North America label market defies economic gloom

Economic pundits may be pessimistic, but regional converters are finding new routes to value through digital print, sustainability and mergers & acquisitions, as Danielle Jerschefske reports

The North American label market as a whole, including Mexico, the US and Canada, has moved beyond the economic doom-mongering in the media. It is embracing industry conferences as a means for networking, benchmarking and learning about new ways modern businesses must evolve in order to remain successful.

The region’s premier trade association, the TLMI, hosted a Technical Conference and its Annual Meeting this fall. Both were refreshing and well-attended by both converter and supplier members. The TLMI Technical Meeting offered a business track for the first time which included in-depth discussion around Lean manufacturing and a strong panel session with leading industry players on aligning sales and operations through strategic planning.

Followed shortly by the Annual Meeting, TLMI organizers did a fantastic job of stringing through the important relationship between innovation, social media, sustainability and labels and packaging. For the first time in Phoenix, attendees listened to a designer and brand owner panel discussion on Future Product Technology and Design: Opportunities for Converting Solutions.

After participating in both conferences, it is evident that long-term success in the converting world will require a comprehensive understanding of social media channels, their use and value to consumers and brands, and the ability to link labels with the modern marketing tactics required to reach the new generation of shoppers.

The PLGA (Packaging and Label Gravure Association) Global inducted its first CPC representative and first female as president at its annual 2011 Operational Conference. PLGA’s new president, Annette Crampton, is the graphics manager at MillerCoors. Over 150 people attended, an increase of six percent over 2010 numbers. The FTA too hosted 1,600 package printers, label converters and their suppliers at its best attended ever Annual Forum to date.

Digital

It’s clear that digital will continue to experience rapid growth in North America over the coming years, but that the technology, rather than ‘overtaking’ conventional machines, will become an important piece of capital within a converter’s overall business portfolio. Leveraging the benefits of a multi-platform printing model will greatly help label converters find longer term success.

This year many more label converters in the NAFTA region adopted digital technology and the market has seen first time installations of Epson’s SurePress in California and Nilpeter’s Caslon flexographic/ inkjet hybrid in-line machine in a number of locations in Canada and the US.

Karstedt Partners published its Commercialization Assessment Report of digital print technology for the narrow web label market, which is neutral between digital and analog and offers an objective view on the value of digital printing in a converters' own plant.

Its key findings are that digital is successfully meeting the expectations of its early adopters, while brand owners view digital as a far more encompassing tool than just print. At the same time, converters must educate brand owners on the capabilities that digital can bring their products and must keep up the value of digital print in the marketplace.

Digital printing fits well into the modern supply chain and the need to simplify complexity, improve speed-to-market, limit tied up assets, be more sustainable and reduce cost. Front-end developments from software suppliers like Tailored Solutions, Radius and Cerm, which recently hired a business development leader for North America, allow converters to re-align and streamline processes with the potential to increase margins. The question is not which process is better, but where each process can best be used.

Sustainability

Sustainability has come a long way in the last year. Critical mandates have come down through the supply chain. Canada introduced a Stewardship Tax on all product packaging that cannot be recycled within the country’s current infrastructure, shining a light, for example, on the use of PS labels on PET thermoformed packaging.

Leading material suppliers UPM Raflatac and Avery Dennison have introduced label constructions with specially formulated adhesives that will not gum up the recycling streams. Already leading brands have adopted software programs such as Compass and Piquet which can evaluate at prototype stage an entire package for the total environmental footprint of each component.

Sustainable manufacturing has been adopted by many of the region’s leading converters as a means of combating continual rises in raw material input costs and helping their customers improve their own environmental profiles – a great way to increase customer loyalty.

Mitsubishi Polyester Films developed a ‘cradle to cradle’PET filmic liner recycling technology called Reprocess that will allow spent liner to be reused to produce first quality liner. The supplier has tested Reprocess liner in high-speed application lines with Spear for beer bottle labeling, and CCL for high-volume health and beauty products. It works reliably, and costs the same as virgin PET liner, according to the company.

Completing the cradle-to cradle recycling loop relies heavily on buy-in from multiple stakeholders through the value chain. Mitsubishi is working hard on building a PET liner waste collection system and has enlisted the help of registered ‘waste’collectors for this purpose. It has distributed Reprocess-labeled containers to participating CPG facilities and packagers to create awareness about the scheme and to try and get the liner viewed as a valuable resource.

Disposal options for release material, particularly film, in the US are bleak. If the material is not land-filled, many thousands of tons are downcycled in China or in other emerging markets to produce low value items like toothbrush bristles and other commodity items. Mitsubishi estimates that more than 60 percent of North America’s release liner is shipped overseas.

Together Mike Fairley and I released the Environmental performance and sustainable labeling - A ‘how to’guide to becoming a ‘greener’label converter and label user at Labelexpo Europe 2011 to help label converters and industry suppliers with information about the environment, sustainability, climate change and the waste debate as it affects the label industry. It reviews the legislation, guidelines, directives, protocols and industry initiatives that have been introduced over the past decade. We sincerely hope that this new ‘How to’book will guide the industry towards a more sustainable and profitable future. It’s no longer a question of when, but how.

