Label and package printing industry predictions for 2017

The label and package printing industry again looks ahead to what the next year will bring, with members of the supply chain telling Labels & Labeling what they expect to be making the headlines over the next 12 months.

With 2016 moving into its closing stages, drupa a distant memory and reverberations still being felt from another successful Labelexpo Americas, the label and package printing industry is on the crest of a wave that promises to take it straight into a bumper Labelexpo Europe 2017.

In 2016, M&A activity up and down the supply chain has been a standout topic for many, as has the level of investment across printers and converters' operations, from pre-press and software, to conventional and digital printing and finishing.

Read in full what the industry had to say ahead of 2016 here, and if you would like to share your thoughts with the label and package printing market, please email 150-200 words to dpittman@labelsandlabeling.com by, latest, December 23.

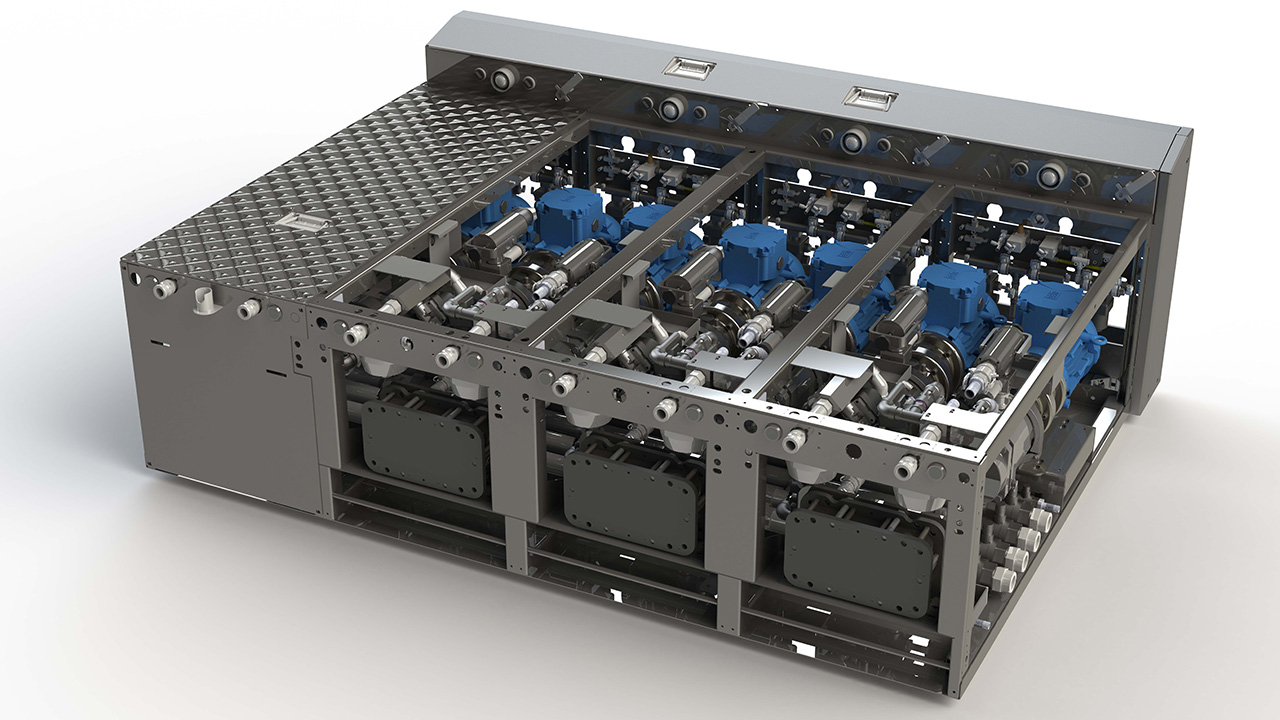

*image courtesy of UPM Raflatac and its new Ice and Ice Premium products, as reported here

----------------------------------------------

Mike Fairley, L&L | Thomas Hagmaier, Finat | Debbie Waldron-Hoines, EFIA |

Jules Lejeune, Finat | Nicholas Mockett, Moorgate Capital | Jennifer Dochstader, LPC |

Jakob Landberg, Nilpeter | Michael Smetana, HP | Filip Weymans, Xeikon |

Mikkel Wichmann, Trojanlabel | Yael Barak, HP Indigo | Kevin Shimamoto, Memjet |

Tino Bocciolini, Armor | Gary Seward, Pulse Roll Label Products | Nathalie Muller, Linkz IM |

