Labelexpo Mexico sees a 15 percent increase in attendees

Labelexpo Mexico 2025 was double the size of the previous edition and included more equipment and market optimism

Labelexpo Mexico 2025 welcomed 6,655 people from 52 countries and more than 200 exhibitors to Guadalajara on April 1-3. The show floor was twice the size of the 2023 event in Mexico City, while visitors from Mexico and the wider Latin American region saw cutting-edge equipment demonstrations from national and international exhibitors.

Aside from Mexico, Central America was particularly well-represented among the show visitors, while converters were also in attendance from countries throughout South America, including Argentina, Brazil, Chile, Colombia, Ecuador and Peru.

Exhibitors said they were delighted with the number and quality of visitors at the show. They were universally enthusiastic about the Mexican label market, despite some political uncertainty caused by elections in both Mexico and the US last year, and the threat of tariffs on Mexican goods exported to the US. Growth in domestic consumption has remained robust, and there has been little slowdown in capital equipment expenditures by Mexican label converters.

There was a significant increase in the number of machines displayed compared to the event two years ago. It was notable that exhibitors largely showed their top‑of-the-range equipment. A B Graphic demonstrated its flagship Digicon Series 3, for example, and many exhibitors were increasing their presence in the local market, either through distribution deals (in the case of many Chinese exhibitors, for example) or the establishing of dedicated local offices, as was recently announced by Italian converting equipment manufacturer Cartes.

