Regional round-up: Europe

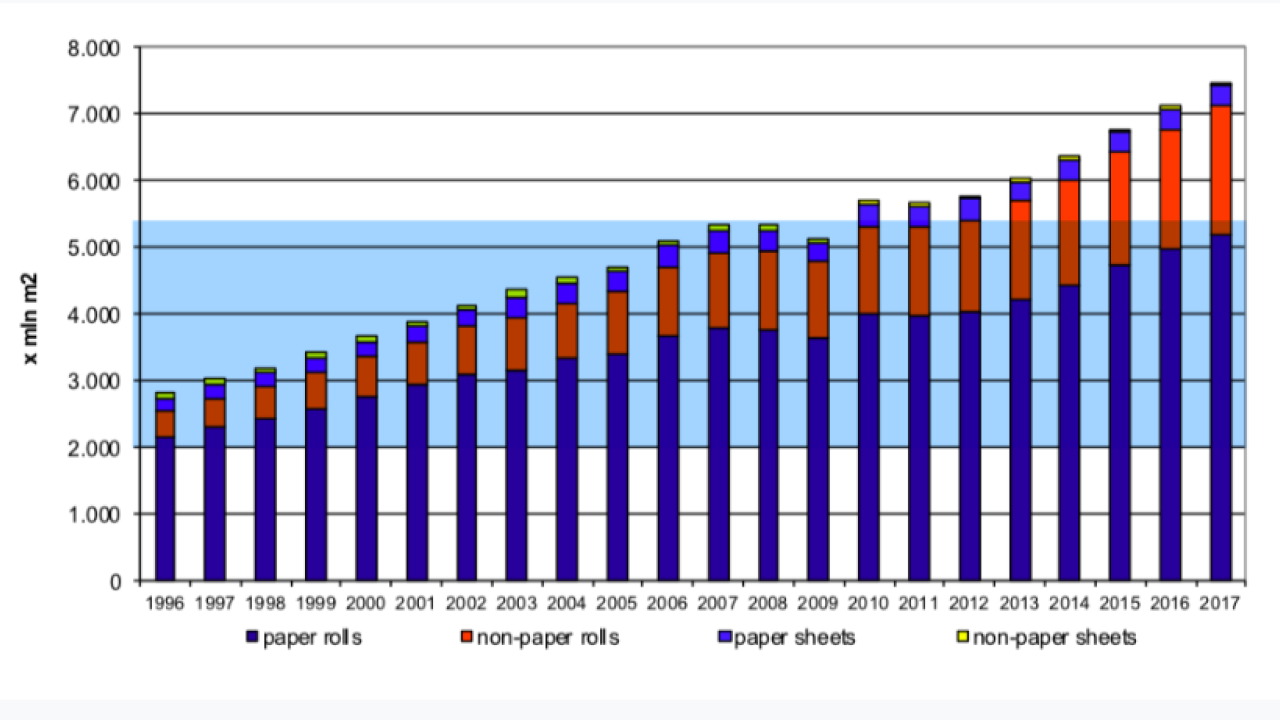

Total consumption of PS label materials in Europe increased by a healthy 4.7 percent in 2017 – the most recent period we have full figures for – representing an average growth of 5.4 percent since 2013.

Filmic rolls continued their growth at the expense of paper, now forming 26 percent of total demand, compared to just 15 percent in 2000. The growth rate of filmics in 2017 was 8.2 percent, double that of paper rolls, while sheet PS materials continued their longer term decline.

Eastern Europe continues to be the European PS powerhouse, accounting for 22 percent of PS volume – almost double the figure for 2003. South and southeastern Europe were the fastest-growing label markets in absolute volume between 2010 and 2017. During this period all European markets added 1.6 billion sqm of annual consumption, amounting to a growth rate of over 28 percent.

The potential for further growth is clear, since the top 15 label markets in Europe still accounted for 95 percent of total consumption in 2017.

Wider trends

Every year Finat also commissions a study into wider European industry trends (the Radar report), and the findings of the full 2017 survey were presented during the Finat congress in June. A key finding is that brand owners remain positive towards PS labels, planning a 3-5 percent increase in spend, although there is a continued migration to shrink sleeve labels in food, personal care and household chemicals. Almost one quarter of the end user sample stated their intention to move to shrink.

Other key end user trends include a preference for more complex labels – mirroring the fact that most new flexo presses are now built to order. Non-prime labels are increasingly functional or ‘smart’.

Specific sourcing of digital labels is still not a priority for food and beverage brands, though there are indications this could change, with digital label procurement forecast to grow by over 7 percent.

Eastern Europe remains the preferred region for label sourcing, but Africa has now appeared on the radar for the first time.

The highest growth sectors – at over 5 percent – include automotive, consumer durables and industrial chemicals, while pharma, HABA, food and household chemicals slowed compared to 2016.

Turning to productivity, the report concludes that European label industry employees generate an average of €173,000 turnover per person, and total sales of between €110,000 and €210,000.

A new category in the Radar report is the amount of running waste produced during a job, excluding matrix waste. The average wastage figure across Europe is 5-10 percent, with the highest figures in southern and eastern Europe (8-9 percent).

