Digital watermarks prove their worth in real-world trials

HolyGrail 2.0’s latest industrial trials demonstrate the technology’s readiness for commercial deployment across European recycling facilities.

The quest for accurate plastic sorting has reached a pivotal moment. After years of development and testing, digital watermark technology has finally proven it can deliver the precision needed to transform how Europe handles post-consumer packaging waste. The HolyGrail 2.0 initiative’s latest industrial trials, conducted at Germany’s Hündgen Entsorgung facility, have demonstrated detection rates consistently exceeding 90 percent, a significant leap forward in sorting technology.

Over 100 days of rigorous testing from August to December 2024, the facility processed real household waste from Germany and Denmark, clocking an average of nearly 56,000 detections per day. The numbers are impressive: 5.66 million detections across 5,949 unique SKUs, with detection efficiency ranging from 87.9 to 93.8 percent. This represents the largest-scale testing of digital watermark technology to date, proving its potential for widespread commercial adoption.

Beyond traditional sorting limitations

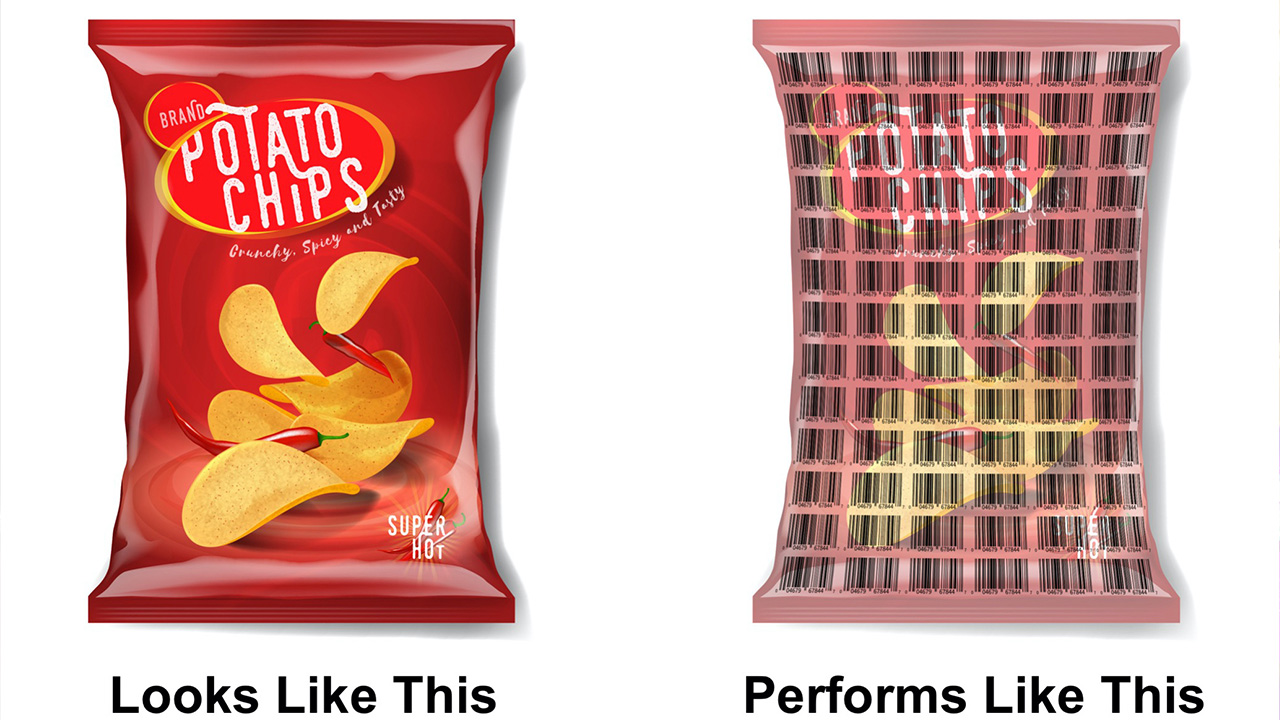

Current near-infrared and visible light spectroscopy (NIR/VIS) systems, while effective at separating basic materials like PET, polypropylene and polyethylene, face inherent limitations that digital watermarks can overcome.

