Exclusive first review of Karstedt digital report

Labels & Labeling is pleased to bring you the exclusive first review of Karstedt Partners’ digital print Commercialization Assessment Report (CAR) for the Narrow Web Label Sector. Karstedt Partners LLC, a consultancy and research firm specializing in helping consumer product companies, packaging converters, equipment and consumable suppliers to understand the value and challenges of digital printing for packaging, has tailored this assessment report on digital print to walk label converters through the what, why, where and how of digital printing.

The report was completed in cooperation with Michael Ferrari, president of Ferrari Innovation Solutions, who brings the industry over thirty years of product packaging experience at The Procter & Gamble Company and a genuine passion for innovation. He identifies the significance of digital print to a CPC as its capacity to streamline the process of reaching the consumer in a new way on the store shelf, while at the same time alleviating resources that can then be reallocated to nurturing the ensuing customer experience through such modern channels as social media and interactive packaging schemes.

The report provides descriptions of the many digital technologies available, applies real brand owner input to the value equation and includes calculation tools for converters to make a personalized assessment of how digital could affect current and future business. The report is unbiased to any printing technology, digital or analog, and offers an objective view on the value of digital printing in a converters' own environment.

Key findings:

- Digital is successfully meeting expectations of its early adopters

- Mainstream users are in the process of evaluating its acceptability for their markets

- The majority of converters who have embraced the technology are finding success with it

- Now is the time for label converters to make a realistic evaluation of digital print technology

- Brand owners view digital as a far more encompassing tool than just print

- Converters must educate brand owners on the capabilities that digital can bring their products

- It is imperative for label converters to retain the value of digital within the marketplace

Digital print technology in packaging had been slow to evolve, the promises idealistic and many early providers and adopters experienced failure, all of which has tainted the reality of its current position. Over the last five years digital printing has made a noticeable impact in the global label converting industry. But what does it mean? There is much confusion amongst converters and the supply chain as to the real value of digital print today.

Karstedt Partners’ Kevin Karstedt, CEO, and Jeff Wettersten, president, were eager to curb the myths and uncertainty surrounding digital in the greater packaging industry. Karstedt explains, ‘We were being asked by label converters to help evaluate if digital made sense for their business. The technology needs to be considered and we could give them a value proposition, but the industry needed access to actionable information.’

‘The fundamental drivers for digital adoption has increased in the last few years and the drivers will only continue to gain strength, particularly when it comes down to reaching the consumer and making the sale,’ adds Wettersten.

Where and why

Five percent of the world’s label jobs are printed digitally. According to Mike Fairley’s Digital Label Printing: A ‘How to’ guide, digital print is growing at a rate of 36 percent per annum. Ferrari describes digital print as a‘disruptive technology’ because of the various solutions itcan provide a CPC. It’s not just about the printed product. One of the most difficult tasks of a brand manager today is reaching the consumer. Ferrari says, ‘Digital printing allows a brand owner to communicate with today’s consumer by maintaining relevancy with the latest trends or current events. The ability to change graphics and to print variable data text means that different codes can be placed on packages to create new mobile shopping interactions. These codes can connect to online websites that create different consumer experiences.’

Digital printing fits well into the modern supply chain and the need to simplify complexity, improve speed-to-market, limit tied up assets, be more sustainable and reduce cost. Front-end opportunities from software suppliers like Tailored Solutions, Radius and Cerm allow converters to re-align and streamline processes with the potential to increase margins.

Incumbent converters must conduct a proper evaluation of digital print technology in order to maintain position against a new supply chain of label printers. Ferrari continues, ‘I far too often hear converters hesitate about getting into digital printing. Such hesitation at the converter level will mean they remain longer in the analog printing world that purchases through RFPs, shrinking margins and leaving them weak. As the conversion continues digital printers grow stronger, establish relationships and it will be very difficult to regain lost contracts.’

Poised as a disruptive technology, digital printing will make its way to market even if it means going around current print solution providers if they are not prepared to analyze how it fits into their analog business.

The high school class of 2011 has never used a library catalog card system, and they don’t know what a cassette tape or pager is. Cell phones have been mainstream only since the early 2000s and already it’s expected that two thirds of the global population will have a smart phone by 2012. Technology is smarter than ever and it’s advancing faster.

iVAT

The digital print CAR for the Narrow Web Label Sector comes with a proprietary spreadsheet called the Investment Value Assessment Tool (iVAT) which provides interactive calculation of a particular digital technology when evaluated with and against conventional operating parameters such as cost, price sensitivity, product mix, equipment and more. This tool allows the converter to formulate multiple ‘what if’ scenarios with their own operating values and volumes to see what impact a digital asset plugged into their business would have.

The iVAT comes preloaded with industry averages of the various processes – flexo, offset, gravure – and has the ability to compare across multiple digital technologies. It also has a forecasting tool to allow plug and play adjustment of sales revenues and an ROI action model.

What’s the implication for analog?

The report does not allude to the demise of analog printing. Most of the modern presses are supported by advanced digital servo drives, internal software, and advanced design to also help converters address CPC’s efficiency needs while boosting margins. High Definition digital printing plates have improved the print quality capability of flexography, challenging the likes of offset and especially gravure. All of this points towards a multi-discipline printing platform that offers ultimate flexibility in an ever more nimble world.