Dr Mark Deakes, IHMA | Isaam Lutfiyya, QuadTech | Ken Moir, NiceLabel |

Brian Ayers, FLEXcon | Paulo Souto, Sistrade | Shaan Patel, Arrow Systems |

Jay Dollries, ILS | Cees Schouten, Geostick Group | Damien Prunty, Pemara Labels (Australia) |

----------------------------------------------

Mike Fairley, director of strategic development, L&L

Much of the technical innovation and production development taking place in label and package printing over the past 10 years has been related to advances in digitized pre-press, color management, digital printing technology, advances in flexo and hybrid presses, as well as increasingly sophisticated finishing line solutions. These developments will continue to take place as run lengths decrease, more versions and variations are required, time to market decreases, and ever-more complex and exciting label solutions are created. On top of these changes can be added pressures relating to costs, investment, margins and profitability ‒ and that’s without even looking at environment and sustainability issues, supply chain traceability demands, food contact challenges and the ongoing trends in globalization. These changes are all undoubtedly increasing the complexity of label and package printing, and the demands made on today’s employees and print managements around the world to manage within a fast evolving industry, and yet remain profitable.

It is all of these demands and pressure that will increasingly see label and package printing companies move rapidly towards ever more automation of both their administration and production process workflows, using sophisticated management information systems (MIS) that will be integrated with specialized inspection and color performance software and technology, through to fully automated press and finishing line set-up. The target aim is now to work towards human-free, 24/7, completely automated and streamlined workflows that receive job orders by electronic data interchange (EDI), use the potential of Cloud computing and the Internet of Things, fully automate production (even using WiFi for remote access and control), liaise with shipping carriers, and invoice and receive payment advice through EDI.

Think this is all a dream? Be assured, it’s not.

www.labelsandlabeling.com | @LabelsNLabeling

Thomas Hagmaier, president, Finat

The label world is changing fast. There are several points to watch in 2017:

- We are running out of skilled printers, with the age of printing staff in Europe over 50. The new generation of machines need different operating staff;

- Big corporations with a lot of capital are able to change markets. Small companies will disappear, get sold to the big ones or have to become specialized;

- It is more and more important to know markets and machines. A company can´t make any wrong investment. Behind all investments must be a clear plan;

- Contact with the customer will be more web-based. Personal connections will lose influence;

- Because the web makes thing transparent, the knowledge difference between customer and the production company gets smaller. Everybody have to be careful not to fall by the wayside.

Debbie Waldron-Hoines, director, EFIA

Label and package printing industries are challenged with the constant need to evolve and meet emerging consumer trends and needs. In 2017, the European Flexographic Industry Association (EFIA) anticipates that the pace of change is not going to slow. Technology is changing the way consumers are shopping and the internet has opened up myriad ways for consumers to make informed decisions about what they buy. Google has called this the ‘zero moment of truth’ – the point in the buying cycle when the consumer researches a product, often before the seller even knows they exist. Competition to sell is therefore intense. The retail journey is also changing from big box supermarket shopping to convenience driven multi-trip shopping patterns. Brands need to stand out in this new crowded retail landscape – online and in store – and want to add value to the shopper experience to drive longer-term consumer loyalty.

Ultimately this is opening up a range of opportunities for the print industry in offering pack and product personalization, customization and premiumization. It’s no longer about ‘cost out’ for converters. Brands want to add value to their packs to create differentiation. Smart ‘connected’ pack solutions with digital marketing campaigns are now the norm and targeted at specific consumer groups.

As a result of these trends, and confirmed by members and partners, EFIA is seeing a keen focus on stand out graphic design utilizing new tactile coatings and ink effects, as well as the use of complementary flexo and digital print systems to deliver short runs of customized packs. Pack designs are being tested more regularly with sophisticated variable data to connect to digital marketing campaigns enticing the consumer. Further growth in retail ready or shelf ready packaging is also helping to deliver the in store stand out as well.

The message is clear: the industry is not standing still. The pace of change is accelerating and the opportunities for industry growth are significant.