Press technology

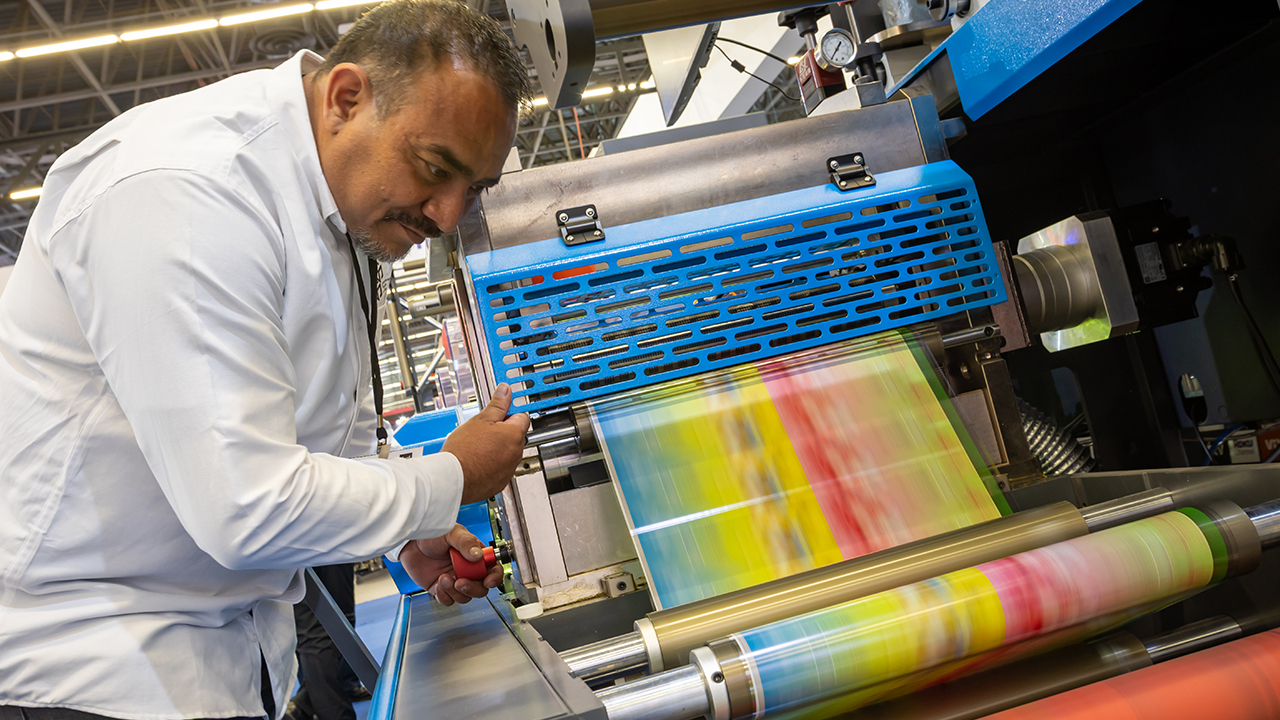

Digital and flexo technology were on display in abundance at Labelexpo Mexico, with press manufacturers reporting increasing interest from local converters in automation and value-added options.

Domino showed its N610i digital label press and the K600i and K300 monochrome inkjet printbars for variable data and 2D code printing. Both systems are proving popular with Mexican converters, according to Gary Peterson, senior account manager, variable data solutions at Domino. ‘The tequila market is booming for us, helped by a government mandate for SAT tax stamps on tequila bottles. Fruit labels, which require variable data, is also a big market.’

Durst showed its Tau 340 RSC E UV inkjet press. Arturo Olaya, business development manager for labels and flexible packaging, said that 2024 was the company’s best year in Mexico, with eight presses sold, while 15 sales are forecast for this year. Durst serves the Latin American market through offices in Mexico, Brazil and Chile.

“There is a lot more drive to automate processes in Mexico. With such proximity to the US market, converters here are learning quickly that quality and faster turnaround are so important”

Etirama demonstrated its new SPS4 multi-substrate chill-drum flexo press, which allows production of shrink sleeves as well as in-mold, wraparound and self-adhesive labels. According to CEO Ronnie Schroter, Mexico is the company’s second-largest Latin American market outside its native Brazil, with more than 40 presses installed. It began selling to the market directly last year, instead of through an agent, and sales ‘have risen strongly since then,’ said Schroter. The press on display was sold to a Guatemalan converter on the second day of the show. ‘We focus on supplying machines to smaller converters,’ said Schroter. ‘We’re not Ferrari or Mercedes, but more like Toyota — cheaper, lower running costs and good reliability.’

Flexi-Vel showed a flexo press from Chinese manufacturer Hyde, which general director Fernando Trujillo described as ‘one of the top two or three flexo presses from China.’ The 12-color machine features precise registration, optimized changeover times, digitalized operation and open-access modular design. The press on display was due to be delivered to a converter in Mexico City after the show — the first sale into the country.

Flora, represented in the Mexican market by Banzi, showed the new Flora J-350 P8 HD UV inkjet label press, which prints at a resolution of up to 1,200 x 1,200 DPI at speeds of up to 100m/min.

GBTL showed a variety of equipment from suppliers it represents, such as the Labstar 330S 5-color UV inkjet press from HanGlory Group and Jingwei narrow web slitting systems with laser and knife cutting.

Heidelberg promoted its flexo and digital press portfolio. Head of marketing Fernando Menendez described Mexico ‘as a great market for us across all segments, but above all in labels.’ The first installation of the recently launched Gallus One digital press took place late last year, and the company installed multiple Gallus Labelmaster flexo presses.

HR Flexo showed Brazilian manufacturer Kromia’s KL1 flexo press, while also promoting the KL2, KL3 and Infinity Master models.

HS Machinery showed its RFP 340 flexo press, which was developed in partnership with Rotocon. The multi-substrate machine can print labels, shrink sleeves and flexible packaging and runs at up to 200m/ min. More than 50 of the presses have been sold in Rotocon’s native South Africa and four in Europe by Rotocon’s German office. The companies’ presence at Labelexpo Mexico represented their first push into the Mexican market, said Rotocon MD Marco Aengenvoort. ‘The press is well-positioned for this market,’ he said. ‘We are looking for a local partner to help with service, but we have 28 engineers spread around the world so are able to offer service already.’