Hybrid solutions already exist in the market (read coverage of the first North American installation in the next issue of L&L) and are likely to become more prevalent, which will necessitate further evaluation of the advantages of stand-alone digital systems versus hybrid systems. The label and packaging industry is on the brink of a fundamental change; this beckons supplier partners to continue to work together to bring CPCs wholly encompassing solutions beyond print.

Evaluate now

The rapid embrace of sustainability and digital technology each have played key roles in creating the modern socialized world, and their impact is only in its infancy. Converters must make the time to properly evaluate the technologies currently available by reviewing this CAR on digital print in the narrow web sector, trade publications and technical books such as Mike Fairley’s ‘How To’ Digital book. Attend supplier- and association-sponsored open houses and conferences, participate in social media and walk the aisles of industry-leading tradeshows.

The Technology Workshop at Labelexpo Americas 2010 helped converters tackle these same questions. Labelexpo Europe 2011 will again give converters the opportunity to see cutting edge machinery in live demonstrations and suppliers will be on hand to answer visitors’ questions. This is the first CAR for digital print to be released by Karstedt Partners. The firm will roll out a suite of similar reports for flexible packaging, folding cartons and corrugated over the course of 2011. It will also produce a report geared towards educating brand owners on the status of digital print in the greater packaging world.

The next edition of Label News will include an exclusive Q&A interview with Mike Ferrari, president of Ferrari Innovation Solutions.

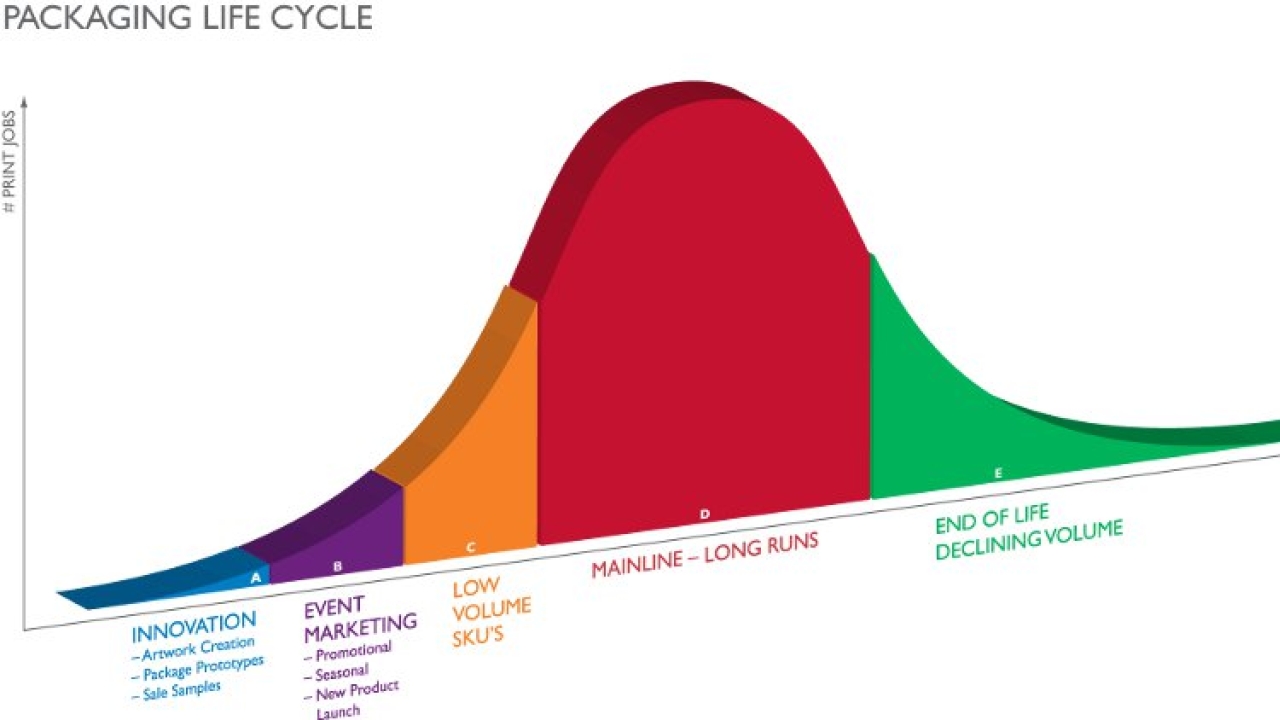

Chart: Packaging Life Cycle

This is just one of many helpful charts you will find in the CAR report that explain and provide you analysis of how you should approach changes in the industry. Current digital print runs fit in sections ABC&E as denoted on the chart. All these segments are controlled by the brand manager. Segment D shows long-run SKU work over 250,000 labels, an area controlled by procurement. Current digital print systems are taking on this segment in the market as converters shift dialogue to the brand owner who is more interested in consumer needs than cost. This ability to increase sales lends to high opportunity for the growth of digital package printing.

Stay up to date

Subscribe to the free Label News newsletter and receive the latest content every week. We'll never share your email address.