Jules Lejeune, Finat managing director

The world of ‘the label’ is growing in every way, and in every direction. Today a label encompasses not only product identification data, but also an increasing tranche of regulatory information and delivers brand identity in ways we could not have imagined ten years ago – through personalisation, tactile and colour-changing features, and devices such as QR codes. Increasing sophistication in product authentication and security devices are an important additional feature; and sleeve labels, flexible packaging, in-mould labels and direct-to-container print will increasingly feature in label converters’ 2017 offer to brand owners. These are all areas where Finat is committed to keeping its members informed on this broadening technical agenda; on representing their interests on legal and regulatory issues; and on continuing its established and respected technical research programme – which will next year include new editions of the Finat test methods and the RADAR.

While the increasing complexity of the ‘label’ has been largely enabled by the developments in the converting technologies employed by our Finat members. Our Finat Radar market research across Europe indicates that, in the coming years, we expect to see ongoing refinements in digital capabilities and in hybrid analogue/digital presses, partnered by advanced ink formulations that deliver specific high-performance features – for example, for food-safe print without migration or setoff – and a range of print substrates to match. LED ink curing is set to grow substantially next year.

Digital print has made product multi-versioning and label multi-language versioning easy and quick. Finat members confirm that print runs are now around just 1500 linear metres per label; and the downward trend is forecast to continue. In fact, overall, only 55 percent of brand owners’ predicted that label purchasing volumes would increase in 2017 – a slight downturn on 2016 sentiment. While over 20 percent of brand owners we surveyed said they do not currently source digitally-labels, they nevertheless say they want their label converters to have digital capability on their production floor.

European brand owners will also continue to demand higher quality at lower prices from their packaging suppliers, and are increasingly looking to the developing economies of, for example, Hungary, the Czech Republic, Poland and Slovakia as viable label sourcing channels. What is more, our most recent Radar research confirms interestingly that more than 70 percent of them claim that they will not be migrating from self-adhesive labelling technology to another format over the next 12 months.

Sustainability will be a headline topic in the agenda of the entire supply chain. Waste management will be the prime concern of Finat and its sister associations around the world in 2017. Spent release liner – a high-value, high-quality feature of the pressure-sensitive laminate – will be a particular focus for recycling efforts, and in Finat we are encouraging increasing formalisation in the relationship between label converters, co-packers, and brand owners to establish a formal release liner collection and recycling system, since around 70 percent of the end users we surveyed indicated they are not currently recycling any of their liner waste.

In the face of all the technological developments, the globalisation of end-user brand markets, and the capabilities of online business, we also expect a continuation of the M&A activity that has seen local and regional label converting companies join together to form multinational suppliers.

Nicholas Mockett, head of packaging M&A, Moorgate Capital

Packaging manufacturers of all shapes and sizes throughout Europe found periods of soft demand during 2016. This may have been down to some destocking in the supply chain, which can’t go on forever. If the European economy avoids a slowdown in 2017 there may be some catching up and consequently a good 2017 for labels and packaging. If sterling remains under pressure, the UK will suffer from cost-push inflation and possibly a recession. However, UK exports will be more competitive abroad, which could be good news, e.g. for Scotch whiskey, a major market for labels and printed packaging.

Within labels globally, we expect IML to be a key growth area and expect the leading players will roll out their expertise to new territories, building on existing multinational relationships with FMCGs which are penetrating new markets with premium products. In 2016 the beer industry consolidated significantly, so that’s an end-use market to watch in 2017 and beyond.

Jennifer Dochstader, managing director, LPC

2016 was a pivotal year for the label printing industry. During Labelexpo Americas, we witnessed the unveiling of a new generation of entry-level digital production presses that allow converters to move into the digital print space at viable price points. We also saw companies showcasing digital inkjet retrofit technology, turning conventional flexo presses into hybrid print systems.

Looking forward, the digitization of the industry will continue. 2014 marked the first year in the North American marketplace that digital production press sales outpaced sales of new conventional presses. This trend will persist, however not only at the converter level. We speak with brand owners on both sides of the Atlantic every day and in the research work LPC does with industry associations, we are seeing a small number of consumer packaged goods companies and contract packagers across North America and Europe buy digital presses to vertically integrate some or all of their label printing requirements. Digital press manufacturers foresee this trend growing in 2017.

For label converters, in an increasingly competitive landscape, the core challenge is to constantly find new ways to add value to the products and services they offer. In North America and Europe printed packaging procurement is becoming more centralized. Some of the avenues that used to offer prospecting opportunities are diminishing. R&D departments, marketing, brand management and package engineering have historically been channels where label converters have had success in securing new customers. These channels are closing as purchasing becomes more centralized and new vendors are directed to deal solely with sourcing and procurement – personnel functions that are non-technical with high turnover rates. The near future will demand that label converters are more innovative than ever; curating new marketing and business development strategies to approach prospects while ensuring the equipment on their production floors meet the changing requirements of their existing customers.

