Equipment investment for continuous improvement strategies

Label converters should start with a simple investment before looking for larger, more complex equipment

Label converters should start with a simple investment before looking for larger, more complex equipment

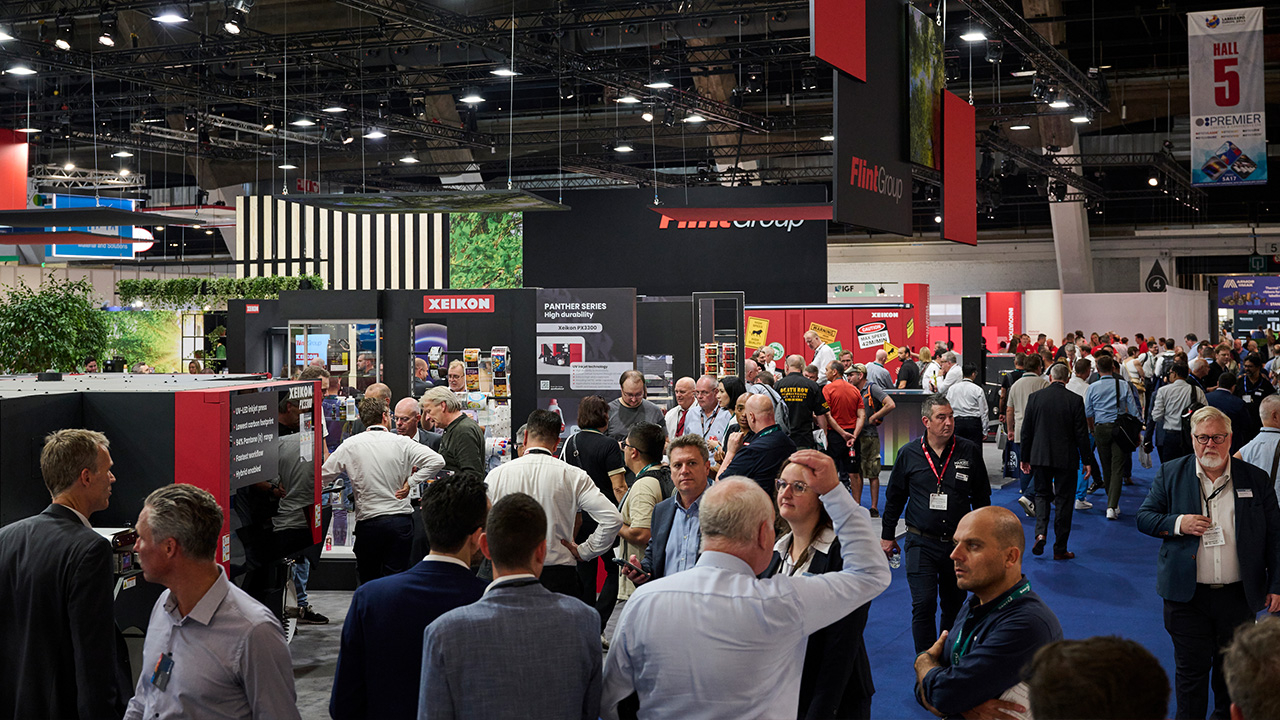

All organizations with a continuous improvement conviction have future equipment investment planning as part of its strategy. Nothing is more exciting to a production operation than bringing in a new piece of equipment. The operational

employees see this as a commitment to the company and their futures. The sales force considers this an opportunity to

remain competitive or become even more competitive with the offering.

Selecting the equipment in concert with the overall company strategy is essential. Is the equipment required to provide better productivity, enhanced capability, solve old equipment cost of maintenance, or automate operations that free up people and open capacity hours? These are essential questions as they drive the decision process.

In many companies, the opportunity to acquire new equipment does not come very often. The justification process is arduous, and the selection process brings out opinions from every facet of the organization. When this happens, there is often a debate about new revenue generation commitments, as these added capabilities drive up the cost of the equipment.

Speaking from experience

Early in my career, I was often involved in this seesaw battle as a project engineer, and looking to gain consensus, I helped design configurations that answered the need for

today but with the capability to address the future based on sales projections.

I’ll never forget the opportunity to replace machine center fabrication equipment used in our manufacturing process. After months of review, capital justification scenarios, and a drive to gain consensus, we selected and acquired a machine with five-axis capabilities to cut parts that were so specialized that many of the competitors could not step up to the ability.

Our sales team was excited about the added competitive differentiation, our manufacturing group was excited about

new equipment, and as a project engineer, I could not have been more excited to have the responsibility of making this happen. As with highly specialized equipment, I understood the lengthy lead time for delivery. I began to worry a little about the larger footprint of the new equipment and the long lead time for installation. I started to panic when the operators were not catching on to the operational training for the equipment.

The complexity added ‘time to market,’ and running late on the project commitments drove extreme pressure on

everyone. I began to believe I could not meet the objective and the project would not be successful.

We marshaled through the commissioning and began producing good parts, relieving much of the pressure a

start-up of new equipment receives. After commissioning, I spent time with the machine in operation without watchful

eyes. I worked with scheduling, designed run speeds, developed setup sheets, and studied the device’s success. It took me about six months to realize that we had made a wrong purchasing decision.

Our desire to add the capability for the future overshadowed our focus on simplification and improvement in the present. Instead of decreasing the setup time, the complexity added to the setup time. The machining center went from 58

percent uptime to 38 percent uptime. Worse yet, the new capability did not bring in added sales because the sales strategy did not align with the manufacturing strategy.

