. If they want to maintain some level of brand and quality control in the secondary market, playing an active role in re-sale is going to be essential. Premium brands can opt for strategic alliances with resellers or attempt to ramp up resale models on their own or supported with third party technology.

“Over the next five years, an estimated 70 percent of the increase in worldwide revenues from luxury goods is forecast to be in China”

The second-hand market, being driven predominantly by young demographics (Millennials and GenZs) is growing four times faster than the primary market and is projected to double in value over the next five years.

There is a self-evident need for reliable means to verify the authenticity of re-sold second-hand luxury, fashion apparel and sportswear products – arguably an even greater need than for the new products marketplace.

Sustainability is a key driver in today’s world – again, being driven primarily by younger generations. Circular economies involving extended life and re-use of products is seen as good and this is a factor in the rapid growth of second-hand markets.

Offline versus online

International and Chinese brand owners often suffer from sales of counterfeits both offline and online. Despite dynamic growth of e-commerce and, as a consequence, more online counterfeiting, the majority of consumer purchasing in China (and elsewhere) is still conducted via offline channels, at least for the premium product categories.

So the market for traditional offline brand protection continues to be robust with strong growth potential in China, although offline distribution channels are at this time being gradually eroded. Note that very different skillsets are required to protect against these totally different types of counterfeiting – some traditional offline brand protection providers have forged links with online brand protection providers.

Consumer empowerment is greatly diminished if the authenticity of a branded product cannot be verified prior to purchase, whether via physical examination by the consumer or authentication technology. And herein lies a huge problem and fundamental weakness in relation to online sales.

But this is not standing in the way of huge growth in e-commerce of brand products that is resulting in huge number of dissatisfied customers around the world, including – and perhaps especially – within China itself.

Traditionally, with ‘bricks and mortar’ offline shopping, consumer product verification prior to purchase was the norm and this is clearly highly preferable. Not only does pre-purchase verification provide reassurance to the consumer prior to owning that product, it also removes the anxiety and anger that would naturally accompany the discovery of a counterfeit variant at a later stage. If such a discovery can occur prior to purchase, then the consumer can simply elect not to purchase the product.

Post-purchase verification, on the other hand, which is the norm for online shopping, means that if the product turns out not to be authentic then the consumer is essentially burdened with the prospect of taking steps to prove that the product is not what it should be, and get money back. This process is not always straightforward as major platforms like Amazon and Alibaba primarily operate with third party suppliers (of varying respectability). A further benefit to pre-purchase verification is that it can significantly enhance detection rates for counterfeits and in a timely way.

It is not unreasonable to assume that consumers, and even retailers, who are motivated, will act to authenticate a product in the retail environment. The motivator for verification can be a loyalty program for which the product authentication is a secondary benefit. Either way, a large body of empowered consumers represents a powerful force for counterfeit detection.

Hotspots for counterfeiting

Within the frame of premium products as covered in this report, a number of ‘hotspot’ product categories have been identified as showing a very high rate of counterfeiting in China – at an estimated 40-50 percent or even higher (certainly higher than 50 percent across tier three cities and beyond): fast fashion – apparel, sneakers, sunglasses, high-end watches, and luxury luggage and women’s handbags.

Such is the high profitability and huge volumes associated with such look-alike designer fast fashion items, that Chinese manufacturers tend to continue despite the clear evidence of breach of original designer and brand owner IP rights. The inevitable and increasing levels of legal actions against them appears to be considered simply to be the cost of doing business. As governments raise the bar in terms of legal consequences such as even heavier fines and the threat of imprisonment for perpetrators, it may be possible to rein in this kind of activity – but there is not much to suggest that this is happening yet.

Some recent estimates have put losses from counterfeit premium women’s handbags at around 20-25 billion USD, which comes to 40-50 percent of the global market. Sales of women’s handbags continue to be robust, with the more classic designs in particular holding their value and so being viewed by consumers as investments as well as fine luxury objects to be used.

Opportunites for brand protection in China

Chinese counterfeiters are highly resourceful and often well-funded. In order to build a realistic defense against counterfeiting, sophisticated brand protection strategies – typically comprising a combination layered first, second and third level devices and features – are generally more effective in deterring counterfeiting of branded products in the Chinese market and indeed elsewhere.

China is the epicenter of world counterfeiting. Solution providers need to be mindful of the risk of their own proprietary technologies themselves being copied or compromised when operating in the Chinese market.

Selection of ‘fit-for-purpose’ brand protection technology in China needs careful consideration given this huge country’s uniqueness and importance in the world of counterfeit branded products. This aspect has been analyzed in detail in the new Vandagraf report.

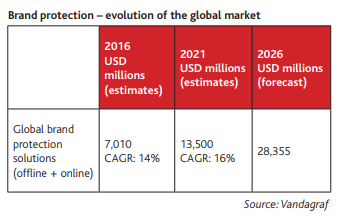

Demand for effective brand protection solutions has not slowed and indeed has never been greater. As can be seen from the table, the growth of the global market for brand protection, already well into double digits at an estimated CAGR of 14 percent, is forecast to accelerate through to 2026.

In 2021 label converters have continued to be the most widely used carrier in ‘offline’ brand protection and this reflects the fact that the label format is such a versatile carrier for security features. Some labels are discarded after the point-of-sale; others are used widely for permanent life-time solutions. The use of packaging materials as a carrier for brand protection devices is growing.

“Recent estimates have put losses from counterfeit premium women’s handbags at around 20-25 billion USD – 40-50 percent of the global market”

As homegrown Chinese brands continue to emerge and gain more traction, so brand protection is likely to become an increasingly pressing priority for Chinese brands selling in the domestic market and increasingly for international sales.

Best estimates put the potential market for brand protection solutions in China at around 5 percent of the global market for brad protection in the near term up to 2026, with substantial further growth potential thereafter.

Historically, in China (and indeed elsewhere) there has tended to be a lack of power in the hands of the courts to deal sufficiently robustly with crimes involving counterfeiting. Infringers were usually subject only to fines, not imprisonment – and without imprisonment as a deterrent, the industry is likely to remain entrenched. But there are now increasing indications that Chinese government is starting to crack down more on the huge problem of counterfeiters operating in the country. More recently, China’s legal system – particularly its civil courts – has made major strides in enforcing trademark rights.

There have been various initiatives in China, both governemental and private sector, and momentume is gathering, for example: China’s new e-commerce law – Online Market Regulation; and the US-China 2020 Phase One Trade Deal – Combatting Counterfeiting.

Opportunities for brand protection providers across a broad range of the vertical markets and product types in China have been identified in the course of Vandagraf’s research.

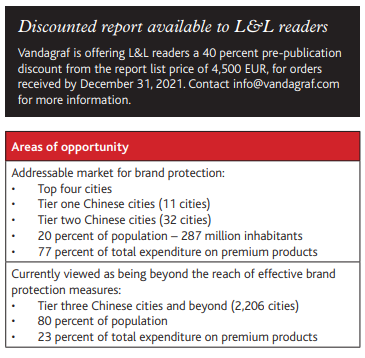

China’s major tier one cities may be seen as relatively mature in an international sense, albeit with high levels of counterfeiting. Meanwhile, counterfeiting in tier two cities is higher than in tier one. In tier three cities and rural areas counterfeiting tends to be very widespread and effective deterrence is seen as beyond reach at this time. Tier three cities and beyond are simply not sufficiently developed or aware, for brand owners to attempt and type of structured brand protection.

Stay up to date

Subscribe to the free Label News newsletter and receive the latest content every week. We'll never share your email address.