Jakob Landberg, director of sales and marketing, Nilpeter

Last year, I predicted that 2016 would be unpredictable – and that wasn’t half wrong. Brexit was a punch in the European gut, and my guess would be that 2017 also can be tagged as ‘unpredictable’. However, it would be nice if 2017 would give us a break to get our ducks in a row after the turmoil of 2016.

I see three tendencies: label customization and complexity, environmental sustainability and globalization. In 2017, I trust we will see that customization will gain a footing within product segments we surprisingly hadn’t envisioned. This tendency will push many speciality machines in the label market – multilayer, multitype substrate, multi-lamination and multi-process.

I believe that the complexity of brand owners’ label jobs will increase considerably. As an example, we now see that wine back labels are heavily embellished as opposed to just being a simple info labels. The ecolabels also push the boundaries for accuracy when it comes to color matching and for exploitation of printing techniques, such as hologram printing. As a business, we will continue to advocate these types of security features. At the other end of the spectrum, we see labels with a ‘handcrafted’ look, supporting the trend of brand story-telling; the steak is not just a steak, but a gift from the farmer ‘Bob’ who has given his cow ‘Angus’ a whole lot of TLC.

We hope that in 2017, and onwards, we will see the end-user segment accepting the fact that there is a correlation between quality and price. The label business offers numerous solutions that will reduce the environmental footprint of the end-product, which everyone agrees is a positive thing. But the brand owners are not even willing to pay a nickel premium to support sustainability. However, a consumer push can make labeling and packaging solutions move toward sustainability –even accepting the cost of it. Cooperation between the label industry and the consumer segment could have a positive effect on our business. Increased consideration for the environment will attract new generations of label converters who are drawn to clean and idealistic businesses.

We at Nilpeter are bracing ourselves for intensified globalization in 2017 and onwards. The world has become a village. So what does globalization mean to the label industry? A strategy would be not to put all of one’s eggs in one basket – and luckily our innovative, aesthetic and eco-friendly business has the capabilities to navigate in an ever-changing world.

Michael Smetana, head of marketing, HP Graphic Solutions Business

2016 has been a remarkable year for HP Inc. as we have continued to demonstrate our commitment to the graphic arts industry. This year’s drupa proved to be HP’s best ever, and revealed a growing focus on digitally printed packaging, demonstrating the changing industry landscape as it evolves against market demands. With digital print emerging as a major trend in the packaging arena, HP proved it was in front of the curve, with a complete packaging line-up and with the unveiling of a new post-print solution and strategic collaboration with packaging giant Smurfit Kappa.

Committed to reinventing our technology, HP’s new solutions this year have spanned the entire packaging market, including the HP Indigo 8000 Digital Press for labels and flexible packaging, and the HP PageWide T1110S and T400s in the corrugated sector. Alongside this, we have seen an impressive uptake of our existing solutions, with the HP Indigo 20000 and 30000 achieving double-digit sales at drupa and surpassing 100 installations across the globe.

Today, HP technology is behind 80 percent of digitally printed labels worldwide, with labels and packaging established as the company’s fastest growing segment. As we continue to demonstrate to brand owners and packaging converters how digital printing is adding value, creating new possibilities and transforming the packaging industry, we are confident that we will see continued growth moving into 2017 and beyond.

Filip Weymans, VP, marketing, Xeikon

2016 has been an exciting year for Xeikon. Our new colleagues within Flint Group are all eager to discover the digital concept, which has blown a lot more wind into the sails to expand on a global scale (US, Latin America, Asia-Pacific) and serve our customers in a better way. Converters around the world still scratch their head at how digital printing workflows can contribute to their business and make them future-proof. Not having the need to convince them about one thing but being able to serve them on a broader scale of products does give them a lot of trust in our advice. And this is becoming more valuable as many suppliers start turning their ships in the direction of labels and packaging. This will create confusion and we think that 2017 will bring even more choices, which makes it challenging for converters to understand what would really serve their business. We’re very much looking forward to 2017 in further building that path with our customers and that’s a driving force for us to organize the Xeikon Café as an environment to bring this industry together and create room for converters to discover and learn.