Konica Minolta demonstrated its AccurioLabel 400 for roll-to-roll label production; AccurioPrint 4065 for sheet-fed label production; and AccurioShine 101 for label embellishment. ‘The Mexican market is maturing, so digital is of increasing interest to converters,’ said Roberto Vázquez, director of indirect sales and digital printing at Konica Minolta Mexico. ‘We have high expectations for the Mexican market this year.’

Manroland Latina represented press manufacturers Omet and Miyakoshi and converting equipment suppliers DCM, Pantec and Prati at the show. Hans Ramon Hoffman, head of webfed labels and packaging business unit, said there is increasing demand for higher-quality equipment and added-value embellishment in the local market.

Mark Andy showed its Evolution Series E5 press and Rotoflex VSI-330 converting system. ‘Despite the political uncertainty, we’ve not really seen a slowdown in Mexico; we are still selling machines,’ said Latin America sales manager John Vigna. The company announced a partnership with Guadalajara-based service provider Canvitech. The Canvitech team, led by Mark Andy’s service director in Mexico, Alfredo Hernandez, will operate as Mark Andy-trained technicians, while the Guadalajara facility will serve as a hub for warehousing and distributing parts and supplies.

Nilpeter has more presses installed in Guadalajara than in any other city worldwide. There are several hundred Nilpeter installations there, according to global sales director Jesper Jørgensen. The company showed its new FB line, available in 14in or 17in web width, which is based on the same platform as its FA line of presses. ‘The press has been a huge success throughout Latin America,’ said Jørgensen. ‘Converters are investing in presses which are wider, more automated and with more added-value options.’

Pulisi, represented in Mexico by Printum Concepts for a year, showed its DSmart 330 inkjet press, for which the Chinese manufacturer also provides in-line and off-line finishing systems. Printum Concepts’ director Miguel Guadalajara said the company had recently sold its first three presses in Mexico. ‘There is great potential for this brand in Mexico,’ he said.

“Despite the political uncertainty, we’ve not really seen a slowdown in Mexico; we are still selling machines”

Sun Digital, HP Indigo’s representative in Mexico, showed the HP Indigo 6K digital press. Cecilia Palafox, country manager, Mexico for HP and PWP (Page Wide Press), estimates that HP holds a 96 percent digital label market share in Mexico, with 86 presses sold in the past 16 years, including its first V12 installation in the country last year. ‘Local converters are increasingly diversifying into different applications such as shrink sleeves, in-mold and flexible packaging,’ said Palafox. ‘The shrink sleeve market is exploding in Mexico and in Latin America generally. Flexible packaging is also growing strongly, and the HP Indigo 200K, which is 45 percent more productive than the 20K, is selling well.’ Palafox cited the example of Bimbo, a massive Latin American bread brand, switching its popular Pan Dulce chocolate-covered bread product to flexible packaging last year. It has made the same move for its Bimbo Galletas biscuit brand this year, too.

Weigang demonstrated its ZJR 5350 Pro hybrid press. The Chinese manufacturer appointed Jetrix as its Mexico distributor in September 2023, and sold four flexo presses in the first year. Emma Ye, sales manager for North America, said: ‘The press allows label printing but also diversification into package printing. We see a lot of potential in this market.’

Converting equipment

In a country with a booming tequila sector and a burgeoning wine industry, demand for high-end embellishment is on the rise, according to the finishing and converting equipment manufacturers at the show.

A B Graphic showed its flagship converting system, the Digicon Series 3. Hugo Barranco, director of Renew Solutions, ABG’s distributor in Mexico, said: ‘There is exponential growth in finishing equipment sales in Mexico. Many offset printers have moved into label production in the last two years.’ Since appointing Renew Solutions as its agent three years ago, ABG has installed more than 25 machines in Mexico, around half of which are Digicon Series 3 systems. Barranco cited wine, tequila and craft beers as key growth sectors for converters installing ABG equipment, while RFID is an ‘increasingly popular’ application. The company sold five machines during the first two days of the show, including the Digicon Series 3 on display.

