Beijing Deji looks to build capacity with press investments

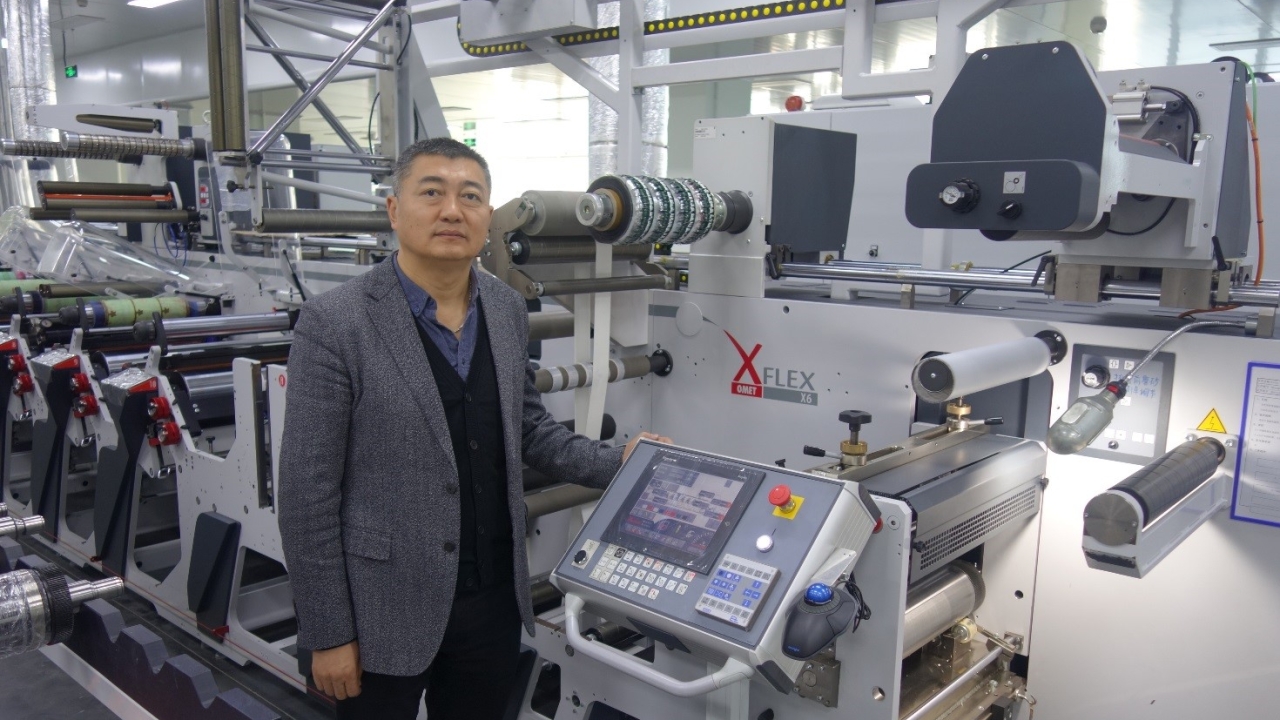

One of China’s leading privately-owned label converters, Beijing Deji has added an almost identical press at its facility in the Tong Zhou District, near to China’s capital city. Both presses are 10-color machines with full UV curing and a 430mm web width. Other capabilities include screen, hot and cold foil, delam/relam, web turn bars and twin die-cutting stations.

Established initially in 2004 in the Chang Ping zone on the northern side of Beijing, the company’s early purchases were Labelmen rotary letterpress lines for the production of automatic labeling labels. As demand grew and diversified into new markets, the converter’s owner, Mr Yu DaYang, decided he needed to research what the new flexo presses had to offer and undertook extensive print trials of his work on the leading manufacturers’ machines.

‘I chose Omet because the print trial went well, and the quality was very good,’ says Mr Yu. ‘We needed a machine quickly and they were able to deliver in eight weeks, which with a competitive price, made the choice easy.’

Since being fully commissioned, the Omet XFlex X6 presses have continued to add at least 20 percent to the company’s productivity year-on-year, according Mr Yu.

Much of Beijing Deji’s work is for the white wine trade and in the dairy industry, especially milk labels, and the two Omet lines are kept busy working 20-hour days, Monday to Saturday. It was this rapid growth in business that highlighted the need for a second press, and after visiting Italy for more trials, the order was agreed and signed at Labelexpo Europe 2017 in Brussels, with the press being installed in August 2018.

Praising the Omet XFlex X6 lines for their ease of make-ready, Mr Yu said that his run lengths vary between 3,000 and 100,000 linear metres, with many of the jobs run off at around 75m/min owing to the complexity of the label. Mr Yu says: ‘Significantly, the Omets take only half the time of their competitors to make-ready, which means that other companies cannot compete with us on the work we produce. The X6 is also especially good at printing on lightweight unsupported films and has IML capability. Best of all, it does it all in-line in one pass.’

He was also influenced by the fact that Omet has a good reputation in China, with more than 70 users, and the Italian manufacturer has a well-established sales and service facility in Suzhou.

Ambitious growth

As a private company, Beijing Deji is able to steer its own course for development, and Mr Yu has ambitious plans for growth. In 2018 the company will generate sales of ¥50 million CNY ($7.4 million USD), but with the new Omet XFlex X6 press now fully operational, he is aiming at ¥80 million for 2019. He is fully confident of achieving it with the added-value capabilities of his Omet lines. These are to be added to with Xflex X4.

‘Very few of our competitors have the technical competence to produce the high-end labels that we thrive on here.’

On the growth and development of digital printing, he says: ‘We have digital capacity already and it accounts for around 40 percent of our business, while along with the operation of our new factory in south China, there’ll be greater growth.’

However, he sees the longer run lengths and lower demand for versioning in China, compared with the West, meaning more alternatives can mitigate against digital print technology in its current form, but the new generation will activate digital printing with some innovative packaging applications, being able to create a new business model rather than a traditional factory model. Mr Yu is keeping an eye on the proliferation of digital/flexo hybrid lines, which, ‘is the future of companies like Deji.’

Investment criteria

Mr Yu adds that China takes its environmental responsibilities very seriously, especially in the narrow web print sector, and he knows that only ongoing investment in the latest technology will be good enough to meet the stricter targets.

This is part of his rationale for targeting the top end of the label market, where the margins are better, and provide the funds for air purification systems and exhaust emission control. Further, Beijing Deji is currently attracting a lot of business through online tendering, which unlike an auction with many bidders, is limited to targets with high quality requirements rather than price only.

Another consideration is China’s burgeoning growth in population and income, which brings increased brand awareness on packaging diversification as well as more precise service that places huge pressure on the packaging sector of the printing industry.

‘”Quality in-quality out”, makes for a healthy and successful business, and those who deal only in price cutting cannot make the money needed for the latest technology,’ concludes Mr Yu.

Stay up to date

Subscribe to the free Label News newsletter and receive the latest content every week. We'll never share your email address.