Mikkel Wichmann, CEO, Trojanlabel

Many of those who have not yet invested in digital technology are waiting for the one-size-fits-all solution, and it is not going to come. For years to come, we will still need different solutions for different jobs in digital label printing. We see efforts being made but I think we are very far from a one-size-fits-all. But even if label printers are taking on digital label printing, so are the print shops, commercial printers, converters, contract packers, manufacturers and brand owners themselves. The commercial printers have at least 20 years of experience in digital printing, and they know exactly what it takes to integrate new processes. They already serve the brand owners with printed materials, so why not labels too? Converters, contract packers and manufactures are all handling various complex processes on a daily basis, and, of course, they can press the print button of a digital label press.

What they might not know is how to prepare the digital files and how to ensure color matching, and maybe there lies an opportunity. What if the label printer provided their customers with distributed printing facilities? What if each customer had its own digital label printer for small runs provided by their label supplier? The label supplier takes care of material supply, installation, maintenance, training, file preparation and color management, as well as enables the customer to print small individual batches whenever this is required. This might be a way for them to cling on to the customer and the huge productions that they will still need from time to time.

We see an increasing demand from brand owners and manufactures to have in-house label printing equipment to serve their need for small batches, variable data and just-in-time production. And I believe that the only way the label printers can stay in the game is to figure out how they can contribute to that trend.

Yael Barak, future platforms and technology – labels and packaging, HP Indigo

Going into 2017 it’s clear that the trends we have seen in the market, including a proliferation of SKUs, dramatically cutting down the time to market and continuing the reduction of waste, are continuing to accelerate. The complexity in the supply chain needs to be managed efficiently. We are seeing more ways to make each label stand out – from the expansion of substrates and materials available, to the ability to make each and every label unique (for example, campaigns by Mr. Peanuts or Mondelez or Budweiser featuring HP SmartStream Mosaic software.) But unlike the past, it is not just the ultra-visionary brands and converters adopting these – it’s now mainstream and even the smaller converters who can offer this to their client base.

But it’s not just about short runs and personalized campaigns. In fact, one of our biggest sources of pride is that, through significant improvements in productivity and production efficiencies, such as available in the Indigo 8000 digital press, our customers are using our solutions to drive a very significant portion of the main business on our presses, to the point that it’s now the primary driver not just in terms of profit, but in terms of volume, too. With more regulations driving for up-to-date, accurate product labels (such as ingredient lists) and the operational advantages of high-capacity digital production we expect this trend to increase in 2017.

Going into 2017, we are seeing more and more embellishments, and even the first demonstrations of embellishments done digitally. At drupa 2016, we demonstrated the first step towards an HP Indigo Digital Combination Press, which is designed to, through a single file and point of control, print both the label and the embellishments in an end-to-end digital line.

It must be said that not all the trends we anticipated in the past few years reached their tipping point. One example is security features. We believe there is a very real need for these in the market, but we still have not seen widespread adoption of features that make full use of digital printing capabilities for security purposes, tracking and brand protection purposes. This is one area for which we see huge potential in 2017 and beyond.

It’s a very exciting time in the label converting market today. There’s growth, and potential for even more growth. Most importantly, after the first wave of the digital revolution in labels, we are now at the cusp of a second revolution – one that fully leverages the benefits of quality, automation, color and, of course, the Cloud.

All of these are posed to helps brands and converters further differentiate through unique, top-quality products that will spearhead the label industry for years to come.

Kevin Shimamoto, general manager, wide format, Memjet Technology

In 2016, digital inkjet solutions showed significant momentum as a mainstream technology. Label and packaging providers weren’t wondering if and when they should move to inkjet, they were asking what solution would best meet their needs and from whom they should buy it. As a result, Memjet partners created a greater diversity of solutions that increase the capability and affordability of solutions for this market. Growth of these types of solutions will continue to grow in 2017. We expect to see significant demand from flexo printers for retrofit digital inkjet solutions. Because these solutions utilize existing capital infrastructure, providers are able to add digital capabilities at a low cost of entry. An example of this is the Colordyne 3600 Series Retrofit, which is now also being sold by Mark Andy. More growth will come from solutions that combine multiple applications in one system. With solutions like the Trojan3 and NS Multi, providers need to invest in only one product to produce several packaging applications on a wide variety of substrates; the NS Multi can print on folded boxes and flexible packaging, while the Trojan3 can print on bubble wrap and even wood.

The digital corrugated wide format solution we created with Xanté has progressed to the manufacturers’ operation, giving this new market the ability to produce their own personalized packaging.

The demand for inkjet solutions —and this high level of product innovation—will continue into 2017 and beyond.