Brotech demonstrated an array of digital embellishment, pouch making, flexible packaging and converting systems alongside local agent Banzi, including the SDF Plus Speedmaster digital finishing machine. Jonathan Cervantes, sales manager, graphic arts at Banzi, and a founding partner of the company, said: ‘The local market is strong, with good consumption. There has been a surge in artisanal food and beverage products since the pandemic, which has increased demand for digital converting equipment.’

Cartes showed a variety of label converting machines, including the GT365HFSRD finishing line for high-end embellishment labels, configured with flexo coating, conventional screen printing and hot stamping as well as tool-less continuous metallic foil doming applications and semi-rotary die-cutting. The company’s first sales in Mexico took place two years ago during the previous Labelexpo Mexico, and the potential it sees in the market has led it to establish an office in Guadalajara for sales, tech support and consumables. ‘We see big potential in the Mexican market, particularly in applications such as tequila, which require high-end embellishment,’ said Virgilio Micale, global sales director. ‘The local wine industry, much of which is based in the north of the country and targets the US market, is also forecast to grow significantly over the next five years.’

Dimatra demonstrated its new Smart Eco inspection slitter rewinder, designed for plastic film and self-adhesive labels. Also on show was the new Dimatra 100 percent Print Inspection System equipped with camera technology. CEO Pablo Orozco said demand for both high-end embellishment systems and inspection technology is rising in Mexico, and that the shrink sleeve market is ‘growing strongly’.

ETI Converting, promoting its Cohesio line for linerless label production, was ‘testing the potential of the Mexican market’ by exhibiting at the show, according to sales director Baudry Bayzelon. ‘It’s a growing market for us, with real potential,’ he said. ‘Converters want to learn about linerless technology.’

Golden Laser, represented in the Mexican market by Banzi, presented its latest digital laser die-cutting system, the LC-350.

Hoaco Automation Technology showed an RFID label converting machine. The company’s rotary die-cutting equipment is widely used across various industries, including automotive electronics, converting, RFID labels, and more.

Lemorau, which appointed Empackt as its local distributor 18 months before the show, demonstrated its EB die-cutting machine for high-volume production, capable of reaching speeds of up to 200m/min; Lemorau 2F, a versatile fan fold machine; Lemorau CTA1500, an automatic core cutter; and Lemorau RA, a label rewinder. All on-stand machinery was already sold to Mexican converter Grupo de Servicios Gráficos del Centro. ‘Mexico is a flourishing market and our presence here is growing,’ said sales executive Lara Sousa.

Martin Automatic described Mexico as a ‘steady market’ for the company, with ‘strong growth in the last six months despite the political uncertainty’. Mike Jelinsky, sales engineer for Latin America, Canada and the US West Coast, said: ‘Label converters in Mexico are looking to diversify their production, which our equipment allows them to do. The non-stop operation is also good for productivity.’

Rhyguan Machinery demonstrated the Rhyguan Plus digital label converting line. The servo-driven machine features spot varnish, hot stamping and semi-rotary die-cutting. Its modular construction allows new features to be added or existing modules to be rearranged.

“Local converters are increasingly diversifying into different applications such as shrink sleeves, in-mold and flexible packaging”

Schobertechnologies demonstrated its RSM550 Digi-Varicut with Single Spider, a fully automized system for high-speed die-cutting and stacking of in-mold labels. Gerald Glaas, executive VP and CSO, said: ‘This is our first time at Labelexpo Mexico. We saw more and more Mexican converters attending Labelexpo Americas in Chicago, so we decided to exhibit machinery here because it is a growing market.’ The company sells directly in Mexico and has ‘a number of big local customers’.

