Food production fueling flexpack growth across the Middle East

Flexible packaging demand in the Middle East and Africa (MEA) will grow at a rate of five percent each year to 2018 thanks to the increasing level of mass food processing and economic confidence across the region.

PCI Films Consulting’s The Middle East & African Flexible Packaging Market to 2018 report states that the value of the MEA flexible packaging market in 2013 was four billion USD, with consumption per capita currently only around three USD compared to Europe’s 30 USD.

PCI Films said this means there is huge potential for future growth in the region’s flexible packaging market and, as countries in the region grow their economies and look to improve transport and distribution infrastructure and encourage inward investment, more and more multinational brand owners are recognizing the potential for local packaged food production to supply the region’s expanding needs.

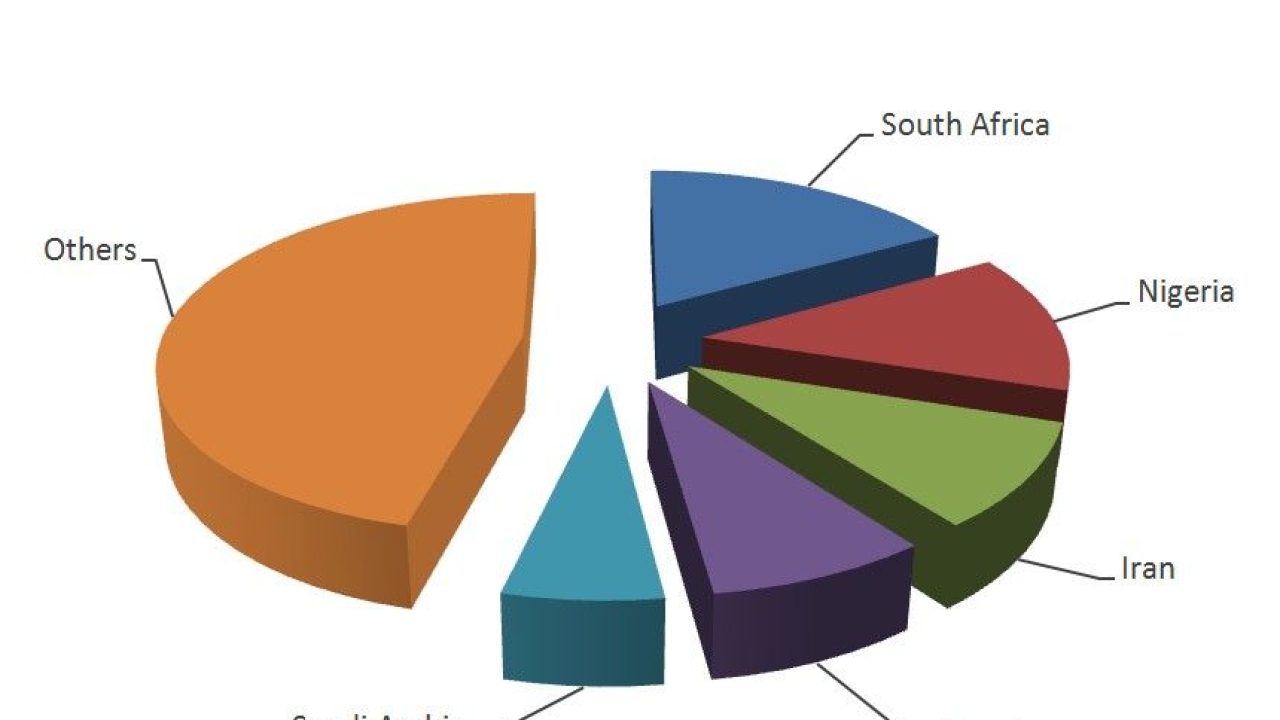

Five countries, South Africa, Nigeria, Iran, Egypt and Saudi Arabia, currently account for over half of total consumption of converted flexible packaging in the MEA region. The most dynamic market is Nigeria, where flexible packaging demand has grown by around 12 percent each year over the past five years. Other smaller markets such as Tanzania and the UAE have also seen above average growth. In contrast to the generally positive picture, flexible packaging sales in Iran and Syria have experienced steep declines due to political, social and economic instability.

Factors identified in the report as driving flexible packaging growth in the region include: a rapidly growing young population and increased urbanization; increased investment in food production and processing across both regions; significant investments in new flexible packaging converting capacity; increased availability of locally produced and competitively priced base substrates; and growth in modern retailing and increased penetration of pre-packed foods.

However, PCI Films said the MEA region continues to be a net importer of flexible packaging especially into Africa, with much being sourced from Europe and increasingly from India and China with the leading European and American owned multinational converters having virtually no local production capability in the region. There is also substantial intra-regional trade, with converters in Saudi Arabia and UAE making use of the films produced as part of downstream petrochemical diversification within those countries. Indian entrepreneurs have successfully established thriving converting operations in Nigeria and the UAE.

The report also noted how fragmented the region’s flexible packaging industry remains, with the top 20 converters from the 350-plus identified by PCI Films accounting for only around 40 percent of production.

Stay up to date

Subscribe to the free Label News newsletter and receive the latest content every week. We'll never share your email address.