‘NIR/VIS spectroscopy separates materials and colors; however, certain packaging features limit its detection capabilities. For instance, the presence of sleeves does not allow you to see the color underneath, multilayer packaging hinders the detection below the top layer, and additives and polymer physical properties are not visible by NIR/VIS,’ explains Margherita Trombetti, project manager and sustainability policy officer at AIM, the European Brands Association.

Traditional sorting technologies also cannot identify crucial information, such as product application, whether for food, cosmetic or detergent use; recycled content levels; or whether materials are bio-based or fossil-based.

‘There are certain types of information that it is impossible to obtain via the technology alone. This is why new technologies are needed,’ adds Trombetti.

Digital watermarks address these gaps by encoding detailed information directly into packaging during the printing process.

‘Digital watermarks’ ability to identify packaging features at the SKU level unlocks a new set of data about the packaging, granting access to any packaging attributes such as additives, viscosity and hidden layers,’ notes Trombetti.

These granular sorting capabilities extend far beyond current systems. ‘When packaging is marked with digital watermarks, it can be sorted based on usage such as food, cosmetics, detergents and others, as well as traced for brand owners’ collection statistics by product and for EPR purposes,’ she explains.

Complementary technologies

Rather than replacing existing infrastructure entirely, the most effective approach combines digital watermarks with established NIR technology. This hybrid approach maximizes sorting efficiency while accommodating both marked and unmarked packaging, a practical necessity.

‘Digital watermarking allows for the splitting of any fraction to a higher level of granularity than is currently possible with near infrared technology,’ states Trombetti.

Integration proves essential for practical implementation. ‘Not all objects will be digitally watermarked, and so a combination of DW and NIR/VIS provides the best of both worlds, enabling mixed sorting of both marked and unmarked SKUs, including responding to dirty, partially marked or damaged packaging,’ explains Trombetti.

“Digital watermarking is a proven method at commercial scale, and the early-adopter markets will benefit from this”

The Hündgen facility trials exemplified this integrated approach through sophisticated equipment configuration. ‘On Hündgen’s main line, a new 2.8m-wide Pellenc ST module enabled with Digimarc watermark detection was installed to process an input stream consisting of post-consumer plastic from the German and Danish collection systems,’ details Trombetti.

‘The detection efficiency ranged from 87.9 percent to 93.8 percent, with strong evidence of consistent detection over 90 percent over long durations,’ Trombetti notes. These results proved particularly impressive given the complexity involved: ‘Nearly 6,000 SKUs from collection in two countries, challenging post-consumer waste, including the presence of films and flexibles in the rigids stream, and the uneven distribution and crumpling of material.’

Implementation challenges

Integrating new technology into existing facilities requires careful consideration of both technical and economic factors. Martyn Tickner, technical advisor at the Alliance to End Plastic Waste, emphasizes the distinction between detection and sorting components. ‘It is important firstly to recognize that the transition to circular systems requires major investments into sorting capability, the key enabler to high-quality recycling,’ he explains.

Investment strategy becomes crucial for successful implementation. ‘We should differentiate between the detection/decision making and the sorting step itself, most typically by air-jet separation of a stream, with the most significant part of the capital cost being the latter,’ he notes.

The detection systems themselves increasingly utilize multiple sensor inputs, combining NIR, visible light, digital watermarks and object recognition technologies.

‘Detection/decision making increasingly utilizes multi-sensory input, with the choice determined by the cost and value that each technology brings to the problem being addressed,’ notes Tickner.

Real-world sorting presents challenges beyond technology implementation. Contamination remains a persistent headache, with waste conditions presenting multiple obstacles.

‘In general, sorting is made more difficult by elements that consumers put in the garbage bag despite not being plastic, metal, or paper, hence contaminating the input. It is estimated that around 40 to 50 percent of such elements can be found in the yellow bag,’ explains Trombetti.

The trials also encountered operational challenges that provided valuable learning opportunities. ‘Waste conditions also presented some challenges: harsh soiling, crumpling, crushing and aging. During the trials, there were some hardware and cooling challenges associated with the detection, but these did not negatively affect the detection and ejection results,’ she adds. Such real-world hiccups are exactly what the industry needs to understand before widespread rollout.

