Finat report puts industry on Radar

The latest Radar report assumes an even greater relevance than usual, since it is the first opportunity to track the impact of the Covid-19 pandemic on the European label industry, and particularly on label converters.

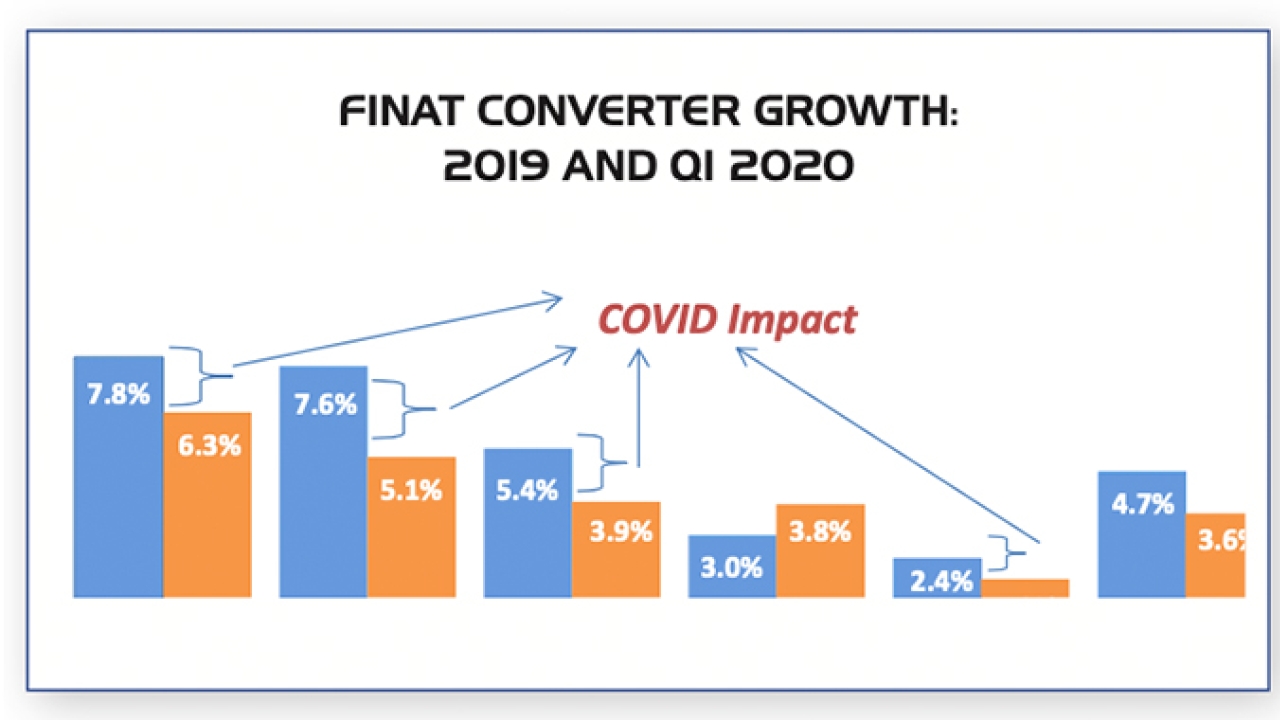

The survey shows starkly that Q1 2020 converter sales growth plummeted from an average 4.7 percent at the end of 2019 (itself down from 2018 figures) to 3.6 percent as Europe went into lockdown.

It is certainly true that some end-use segments surged due to consumer stockpiling at the beginning of the crisis – household chemicals and non-perishable foods particularly – but the big question is whether this is a temporary blip, or will it hold up by the time next year’s Radar survey is conducted.

The Radar survey also attempted to answer longer term Covid-related questions: will the virus continue to create supply and demand disruptions for some consumables categories? Should companies be exploring alternative sourcing strategies?

More than half of the survey group reported that delivery times have been a major issue, with companies unable to get the products they needed when they required them. Only 16 percent reported that delivery times remained the same between January and May of this year. Converters in the UK/Ireland reported the fewest problems with delivery disruptions, possibly driven by shored-up inventories due to Brexit. The highest numbers of converters reporting delivery time delays were in central Europe.

Turning to the employment effects of the pandemic, the report finds that only a small number of participating Finat converters had to make employees redundant. More ominously, 38 percent of companies were concerned they would have to do so ‘in the near future’. Nearly half of participating converters had not seen any redundancies during the first two quarters of this year and do not foresee having to do so in the near future.

Putting this is a wider context, as of mid-June, unemployment remained at historic levels in many labor markets around the world and despite early signs of recovery in some regions, retail sales and manufacturing output remain well below pre-Covid levels. An additional factor to consider in this analysis is the support national governments are extending to companies to prevent layoffs, and when that support might end.

Converter growth

Looking at pre-Covid growth trends, we see from the Radar report that 2019 delivered slightly lower sales growth for converters compared to 2018 as uncertainty gripped financial markets and the potential effects of Brexit were factored in. The sales average for all survey participants was 4.7 percent in 2019 compared to 4.9 percent for 2018. Once again eastern Europe delivered the highest converter growth rates – an average of 7.8 percent – while central Europe showed the sharpest decline with 2019 sales growth averaging 2.4 percent compared to 2018.

While overall year-on-year profitability rates were up for the participant group as a whole, this was primarily driven by strong profit growth in central and southern Europe. UK/Ireland converters reported robust sales growth at 7.6 percent, but profitability levels were down compared to 2018. Converters in Scandinavia reported the sharpest contraction in year-on-year profitability with an average of -3.8 percent for participating converters in the region.

