Accounting and financial management

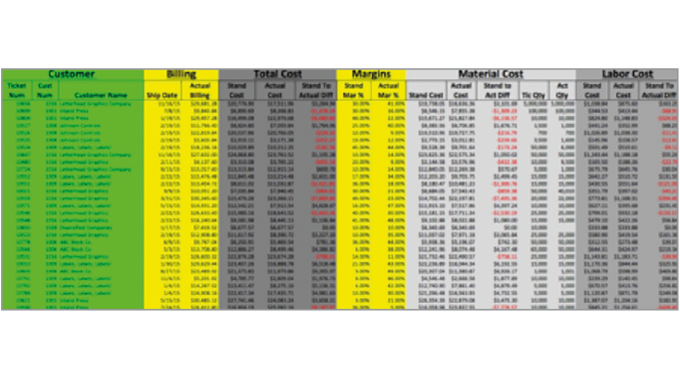

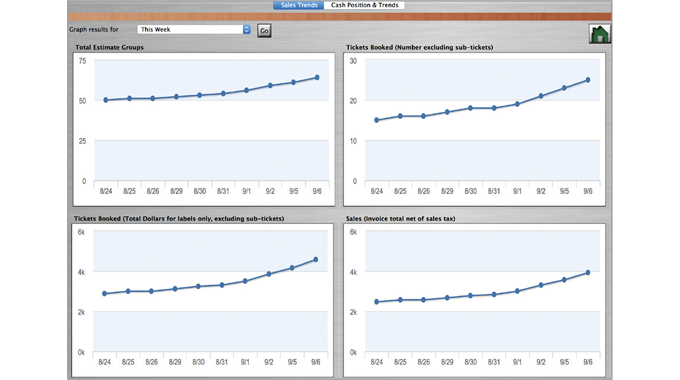

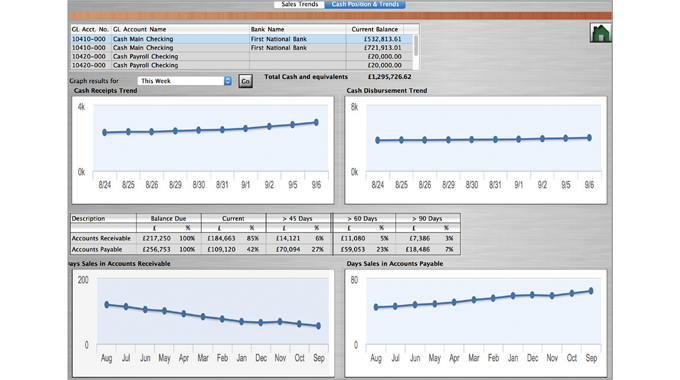

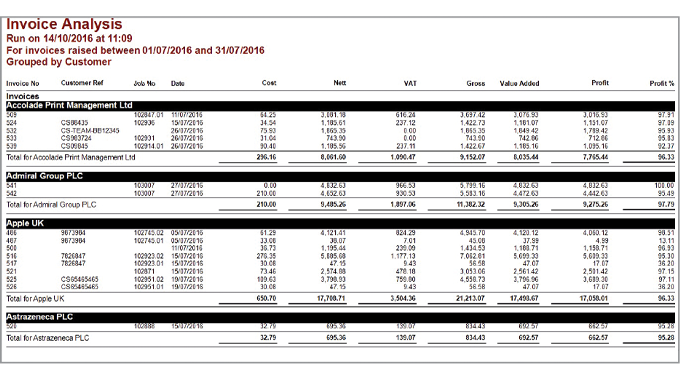

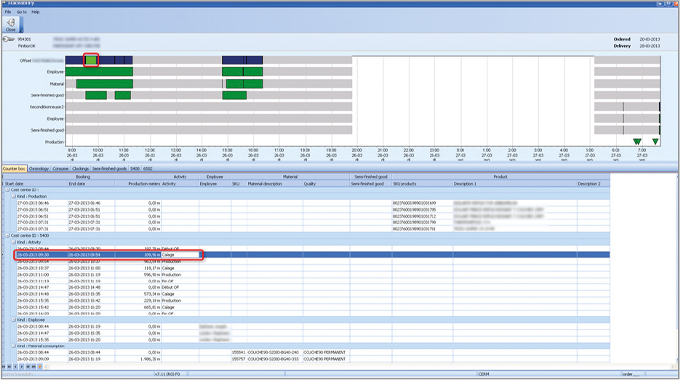

The accounts operation is at the heart of any label or package printing industry management information system. It operates the general ledger/nominal ledger where all financial transactions are received, processed and summarized in real-time. The results of these transactions are shown in financial and executive summary reports which provide the management team with financial forecasts, profit and loss data, and all the usual financial management data provided with Ledger Analysis tools.

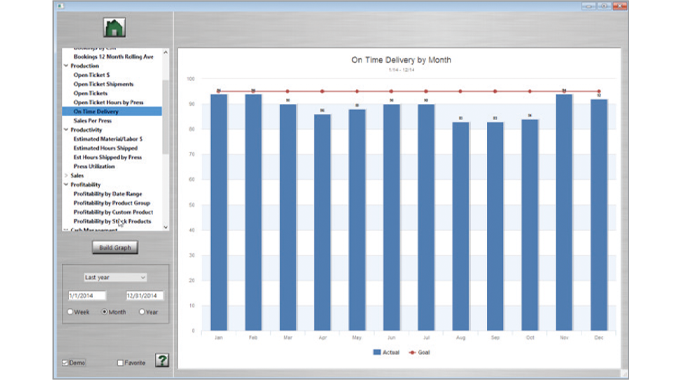

Using real time data it is possible to view critical business data at a glance, have on-screen up-to-date management reports, track the company’s progress against key business performance indicators, obtain an instant picture of how the business is performing and quickly highlight any areas in need of attention.

Stay up to date

Subscribe to the free Label News newsletter and receive the latest content every week. We'll never share your email address.