Economic viability

The transition from research trials to commercial deployment hinges on demonstrating clear economic value for all stakeholders. The newly formed Circular Packaging 2030 consortium, emerging from HolyGrail 2.0, focuses specifically on proving the business case for intelligent sorting across European markets.

“Meeting the 2030 EU-wide PPWR targets requires investment not only in sorting, but in recycling capabilities”

‘Circular Packaging 2030 is a collaborative consortium of companies and organizations representing the entire packaging value chain. Its mission is to prove the economic viability of a circular economy for selected plastics packaging use cases,’ explains Trombetti.

The consortium’s comprehensive approach addresses multiple stakeholders’ needs simultaneously.

‘The primary aim is to demonstrate end-to-end business value creation by implementing intelligent sorting for all PP plastic materials, and identification of the right recycling path to create food-grade [recycled polypropylene] material. This may later extend to other material types,’ she continues.

The consortium’s methodology encompasses rigorous evaluation criteria, including sorting performance metrics, business case evaluation and return on investment assessment.

This comprehensive evaluation approach recognizes that advanced sorting represents just one component of the circular economy equation.

‘Meeting the 2030 EU-wide PPWR targets requires investment not only in sorting, but in recycling capabilities. However, advanced sorting is a key enabler for recycling and hence PPWR compliance,’ emphasizes Trombetti.

The infrastructure investment strategy focuses on scalable approaches rather than retrofitting facilities individually. ‘The industry should focus on implementing advanced sorting, including managing this on a large scale as a second sorting step rather than retrofitting capabilities into each individual municipal sorting facility,’ she advises.

Strategic market demonstrations

The transition to commercial deployment begins with carefully selected market demonstrations in Belgium and Germany. These locations offer distinct advantages for validating the technology’s commercial viability under different conditions.

‘Both markets were selected for strategic reasons. Belgium offers environment to demonstrate the business case for a circular economy in flexible polypropylene packaging,’ states Trombetti.

The country’s institutional advantages make it particularly suitable for testing. ‘This is largely due to Fost Plus, a well-positioned and highly proactive Producer Responsibility Organization, whose ambition makes them a key partner,’ she notes. ‘Leading brand owners who were instrumental in previous semi-industrial and industrial trials are also actively involved in this market demonstration, driven by their commitment to meeting the EU-wide 2030 targets for recyclability and recycled content.’

“Plastic recycling rates will increase progressively and differently region by region”

Belgium’s existing infrastructure provides an excellent foundation for advanced sorting implementation. ‘Belgium sees high annual volumes of flexible packaging and its advanced sorting centers already deliver very pure flows. By introducing watermark recognition technology, we are completing the final step toward achieving truly circular flexible packaging,’ Trombetti explains. Its positioning as a perfect testing ground makes sense.

Germany offers complementary advantages for rigid packaging applications. Germany is also being explored, given high amounts of rigid PP in their market. Moreover, this market demonstration can benefit from the sorting equipment that is already installed in the partner MRF Hündgen Entsorgung,’ she adds. Leveraging existing infrastructure makes economic sense.

The demonstrations will follow a structured two-year timeline focusing on specific outcomes. ‘This will be a two-year market demonstration, focused on sorting post-consumer, digitally watermarked PP packaging from selected markets. The resulting fractions will be recycled using various technologies to assess performance and output quality,’ details Trombetti.

Regulatory compliance

The European Union’s Packaging and Packaging Waste Regulation creates urgent timelines for industry transformation, requiring sophisticated tracking and reporting capabilities.

‘Digital watermarks embody the perfect example of how the EU-wide goal of the green and digital transitions can happen together: DW carry a wide range of attributes such as manufacturer, SKU, type of plastics used, composition for multi-layer objects, food vs non-food application,’ notes Trombetti.

The technology’s data collection capabilities support comprehensive regulatory reporting requirements. ‘Digital watermarks have the potential to meet other PPWR requirements. Notably, to enable the creation of a Digital Packaging Passport that can help companies meet EU reporting requirements, such as communicating about the material composition of the packaging to facilitate sorting, or about the presence of substances of concern, or even to get highly reliable and accurate data for EPR reporting obligations,’ she explains.

Timing becomes critical for meeting regulatory deadlines.

‘Given the urgency for improvement, it is important to move forward with technologies that are already in place today that will support the viability of downstream investments, rather than waiting for maturation of even newer technologies,’ explains Trombetti. This approach provides ‘the most assured route towards PPWR compliance.’