The Radar report showed almost one fifth of the converters surveyed were already producing flexible packaging, a 3 percent year-on-year increase. Around one third of the sample were also printing shrink sleeves. In the category of flexible packaging, not including sleeves and stand-up pouches, there was an astonishing 14 percent year-on-year increase to 27 percent, with a further 8 percent ‘very interested’ in entering the flexpack market.

These figures are confirmed by Labelexpo visitor figures for the last three European shows. Labelexpo asks visitors if they have responsibility for buying flexible packaging-related products, and the number of affirmative answers increased from 37 percent in 2013 to 43 percent in 2017.

European consumer trends all point towards increasing opportunities for label converters in the flexible packaging and shrink sleeve segments: smaller pack sizes for smaller households; single serve and eaton-the-move products; more varieties and pack customization.

Digital trends

Finat has also launched, through the LPC consultancy, a Digital Press Index to track installation trends in Europe in the broad categories of toner and inkjet/hybrid.

According to LPC’s figures, digital printing now represents 10.5 percent of new press installations in Europe. Out of the 2,300 digital presses installed in Europe, LPC says 71 percent are currently toner-based and 29 percent inkjet/hybrid. Figures collected by LPC for press installs in 2017 show that 59 percent of the 300 digital presses sold in Europe were inkjet/hybrid.

When Finat surveyed converters’ buying intentions for its Radar report, an equal number were aiming to invest in conventional flexo and digital presses. Of those investing in digital, one third intended to buy toner presses and 58 percent inkjet, of which 21 percent chose hybrid.

Looking into what converters intend paying for these digital presses, almost one quarter of the sample will be investing €1m-1.5m – firmly into more advanced flexo press territory.

Turning to European brands’ attitudes to digital print, LPC finds that almost one third of its sample are ‘true believers’ in digital – they have fully integrated digital print into their marketing and logistics operations.

Another 20 percent are ‘unconvinced users’, who have had some success with digital but are held back by higher costs from migrating more products from flexo.

Brands not yet using digital LPC breaks into ‘optimistic’ and ‘pessimistic’. The former represent 35 percent of the sample, and are convinced that at some point digital will work for their organizations; the pessimistic 15 percent simply believe that digital is too disruptive to their working methods and supply chains, despite understanding the technology.

Consolidation

Consolidation continues to affect the European label industry, both among suppliers and converters.

The most significant European consolidation involved leading Italian package printing group Nuceria joining forces with All4Labels to boost the group’s global reach. Through the merger with Nuceria, the All4Labels Group hit a total turnover exceeding €500 million from 29 production facilities across the globe, including the former Rako and X-Label operations in Europe.

Antonio Iannone, founder and managing director of Nuceria Group, takes responsibility for the group’s Italian operations, while Guido Iannone, general manager of Nuceria Group, became a member of the All4Labels global management board and with responsibility for one of the global sales business units.

With its headquarters in Hamburg, Germany, All4Labels was founded in 2016 as a global platform for family owned businesses ‘which share the vision to develop sustainable packaging solutions in a global context, while retaining the flexibility and strength of an owner managed business.’

One of the UK’s leading label converting groups, Reflex Labels, ramped up its acquisition program, adding Sherwood Packaging, MP Logistics, Barcode Tech and Kingsway.

St-Luc Labels & Packaging, headquartered in Nazareth, Belgium, took over Pharmalabel, a Dutch pharmaceutical label specialist, to enhance its one-stop-shop offering. The takeover means St-Luc Labels & Packaging now has four branches in three countries: St-Luc Labels & Packaging (labels, shrink sleeves and flexible packaging) in Belgium, Microbox (folding carton) in France, and Altrif Label (labels and booklets) and Pharmalabel (pharmaceutical packaging) in the Netherlands.

On the supplier side, the biggest announcement was the Mark Andy acquisition of Presstek. Although not strictly a European transaction, it did involve the integration of Presstek’s UK-based headquarters and demo center into Mark Andy’s European organization.

Global Graphics, meanwhile, was acquired by Congra Software, the parent of Hybrid Software. Global Graphics is headquartered in Cambridge, UK, and develops platforms for inkjet print systems. Both companies were already co-operating closely, with Guido Van der Schueren the controlling shareholder of Congra and chairman of the board of Hybrid Software. Since May 2014 he has also acted as chairman of Global Graphics.

Sustainability

A key sustainability development in 2018 was the European Union’s adoption of the Circular Economy package, which aims to ‘close the loop’ of product lifecycles through greater recycling and reuse. Although not targeted the label industry directly, there are clear implications for labeled packaging.

Member states will be required to ensure that, as of 2030, waste suitable for recycling will not be sent to landfill, and that by 2035 the amount of municipal waste disposed of in landfills will be reduced to 10 percent or less of the total amount generated.

The directive includes measures ‘to encourage the development, production, marketing and use of products suitable for multiple use that contain recycled materials, and that are, after having become waste, suitable for re-use and recycling.’

An amendment to the Packaging Waste Directive aims to increase packaging waste recycling, including encouraging an increase in the share of reusable packaging placed on the market. By the end of 2025 (and 2030), at least 65 percent (2030: 70 percent) by weight of all packaging waste must be recycled, including 50 percent (2030: 55 percent) of plastic.

Stay up to date

Subscribe to the free Label News newsletter and receive the latest content every week. We'll never share your email address.