M&A

Multi-Color Corporation continued on the acquisition trail through 2010- 2011, most impressively with the purchase of privately held York Label Group in October for 356 million US‚Äàdollars. York Label Group primarily serves the pressure-sensitive label markets for home and personal care, food and beverage, wine and spirit and healthcare. York Label had 12 plants across the US, Canada and Chile, many of which are currently being folded into existing Multi-Color sites. Arguably the world’s second largest label converter, the firm believes its customers will benefit from a wider product offering, greater flexibility and plant redundancy, more investment in technology, increased access to innovation and greater consistency in quality and service. This huge acquisition was followed by a move in Italy and Poland, and the establishment of Latin American operations for the wine markets in Chile and Argentina earlier in the year.

Smaller to mid-sized label converters made a number of moves this year as the market finally experienced some of the consolidation that’s long been expected. Kopco Graphics acquired flexible packaging converter Techpak, Smyth acquired Dow Industries to improve its Northeast presence, I.D. Images bought Heather Label to expand into Southeastern US, Repacorp acquired Aladdin Label to move further into primer label production, Western Shield purchased Self-Stik Labels, Brook & Whittle purchased PackStar Group for its shrink sleeve label production capability, and CCL acquired Thunder Press, a pharmaceutical leaflet and expanded content label producer.

Big moves were also made by the market’s industry leading suppliers. RotoMetrics officially acquired Gerhardt International in April and Labelexpo Europe marked the first industry event where the two companies’products were exhibited together and the first joint venture technology project, AccuStar flexible die system. RotoMetrics now has 950 employees and operations in 17 countries. It opened a Converting Technology Center at the home office in Missouri over the summer and is aggressively working on new flexible die technologies. EFI acquired Australian MIS supplier Prism and Anderson & Vreeland expanded its reach into Quebec with the acquisition of Flexolution.

North America Converter survey 2011

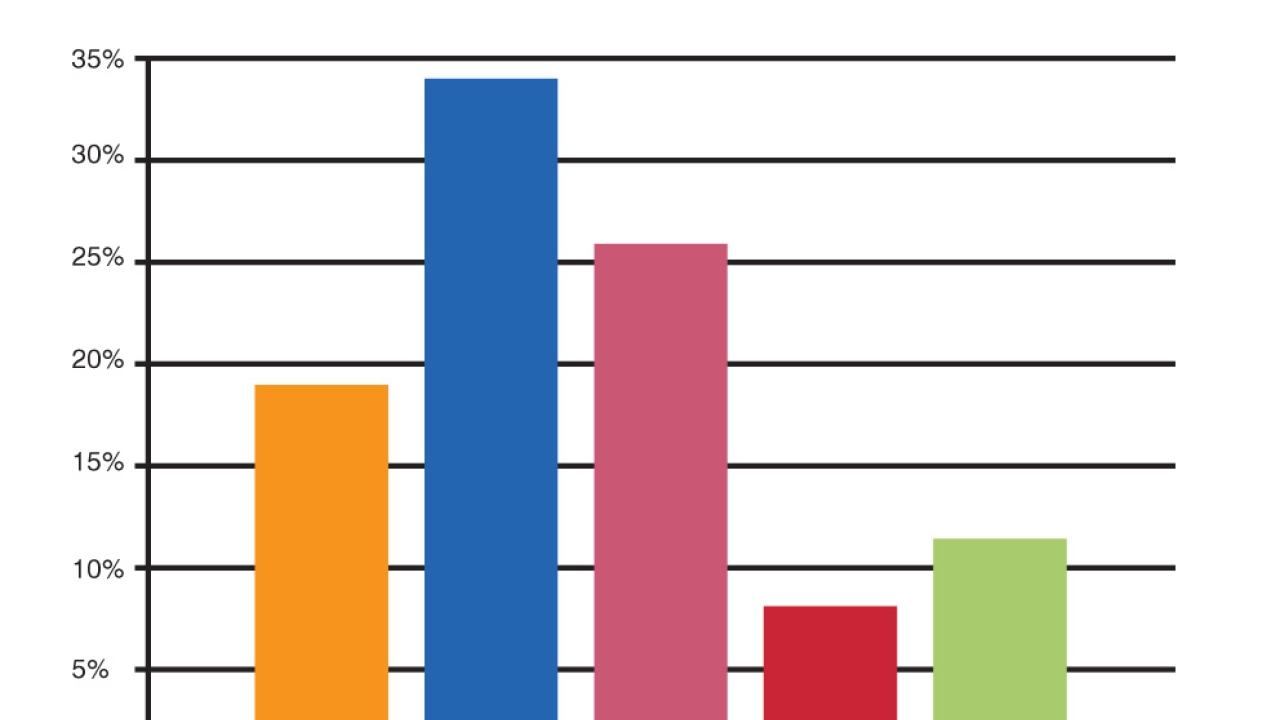

Labels & Labeling’s North America Label Converter survey, conducted in January 2011, revealed that over 40 percent of respondents are already producing flexible packaging, while nearly 20 percent are converting folding cartons. Fifty-seven percent are producing some sort of ticket or tag. Over 40 percent of respondents were able to achieve over 10 percent in sales increases while over 80 percent reported above a five percent operating profit on these sales. Almost 60 percent of respondents are using social media avenues. LinkedIn is believed to be the most valuable to a business. Benefits to social media participants have included new business leads, improved customer communication, increased hits to the company website and the ability to establish new business partnerships.

Pictured: Chart shows the percent sales growth in 2010

This article was published in the L&L Yearbook 2012.

Stay up to date

Subscribe to the free Label News newsletter and receive the latest content every week. We'll never share your email address.