Vemax, a Brazilian converting equipment manufacturer, began selling into Mexico and the US five years ago through agents. In September last year, it appointed Francisco Pisano to lead its sales efforts in Mexico, and the new direct approach is paying off with seven sales since then. ‘We are increasing our focus on the Mexican market and building local service and support,’ he said. The company demonstrated the VRR TA V380 inspection rewinder and the new compact VSM 250.

Workflow

Workflow and software technology took center stage, as converters face increased pressure to optimize operations amid workforce challenges. Experts say the rapid growth of nearshoring from many Asian companies looking to serve the North and South American markets has caused a knock-on effect of fewer skilled workers to operate label printing and converting equipment. This, in turn, pushes converters to look for smarter and more automated ways to run their business.

‘This market understands the need to be more efficient to enter the US market,’ said Esteban Garcia, business development manager at Cerm. ‘Everyone wants to know how to get more value out of their equipment and maximize their processes. The Cerm technology gives them the tools so they can strategize around efficiencies.’

Software suppliers like Cerm, Amtech Software (Labeltraxx), eProductivity, SisPro and Twist Software showcased technology designed to streamline production, reduce manual touchpoints and uncover new efficiencies. Each of these companies’ respective technologies can help label converters manage everything from estimating and scheduling to inventory, allowing companies to do more and with greater efficiency.

Steffen Haaga, director of global business development at Cerm, said: ‘There is a lot more drive to automate processes in Mexico. With such proximity to the US market, converters here are learning quickly that quality and faster turnaround are so important. They are learning quickly that what you cannot measure, you cannot manage. And what you cannot manage, you cannot improve.’

Color management exhibitors and RIP processing companies showed Labelexpo Mexico visitors their technology designed to optimize workflow efficiency and color accuracy across various substrates.

Hybrid Software showed technology that simplifies spot color simulation, extended gamut printing and digital press optimization. Hybrid Software’s VDP Execute automates workflows for variable data, and can work well for short runs, personalized packaging and custom labels.

GMG offered its ColorPlugin software for converting spot and process colors within Adobe Photoshop and Illustrator, transforming spot colors into 4c and extended gamut process inks.

Materials

Sustainability was a major focus for material and ink suppliers at the show. Customers are interested in materials made from recycled content, exhibitors said. They also want materials that make recycling easier. And these same exhibitors, who came from all over the world, said that Mexico is an attractive market to do business in. The local economy is growing, and it has the second-largest population in Latin America, with a population of nearly 130 million. Bordering the US, Mexico offers substantial nearshoring potential and serves as a gateway to the rest of Latin America.

Arclad, a Colombia-based company with a presence throughout Latin America, showcased sustainable materials, such as its wash-off PET, which enables the recyclability of PET containers; its bio-based hotmelt adhesive, which has at least 60 percent of its raw materials coming from renewable sources; and its new product, a recycled-content polypropylene.

UPM Raflatac focused on sustainability by featuring its Carbon Action plastic label portfolio, its Label Life lifecycle assessment service and its wood-based Forest Film plastic face material.

Avery Dennison also exhibited its sustainable products, such as its linerless labels, and RFID. Avery Dennison has a significant presence in Mexico, with three distribution centers, a factory in Querétaro, and a new RFID facility in Querétaro, which is Avery Dennison’s largest RFID facility in the world, as well as additional sales representatives and service teams.

‘The trade that we have today with America and Canada makes Mexico an attractive market,’ commercial manager Mariana Méndez said. ‘Also, we have connections with South America and the Caribbean.’

Cosmo Films exhibited a range of BOPP films for the packaging industry, the thermal lamination and pressure-sensitive segments, and industrial films and synthetic papers. Based in India, the company has warehouses worldwide and plans to open a warehouse in Mexico soon. Latin America, in general, is a growing market for Cosmo Films.

‘It’s a developing market,’ vice president Kapil Anand said. ‘It’s not yet a mature market, so a lot of new printers are putting up new machines. There are a lot of new customers that are coming to us.’