With the Radar surveys now entering their seventh year, the authors were able to make some interesting longer-term observations. Thus between 2013-2019, converters in eastern Europe and UK/Ireland have witnessed the highest growth rates, with the average hovering around 9 percent. Scandinavian converters have historically reported the lowest year-on-year growth, averaging 3.7 percent since 2013.

Growth per end use category

As in previous Radar surveys, participating companies were asked to indicate revenue growth, or contraction rates, for the top five end-use sectors each company serves.

For the first time the food segment delivered the highest year-over-year sales growth, followed by transport/logistics, personal care and pharmaceuticals.

Capital equipment

Capital equipment purchasing intentions contrast sharply from what converters were projecting in last year’s Radar survey. While 25 percent of Finat converter respondents projected they would purchase a conventional or digital press in the 2019 Radar report, that figure falls to 20 percent in this year’s report. However, it is worth bearing in mind that the Radar response forms were sent out in March-April when the ravages of Covid were at their height, and the authors predict those capital investment figures might well be higher if the question was asked now.

A detailed breakdown of converter equipment purchasing responses gives an interesting picture. Looking at what press types converters plan to buy between 2020-2022, 32 percent indicated they will purchase a conventional press, 32 percent a digital press and 5 percent a hybrid press. The ‘digital’ category breaks down into 24 percent for a toner-based press and 8 percent for inkjet. These purchasing indications were pretty much uniform across all European regions.

In addition to specific press formats, converters were asked to indicate the price point of their next digital press purchase. The authors speculate that once again, we see the influence of more expensive hybrid press and toner-based systems in the price point data. In the 2019 survey, 39 percent of converters indicated they would be spending 750,000 EUR or more on a digital press in the following years; 43 percent of converters indicated the same in 2020. Twenty-five percent of surveyed converters indicated they would be spending 500,000 EUR.

Beyond labels

The Radar survey also asks converters if they are diversifying from PS labels into new packaging formats such as cartons, in-mold labels, shrink sleeves and pouches.

A striking result is that converters in this year’s survey showed the least interest in entering shrink sleeve and pouches production – very different from last year’s survey, which showed pouches as the sector with the highest converter interest.

The authors speculate that, with the bigger converters and groups already producing flexible packaging, smaller converters might be put off by the investment and learning curve required in entering the pouch sector. At the same time the advent of the global pandemic has seen converters refocus on their core PS labels business. It is certainly the case that technologies such as shrink sleeves and pouches require higher (or different) levels of expertise and the necessity of forming relationships with new consumables suppliers, as well as significant capital investment.

For the second Radar survey running, linerless labels remains one of the top markets label converters are interested in entering, coming in as number one in this year’s survey. As many as 20 percent of survey respondents expressed an interest in entering linerless production, led by converters in the UK/Ireland and central Europe.

It would be of great interest to know if this growing interest is in the logistics/VIP sector, where linerless is well-established, or in the prime label market where end users have yet to make a major commitment to the technology.

The survey results show an interesting picture of how different types of label production are distributed among converters. Not surprisingly self-adhesive labels are produced by the overwhelming majority of the converter sample. Wet-glue labels are produced by almost 20 percent of the sample, suggesting that most wet-glue label converters are now fully integrated with self-adhesive label production, whether through acquiring roll-fed converting companies or expanding their own production facilities.

The next biggest category is shrink sleeves, at 17 percent, followed by flexible packaging at 14 percent and wraparound labels at 10 percent. If we add together shrink sleeves, flexible packaging and wraparound labels, we see that over 40 percent of the converter sample are producing unsupported filmic products which ten years ago would have been pretty much the exclusive province of wide web flexible packaging converters. This shows how far and fast the narrow web industry has moved in the direction of diversification.

At the foot of the table we see that folding cartons and in-mold are both at 5 percent. IML has not shifted much in terms of overall production volumes in Europe in the last ten years, and cartons are produced mainly by the bigger packaging groups which also include label divisions.

Liner recycling

Given Finat’s strong support of liner recycling initiatives, it is interesting to see the Radar reports tracking how this is impacting label converters. The encouraging news is that converters are increasingly working with their labelstock suppliers to make self-adhesive labelstock constructions more sustainable. Converters indicate landfilling and composting are their least-probable strategies for channeling their spent/used liner in the coming years.

Converters were also asked to indicate how they would be willing to support liner recycling in the future. Over 80 percent of converters indicated they would be willing to ensure that their spent liner is made available for targeted collection within 200km of their label production facilities. Just over one-third of converters indicated that they would be willing to make a modest financial contribution in order to establish and operate a full liner recycling program.

Converters also indicated they were more willing to pay slightly more for a liner material that contains recycled content than to accept inferior performance of that liner on their label presses. More than 60 percent of converters indicated they would be willing to accept a uniform color for liners that contain recycled content.

Labelstock growth

This issue of Radar compares Q2 2020 with Q2 2019 labelstock consumption volumes in Europe using data taken from the quarterly Finat Labelstock Statistics Report.

Labelstock growth in Q2 2020 is at the highest point for both papers and films since Radar started tracking trends seven years ago. These numbers reflect the surges resulting from the coronavirus pandemic – both consumer stockpiling and label converters stockpiling materials in an attempt to avoid supply chain disruptions in surging and critical markets.

Material volume growth trends have particularly impacted the food, medical, personal care and hygiene sectors, as well as VIP labelstock used in the e-commerce sector. Self-adhesive signage has also surged as regions sought ways to ensure social distancing best practices.

Stay up to date

Subscribe to the free Label News newsletter and receive the latest content every week. We'll never share your email address.