I spent six months realigning the bill of materials and process flow so that the machine only worked on extremely long runs. In the end, we increased the uptime with output levels meeting financial projections—something I could have quickly done with a much less complicated and costly piece of equipment.

I speak of this now because many converters went through a capital spending cycle a few years ago. They acquired

equipment with increased decorating capability because of perceived higher margin opportunities of high value-added

labels. Many of these added equipment features have now been in place for over a year without being used. Adding complex equipment to an operation demands that the equipment be run and utilized. This constant need impacts operational focus.

Further study outlines the sales organizations of these companies could not sell the perceived value. Many converters struggle to maintain existing margins, let alone increase margins against larger foes willing to leverage size and reduce prices. Gaps in technical capability surfaced in the shops looking to operate the new complex equipment uncovering new resource requirements that are yet to be solved.

New industry studies indicate equipment purchasing trends will be positive over the next few years. Reviewing market trends supporting the study’s purchasing plan data for small, medium and mid-size converters, I see a real opportunity to seize the moment and overt another super machine cycle as described by Dr Richard Schonberger in the book World Class Manufacturing. A much more palatable low-risk equipment investment strategy begins with a detailed evaluation of the current capacity that can improve with more straightforward equipment. Achieving operational improvements can be quick, speeding up the benefit to the organization.

Large multi-facility roll-ups by private equity will face equipment acquisition decisions to determine the most logical course of action with their older fleet of equipment purchased. Privately held small, medium and mid-size converters segments typically have a fleet of equipment designed and built in the 1980s and 90s. Now 30 years old, this equipment often performs well, but replacement parts and maintenance are becoming increasingly problematic. Many converters with older equipment have considered purchasing new equipment several times but held back on the decision because the equipment they specified was extraordinarily costly and overly complex.

There is no doubt the graphics in the industry continue to impress, but it is also a fact that conventional low-end labels and prime labels account for the lion’s share of the market. We also know that in downturned economies, specialty market label demands decrease significantly as well.

Simplify first

Our continuous improvement focus reminds us that we must simplify before we automate. Automate repetitive process operations and buy capacity for eight to 12 months of projected demand growth. A smart continuous improvement strategy is to support the production growth plan by adding simple equipment every year. For example, many single factory operations have legacy 4-, 6-, or 8-color flexo equipment. Jumping to new technology like digital could strain the organization, but replacing old flexo equipment with unencumbered new flexo equipment provides a step change in productivity with known technology. I just completed a facility study with a location with five 10in and 13in flexo presses that were more than 20 years old. The presses had very little ancillary equipment other than a turn bar and an occasionally used sheeter conveyor. Assessing the products printed, the workforce capability, and building on the success already being recognized drove my recommendations.

It was more advantageous to purchase a wider flexo press but also with the ability to accommodate the existing smaller print plates library. Still, it could begin a transformation to a more expansive, more advantaged width. We could prove a five-month payback with its existing book of business. The new flexo press had no extra alternate printing capabilities. Still, it was straightforward to set up, and several of the manual steps on the old presses were automated on the new flexo press. This lower cost, lower risk approach checked all the boxes for an excellent investment.

The new equipment can be retrofitted later as growth patterns change or if a change of strategic direction is part of future consideration. The benefit to the converter included an immediate reduction of production labor costs, revitalization of the workforce now excited the company was investing, and improved print quality. Critical quality attributes like registration, dot control, color matching and die-cutting all were improved. Another immediate benefit was the reduction of waste by more than 50 percent.

Some companies will insist on the new technology spend for digital. I believe there is a lower cost, lower risk investment approach for simplified digital and finishing equipment as well. The investment cost will be higher than an essential flexo press, but the message is similar. Start with a simple investment before looking for larger, more complex equipment. There are a lot of competing resources for investment capital.

The time is now

Small, medium and mid-range converters who have been very frugal and cautious buying equipment should invest in upgraded equipment now as part of their commitment to continuous improvement. Simple press and finishing equipment are easier to set up, operate and maintain. Several smaller pieces of equipment provide project risk mitigation and operational protection should a facility have a catastrophic problem.

Larger multi-national and multi-facility converters should also look to newer simplified equipment spending as part of their strategic plans. They may have more capability to spend for larger super machines, but they should measure the proposition. In the label and packaging printing equipment world, there will always be a need for larger, more complex equipment. These purchasing cycles for this type of equipment are less frequent. The justification for the increased capital required includes much longer production runs with graphic and design differentiation.

Complex equipment increases the organization’s cost structure because overhead spending will need to grow with the marketing and advertising campaigns required for the new capacity. Overhead costs will increase when leaders realize people development in sales, engineering, maintenance and operator training are gaps that need to be filled to support the investment.

Complex equipment capacity requires increased production demands often taking a year or more for an organization to digest. Those companies buying the larger equipment typically run one shift in the first year, two shifts in the second year, and three in the third.

I’m hopeful that the discussion with converters leads to a commitment to replacing old equipment lines with new simplified equipment at a smaller investment level that fuels manufacturing capability. The best strategy is lower cost and more aggressive capacity improvements that strengthen competitiveness in this dynamic market.

Stay up to date

Subscribe to the free Label News newsletter and receive the latest content every week. We'll never share your email address.