Flexible packaging to grow in North America

Converted flexible packaging growth in North America is forecast to average around four percent per year to reach over 25 billion USD by 2018, with growth in Mexico expected to bounce back to grow at US and Canadian levels over the period, according to a new report from PCI Films.

PCI Films’ The North American Flexible Packaging Market to 2018 states that demand in North America’s converted flexible packaging market has been underpinned by recovering economies and flexible packaging formats being used as alternatives to traditional rigid packaging.

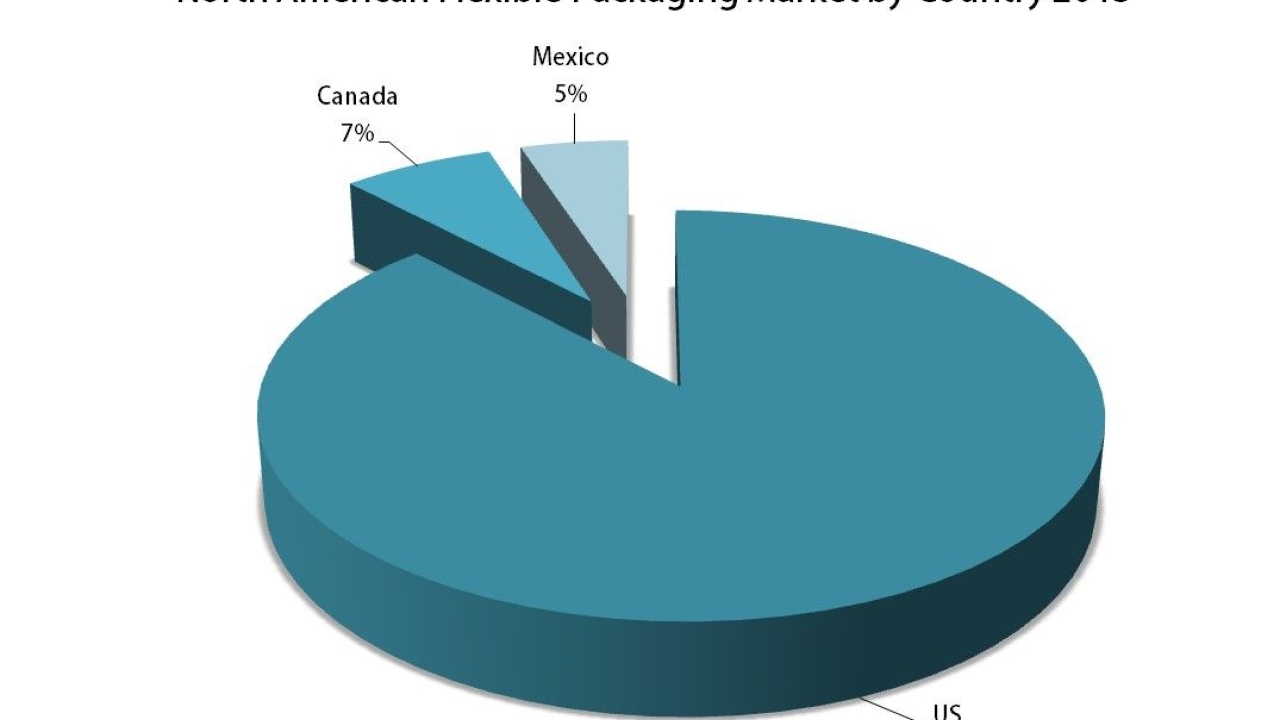

Within this, the North American converted flexible packaging market accounts for approaching 30 percent of global consumption with an annual spend of 20.7 billion USD in 2013. Around 90 percent of sales in the region are concentrated in the US, with Canada and Mexico accounting for seven and five percent respectively.

And after slowing in 2012 due to the economic downturn, demand for converted flexible packaging recovered to grow by around four percent by value in the US and Canada in 2013, while the Mexican flexible packaging market slowed markedly during the year to around 1.5 percent due to uncertainties following the change of government and slowing GDP growth.

Weakening margins and other competitive pressures caused significant rationalization and restructuring in the region with many plant closures and divestments, especially amongst the leading players.

For the future, converted flexible packaging growth in North America is forecast to average around four percent per annum to reach over 25 billion USD by 2018 with growth in Mexico expected to bounce back to grow at US and Canadian levels over the period.

Per capita consumption of flexible packaging in Mexico is less than one-fifth of the US figure, illustrating its potential for future growth.

The North American Free Trade Agreement (NAFTA) also continues to help drive demand in Mexico, with many US packaged food companies manufacturing in Mexico for the US market to take advantage of lower labor rates.

PCI Films consultant Paul Gaster said: ‘While the economic slowdown adversely impacted the flexible packaging industry’s profitability, volume growth has continued to be sustained by servicing primarily defensive markets such as food, pharmaceuticals and pet food.

‘Also, as packaging technologies have evolved, flexible packaging is becoming a viable alternative to rigid formats in a growing number of applications, with the stand-up pouch enjoying strong volume growth.’

Stay up to date

Subscribe to the free Label News newsletter and receive the latest content every week. We'll never share your email address.