India-based MLJ Industries showcased film and paper-based labelstock and release liners. The company came to Labelexpo Mexico looking for partners. Director and founder Siddarth Jian said that MLJ exports to the Middle East and Africa but doesn’t have much of a presence in the Americas yet and is looking to expand.

Fedrigoni, which showcased self-adhesive label materials and tapes, greatly expanded its presence in Mexico by acquiring Mexico City-based Industrial Papelera Venus in 2020. This decision was driven by an interest in Mexico’s export market to the US, as well as Mexico’s local, growing demand for labels, said Priscila Azevedo, Latin American marketing manager.

“We see big potential in the Mexican market, particularly in applications such as tequila, which require high-end embellishment”

Wausau Coated exhibited products from its new line of materials for wine, beer and spirits. The company highlighted its Hydro Opaque material, a roll labelstock that performs well when wet. To demonstrate this, the company kept a bottle of wine, with a Hydro Opaque label, in an ice bucket full of water at its stand for all three days of the show.

This year was Chiripal Poly Films’ first time exhibiting at Labelexpo Mexico, where it showcased materials for wraparound labels, in-mold labels, pressure-sensitive labels and release liners. Nitish Verma, general manager of sales and marketing, said Chiripal Poly Films wants to expand its presence in Latin America. South America, in particular, is a large market for in-mold labels, he said.

Garware, another material supplier from India, also exhibited at Labelexpo Mexico for the first time. There, it showcased a range of its proprietary films, including silicone liners, thermal lamination film, PVC film and a new PET-C film.

Canada-based Hardvogue showcased in-mold label films, BOPP, metallized paper and shrink PETG/PVC films, among other products.

Yupo showed two new products: the SuperYupo Plus substrate for conventional offset printing, and CleanSort in-mold labels, which detach during recycling, helping with the recycling process.

Other companies at Labelexpo Mexico included JCR Pack, which showcased PETG and PVC shrink films; DNP, which showed thermal transfer ribbons; International Media Products, which featured wax ribbons and resins; and Green Bay Packaging, which showed various materials, including paper, white and transparent BOPP, PVC and more.

M+S exhibited BOPP, PVC and craft tapes, as well as paper and film label materials and ribbon. M+S is based in Mexico City, with additional distribution points in Guadalajara, León, Aguascalientes, Querétaro and Puebla, with a new office coming to Monterrey.

LBT Ribbons, based in Guadalajara, featured its wax, wax-resin and resin ribbons, which it manufactures.

Overtape, also based in Guadalajara, showcased its matte and bright laminates and BOPP, PETG and PVC films for the labeling industry. Guadalajara is a ‘metropolis of labels here in Mexico,’ Overtape sales manager Saul Chale said.

There were also companies exhibiting materials for embellishments. Kurz showcased hot-stamping foils, cold foils and holographic materials. K Laser exhibited its line of cold foil for shrink sleeves and labels. ‘Brand owners are looking for ways to make their products stand out in the supermarket,’ said Jaime Ancalmo, director of sales for Latin America at K Laser.

Chinese material suppliers had a significant presence at Labelexpo Mexico. These companies included Jinda Packaging Materials Technology, Fangda Packaging, Youhua New Material Technology, Soontomax Label Material, HSF Films, Super Color Inks, Todaytec Digital and more.

Inks

Siegwerk showcased environmentally friendly inks, including washable inks and inks made from vegetable oils and soy.

Nazdar exhibited two new products, both launched in Q4 of 2024: its 68500 LED flexo inks, for presses that run 400-500 ft/min, and its W181 water-based ink system.

Natural Inks showed a range of inks, including water-based, solvent-based, UV and UV-LED.

Zeller+Gmelin showcased standard UV and LED inks, as well as coatings, adhesives and primers. It currently has distribution centers in Guadalajara and Querétaro, and it’s looking to open a third distribution center in Monterrey. Mexico is its fastest‑growing market in the Americas.