Tino Bocciolini, vice president, sales and marketing, Armor ICP

As far as consumables in labeling and flexible packaging applications are concerned, the auto ID market remains fundamentally robust and 2017 will see this positive trend continue.

Year in and year out, growth continues at around the five percent mark and it is the objective of all market players to exceed this organic growth rate by exploiting their particular competitive advantage.

Thermal transfer technology is now 30 years old and has reached maturity, yet still offers advantages that cannot be equalled: it is economic, reliable and clean. Today, low-cost operators are gaining a solid foothold in our industry but, as is always the case, they will quickly come up against their own limitations. You just have to offset the anticipated gain from the printed label against the constraints and risks incurred: the outcome is clear and is a simple matter of common sense. At the end of the day, quality and service will come out on top whenever the solution is coherent, appropriate and offers a high level of performance.

Transportation costs are falling, global customs agreements are becoming less onerous and all costs along the supply chain are on the way down; yet proximity and the concept of customer service increasingly go hand-in-hand with growth and loyalty, especially in emerging regions where markets are posting above average growth rates.

All of Armor's most recently established transformation subsidiaries (India, Mexico and South Africa) confirm the value of proximity by producing remarkable penetration rates, and this is only the start.

To this can be added moving upmarket into niche applications, where the search for added value is the logical counterbalance to low-cost approaches. We must find new applications which are more demanding, more captive and more profitable, all of which will enhance the market as a whole. Armor's R&D is focused on such new developments, which are always more environmentally friendly - a further sign of a well-structured industry continuing to make progress.

Each year our volumes increase and our carbon footprint reduces as new fields of activity open up: it is this very virtuous circle that motivates us to maximise performance.

Although 30 years old now, thermal Ttransfer technology still has a number of cards to play and ARMOR will continue to demonstrate its commitment via investment, innovation and new sites throughout the world.

Gary Seward, managing director, Pulse Roll Label Products

We see no signs of the trend towards digital color management abating, as the value of pre-press color control and ‘going digital’ for next-generation flexo printing is recognized, and as demand from brand owners for accurate and standardized color continues. We anticipate label producers working more closely with their ink partners not only to achieve optimum print quality but also to help increase production efficiencies, reduce waste, minimize press downtime and increase overall profitability. For example, switching to our high strength PureTone mono-pigmented mixing bases allows finer grade anilox rolls to be used thus improving print quality but also reducing our customers’ anilox inventory. Demonstrating this trend, industry interest in our PureTone inks as part of a total color management concept has been unprecedented, not just in the UK but worldwide.

We also see exciting potential for premium laser-markable coding as brand owners, retailers and label printers seek solutions to overcome current challenges faced in the quest for premium printed variable data. In partnership with DataLase, and as its preferred narrow web ink partner, our new UV flexo coating, PureCode, has been formulated to provide superior marking on the finished label. Another example of product development providing a value-added solution for brand owners and label printers alike.

2016 has been an outstanding year and alongside our success in the UK and Europe we have also focused on building a presence in Asia-Pacific, which offers tremendous opportunities for future growth. Recently accredited with the world-recognized Investors in People Standard, Pulse Roll Label Products continues to build a skilled and experienced team. Our focus on R&D and product development to provide innovative ink and varnish solutions has contributed to our growth once again this year and will remain as we hope to take advantage of the many opportunities that the UV flexo sector has to offer in 2017 and beyond.

Nathalie Muller, CEO, Linkz IM

In 2017, smart packaging will continue its rapid growth, especially digitally connected packaging. This means that simply by scanning a product or label with a smartphone, people get access to tailored information. This is part of the consumer trend where people increasingly expect to engage with brands whenever they want to and to obtain extra, personalized value from a product. This can be in the form of entertainment, detailed information that doesn’t fit on the packaging, how-to videos, discounts and other digital services. A clear example is QR codes, which are making a comeback, albeit in a different way than when they became popular with consumers five years ago. But technology has moved on and other triggers can be used for scanning by consumers as well: Digimarc Barcodes (imperceptible digital watermarks), good-old EAN barcodes, RFID and NFC tags, and also image recognition.

In turn, platforms that manage these triggers deliver detailed insight into customers’ behaviour, allowing brands to tailor their messages and improve brand satisfaction. Forward-looking brands are starting to use some of these triggers for track-and-trace in their supply chain, or one-off marketing campaigns with a ‘wow’ factor. In 2017 this trend will spread and brands will start to use these triggers as a new marketing channel to their customers. This is further fuelled by digital presses that allow for labels and packaging with individual codes (visible or invisible).