The regulatory framework also requires significant infrastructure development beyond sorting capabilities.

‘Next to progress on sorting infrastructure, an upgrade in recycling capabilities is needed. It will take many years to install adequate infrastructure for chemical recycling. However, we already have significant mechanical recycling infrastructure in place, which can be more rapidly developed to provide the quality required to meet the PPWR targets as long as feedstocks are accurately and efficiently sorted,’ she notes.

Global adoption

While European markets drive current development, the technology’s global potential depends on varying regional conditions and requirements. Tickner outlines how adoption patterns will differ based on local waste management maturity and economic conditions.

‘Plastic recycling rates will increase progressively and differently region by region, driven by waste management policies, targets, brand-owner ambitions and financing mechanisms, which in turn create end-markets that support the investment in collection, sorting and recycling,’ he explains.

Regional infrastructure variations create different opportunities for implementation. ‘In OECD countries with more mature waste management systems, sorting will largely be fully automated and capable of advanced detection such as NIR, DW, object recognition [OR]. In lower-cost countries and those with less mature waste management systems, manual sorting will dominate,’ notes Tickner.

However, advanced detection technology can provide value across diverse operational contexts. ‘Even here, advanced detection can be deployed, using laser lights to guide manual sorters. And in all cases, quality control of incoming materials will be relevant,’ explains Tickner.

The strategic decision for brand owners involves weighing implementation approaches and timing considerations. ‘Perhaps the trade-off for brand owners between taking the initiative and costs for digital watermarking versus relying on others to implement object recognition may favor a strategic decision to adopt digital watermarks,’ suggests Tickner.

Competitive landscape

The sorting technology landscape continues evolving rapidly, with artificial intelligence-enabled object recognition advancing alongside digital watermarks. However, a pragmatic perspective on technology selection and implementation timing should be maintained.

‘For sorting and data collection, the capabilities of AI-enabled object recognition (OR) are advancing fast, and while the limits of performance and operational cost in highly complex systems are not yet determined. OR represents an approach with a lower entry barrier for brands, at least for today’s needs in rigid packaging,’ explains Tickner.

Tickner highlights the importance of action over prolonged evaluation. ‘We believe that the actual choice of detection approach is of secondary importance and is consuming too much energy. Digital watermarking is a proven method at commercial scale, and the early-adopter markets will benefit from this,’ he states.

Risk management considerations favor implementation over waiting. ‘The regret cost of inaction is far higher than the regret of implementing a detection technology and then finding in five to 10 years that performance boundaries and market requirements have evolved in favor of a different approach, and some retrofit costs are required,’ observes Tickner.

The competitive landscape will likely support multiple detection technologies, each optimized for specific applications.

Next steps

The Circular Packaging 2030 consortium has established comprehensive milestones for commercial deployment over the next two years, encompassing technical performance, economic viability and regulatory approval processes.

Key objectives include achieving ‘sorting performance metrics comparable to those in HolyGrail 2.0 Phase 3 and aligned with regulatory standards’, along with demonstrating ‘added value for both feedstock and recyclates, focusing on the production of high-quality materials suitable for target packaging applications,’ explains Trombetti.

Economic validation remains central to the consortium’s mission. The program will ‘assess the ROI for all stakeholders to validate the commercial viability of a circular economy model’ while working to ‘produce high-value recyclates that justify investment in intelligent sorting technology,’ she details.

The demonstration’s expected outcomes extend beyond immediate commercial deployment. ‘By the end of the market demonstration, the Consortium expects to achieve a pathway for food-grade PP recyclates initially for non-food contact applications and outline a clear roadmap toward EFSA approval,’ she explains.

Success in these demonstrations will provide the foundation for broader rollout across European markets. The readiness for widespread implementation represents the culmination of years of hard work and testing. With high detection efficiency and the ability to sort at unprecedented granularity, digital watermarks offer a proven path toward the accurate sorting essential for circular packaging systems. The transition from HolyGrail 2.0 research to HolyGrail 2030 marks a pivotal moment in the evolution of packaging recycling, one that the industry has been waiting for.

Stay up to date

Subscribe to the free Label News newsletter and receive the latest content every week. We'll never share your email address.