Mexico City-based Azteca Inks exhibited UV and LED inks, laminates and varnishes.

Plates

Among the companies exhibiting plates, platemaking and plate-mounting equipment at Labelexpo Mexico was Heaford, which brought a manual ELS and a semi-automatic FTS plate-mounter to Labelexpo Mexico. Mexico has many converters, many of which are small companies, said Nick Vindel, Latin American sales manager. Vindel said Heaford works to convince these converters to move from mounting plates by eye to using plate-mounting equipment.

Xsys featured its plates, sleeves and platemaking equipment. Tesa Tapes exhibited plate-mounting tapes and adhesives, while Beta Industry featured the Beta Flex Pro2, a technology that analyzes flexo plates.

Fujifilm showcased various products, including plate processors, offset computer‑to-plate technology and Flenex water-wash plates. Fujifilm processed these plates live at its booth to demonstrate the benefits of water-wash plate processing, which is faster and more environmentally friendly than solvent processing.

Dies and tooling

Kocher+Beck showed its GapMaster EM system, which is reverse compatible with any previously installed K+B GapMaster model. The mechanical adjustment handle is replaced with the EM retrofit gearbox, providing digital technology with maximum precision. The company appointed CRD as a local distributor in late 2023, which has allowed it to provide a ‘higher level of service’ and achieve an ‘uptick in sales’, according to CEO David Morris. ‘Mexico is an important market for us,’ he said. ‘The recent expansion of our facility in Kansas and the installation of new equipment show the importance of the North and South American markets and help us to support local converters.’

“Nilpeter has more presses installed in Guadalajara than any other city worldwide”

Maxcess, promoting its range of dies and tooling, sees Mexico as ‘an excellent market, with lots of growth and lots of machinery being installed,’ according to Jackie Ramos, senior technical and sales manager for Latin America. ‘Label designs and the materials used are becoming more advanced, which is increasing quality demands in the local market. Guadalajara is an important center of the local print industry, and the quality of visitors to the show has been very high.’

Rotometal was represented at the show by agent Grupo Sigma. Director Emma Lozano Valdivia said the year had started slowly, but ‘the last couple of months have really picked up’. Representing Rotometal for the past six months, she described it as ‘a well-known, high-quality brand’.

Wilson Manufacturing considers Mexico ‘an important growth market’ according to Mike Devaney, vice president of sales. The company, promoting its range of dies and tooling at the show, ‘has invested in serving the local market and this is paying off,’ he said.

Ancillaries

GEW was promoting two products for LED curing: AeroLED2 and LeoLED2. Company representatives noted a clear shift to LED curing technology among Mexican label converters. Driven by a demand for energy efficiency, faster production speed, improved sustainability and longer lamp life, LED is an attractive upgrade, said Amir Dekel, vice president of sales.

At Harper’s booth, Juan Bermudez, executive vice president, saw a lot of interest in the company’s X-Cast engraving technology for flexo printing. X-Cat was developed to combat common flexo printing problems: ink spitting, moiré, trail edge voids, ghosting, and ink re-solubility. Bermudez said: ‘Mexico is a very dynamic market. People here are not shy about investing in new technology. They are committed to efficiencies and standardization to ensure profitability. Latin America can be price-sensitive. But if there’s a correlation between value and the price you’re offering, then it’s not a difficult decision.’

Exhibitors praise event

Héctor Yáñez, director of marketing, graphic arts at Fujifilm de Mexico, said: ‘The event has gone very, very well. There have been many more visitors than in the previous edition in Mexico City, with a strong, continuous flow.’

Amir Dekel, vice president of sales at GEW, commented: ‘Labelexpo Mexico this year was larger than previous shows in the region and showed the growth of this market in Latin America. We successfully closed a significant amount of business in the booth and opened several new opportunities for the near and far future.’

Stay up to date

Subscribe to the free Label News newsletter and receive the latest content every week. We'll never share your email address.