Dr Mark Deakes, general secretary, International Hologram Manufacturers Association

China in particular continues to offer almost limitless scope for the holography industry today and in the years to come. But we need to see more and quicker action if the tidal wave of Chinese counterfeit goods flooding onto the market is to be checked, let alone stopped.

More needs to be done to tackle the problem and this might include increased integration of holograms in China as part of brand protection strategies.

The Chinese cannot defeat counterfeiting on their own, so collaboration with the likes of the IHMA, and what we offer in terms of helping China to tackle counterfeiting, has to be a welcome priority. International communication, open-mindedness and closer collaboration will be beneficial as we move forward, helping us to tackle and solve this problem together.

Dr Deakes’ comments come from a detailed exploration of opportunities for holograms in 2017, which can be read here

Isaam Lutfiyya, business development manager, QuadTech

2016 has been a fantastic year for QuadTech. We launched four brand new products this year and dramatically increased the pace of our innovation. The results of this have set us on a course to better meet the needs of our customers today, but importantly, tomorrow too. We have some amazing products and technology in development. We have been delighted by the market’s reaction to these changes – and seen a significant rise in sales, from both existing and new customers.

The key priority moving into 2017 is to preserve the pace of innovation that we’ve established with so much success this year. With new products planned for launch in early 2017, we’re not only developing individual segments, but also taking a holistic view on the needs of our clients and the wider market, and working on solutions that connect us across segments. We recognize that, while we have market-leading solutions, we have opportunities to increase customer value and help them solve other business issues. This recognition has led us to broaden our approach, solidify our focus for 2017, and focus on solutions that help customers improve their entire workflow, rise above their competition and satisfy brand owners.

When comparing offset and flexo technology, it’s now commonly understood that we can expect more growth in the latter. However, this doesn’t mean that there aren’t still plenty of opportunities in offset technology. Even where printers aren’t investing in new presses, they are often taking on more work and making their current presses more productive, meaning that for many, workload is still increasing. Over the course of this year, we’ve seen both flexo and offset printers embracing QuadTech technology; a reflection that opportunity still exists, even in the face of a slowing market.

Digital is a key strategic focus for us. We’ve been working with digital press owners for a while now to explore the potential of this market, and we’re looking forward to sharing positive news on this in the near future.

www.quadtechworld.com | @QuadTechWorld

Ken Moir, vice president, marketing, NiceLabel

2016 marked a year of transition. Historically, companies viewed labeling as a background process. That started to change as many moved away from fragmented solutions and decentralized labeling operations to centralize labeling processes and standardize on label management systems. As we look to 2017, we expect companies to take advantage of the productivity gains and cost savings that next generation label management systems provide. New levels of print productivity will deliver process improvement that drives down the cost of labeling. Companies will benefit from increased agility that will allow them to easily comply with regulations, meet customer requirements, ship product faster and sell more. Business users will be able to take ownership for labeling so that costly IT resources can focus on other mission critical tasks. Labor costs associated with labeling will drop and hidden indirect labeling costs like fines, recalls, production shutdowns and shipping delays can essentially be eliminated. Growing companies will be able to streamline labeling outside the enterprise by extending labeling to third parties.

2017 will be an exciting year as we watch companies leverage label management to transform their business and accelerate growth.

www.nicelabel.com | @NiceLabel

Brian Ayers, market development specialist, FLEXcon

As we move into 2017, one major trend we’re seeing at FLEXcon is a dramatic increase in personalization for label design. Consumers are demanding more customized and attractive label designs, and we expect that to continue next year. Prior to digital printing, manufacturers relied on smaller individual batch runs to achieve similar levels of personalization found in the market today. Now, the evolution of digital print capabilities has enabled us to personalize everything for the consumer – from health and beauty products, to outdoor power tools, to food and beverage labels. We believe that product portfolio will grow even larger in 2017, which will require a greater demand for digitally personalized labels. To accommodate this shift and embrace cutting-edge digital print technology, FLEXcon has developed new topcoats, which can be coated on their industry recognized components so converters can continue to sell into applications with specifications while utilizing the new digital printers currently available in the market. Our topcoats have all been fully optimized to take advantage of the latest digital print technology, and are compatible with the top printers in the market.’

