Finat notes drop in European labelstock demand

Association attributes this to label companies destocking at the end of a volatile 2022

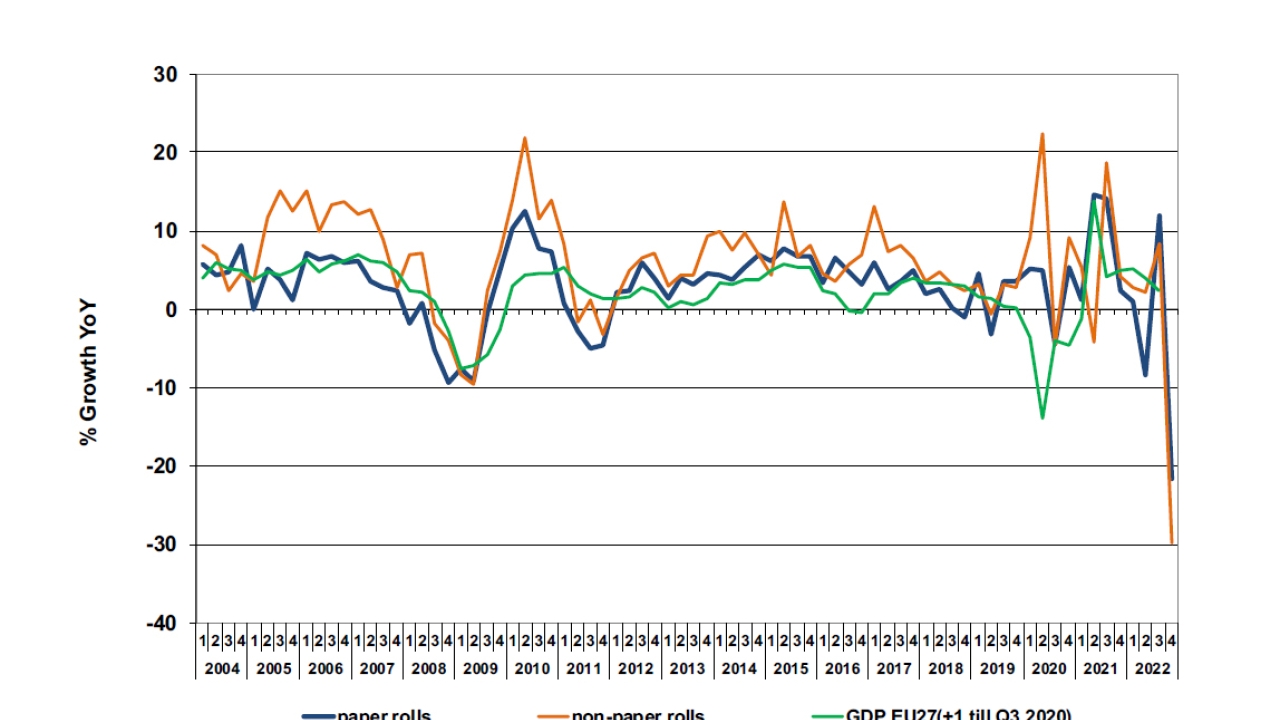

European roll labelstock demand in m2, growth versus same quarter in previous year compared to GDP, 2004 - 2022

In the fourth quarter, labelstock demand in Europe dropped sharply, after a poor first half of the year caused by strike-related paper shortages from Finland, and a rebound in Q3. For the year as a whole, European self-adhesive labelstock demand decreased by 4.7 percent compared to 2021.

Compared to the fourth quarter in 2021, European consumption of paper and filmic roll labelstocks decreased by no less than 24 percent, the sharpest year-on-year decline in a single quarter recorded since FINAT commissioned the collection of quarterly statistics in 2003.

The contraction in demand is a correction of the ‘erratic’ market behavior in the previous three quarters that started with the long-lasting paper strike in Finland, the resulting paper shortages and increasing lead times, the refilling of label converter warehouses in the third quarter and the mounting general economic uncertainty in the intermediate period caused by the Russian invasion of Ukraine, rising energy and raw materials costs, rising interest rates and a looming recession due to losses in disposable incomes of European consumers.

As a result of this, label converters decided to deplete stocks towards the end of the year and postpone the procurement of new labelstocks. In spite of recessionary expectations, underlying fundamentals for the European label industry until recently remained positive, according to the latest Finat Radar. The report, released in December, was based on a survey in November among 60 brand owners. According to the survey, nearly 85 percent of the respondents expected their label procurement to increase or at least remain stable. Given the moderate general economic forecasts for Europe that have emerged more recently, the coming months will tell whether these expectations were justified.

Stay up to date

Subscribe to the free Label News newsletter and receive the latest content every week. We'll never share your email address.