Paulo Souto, director, Sistrade

I have big and smart expectations for 2017. The concept of Big Data is not new and has been around for some time already but it is going to stay and be ever-more important for label converters and packaging producers. ‘What shall we do with all the data? How can we use it for sustainable growth?’ In my opinion, these are the two questions that leaders and the industry are asking themselves. The amount of data that is available is so huge and its management has never been more important. The first steps have already been made by most, which include data mining and storage systems; now it is time to refine the data and invest resources and time to analyze it. Our Business Intelligence and Smart Statistics tools will be high in demand over the coming year.

Smartphone, smart watch…‘smartfactory’? This year’s tradeshows have proven that 3D technology earned its firm place within the industry, therefore, I believe that the coming trend for the industry is making a factory smart. How? Why not start with virtual reality and 3D technology?

Shaan Patel, business development manager, Arrow Systems

I think as the demand for short run labels increases we will see a greater emphasis on the digital markets and a shift away from flexographic printers. I don't think it will be long before the benefits of going digital outweigh the costs associated with getting into that market. While there will always be a place for high production printers within the markets, I think that we will begin to see a lot more small printing companies using digital technology to produce short to medium sized runs.

With this increase in the number of small printing companies will come with it an increase in the demand for digital printing solutions (of which there are already many) and digital finishing solutions. Specifically, I think we will see a move away from knife finishers and a push towards more laser finishing solutions. This shift is something that is already being addressed by companies like Anytron and others who are creating affordable laser finishing options.

Jay Dollries, CEO, Innovative Labeling Solutions

Brands are struggling to engage and retain consumers who are increasingly immune to traditional marketing efforts. Relevancy, speed to market, SKU proliferation and continued consumer demand for customized packaging are a few of the driving forces shaping our predictions for 2017:

- Digital print is giving brands the flexibility to easily and cost-effectively change graphics and text, ensuring maximum relevance and impact; as omnichannel marketing strategies continue, digitally printed packaging and labels will play a crucial role as powerful marketing tools in the creation of seamless customer experiences;

- New developments like the digital embellishment technology being developed by HP Indigo will also come to fruition; the one pass solution will present innovative opportunities to increase shelf appeal and add value to label and sleeve jobs;

- Competition amongst printers who have acquired digital printing capabilities has increased, and this will drive innovation around digital workflow systems to streamline production, as speed-to-market becomes a larger differentiating factor for brands looking for relevancy;

- Digital print has yet to make the same penetration into flexible packaging as it has in the label market, but we can expect that to change in 2017, with demand for sustainable, convenient packaging only growing and the market prime for leveraging digital print.

www.ilslabels.com | @ILSDigital

Cees Schouten, technical director, Geostick Group and Dscoop board member

2017 looks set to be an exciting year for digital print providers. The trend towards smaller run lengths will continue and I expect this will be the year that the flexible packaging market, which has so far been very much in the early stages of digital adoption, to start making serious strides in exploiting the benefits of shorter runs, shorter lead times, customisation, etc. The label market will continue to expand, with more automation in the workflow to support that growth. Web-to-print will also rise and printers will offer more and more services such as labels, sleeves and packaging all under one roof. The effect of this will see some printers consolidating and growing, whilst smaller print houses may struggle to compete unless they can find a way to add value to their services. This is what we see within the Dscoop network, smaller businesses with their fingers on the pulse; sharing best practice, adopting the right technology early, working collaboratively to offer more services with more value and stay on top of the game.

www.geostick.nl | @geostickbv | @myDscoop

Damien Prunty, general manager, Pemara Labels (Australia)

In 2017 we should expect to see a continuing push to drive time and cost out of the supply chain. Ongoing time to market pressures, particularly in the FMCG markets, will impact packaging companies’ lead times, and proactive packaging companies will be focusing on workflow improvements in line with technology investment to get ahead of these pressures. End-to-end artwork and digital asset management systems will allow packaging companies greater flexibility and more timely response to changing market conditions, including new product development, and to accommodate increasing regulatory change requirements.

We will also see the various digital print technologies continue their push to become the dominant printing technology in the packaging sector. Speeds right now are increasing, extending into what were traditionally conventional print runs. In markets where brand owners are looking to “converse” directly with consumers through product labeling, digital provides a unique solution, and those same brand owners are becoming more aware about the value of digital versus the cost. This is evident in all of the high volume branded products printed digitally in the marketplace.

Stay up to date

Subscribe to the free Label News newsletter and receive the latest content every week. We'll never share your email address.