Job costing and shop floor data collection

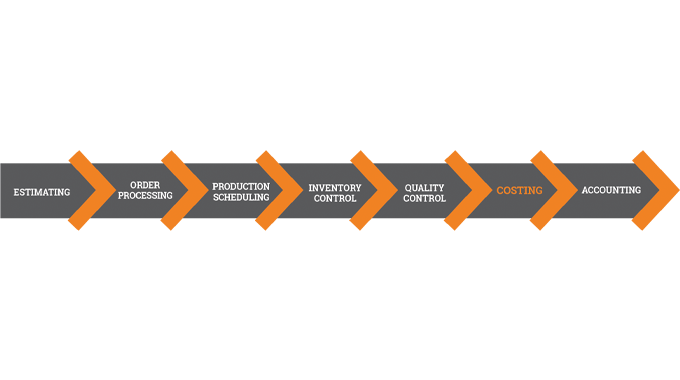

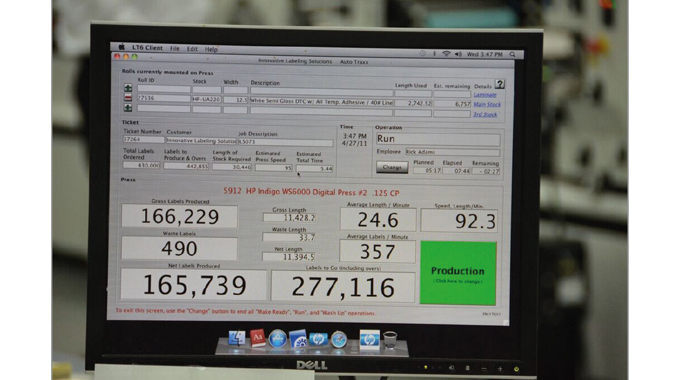

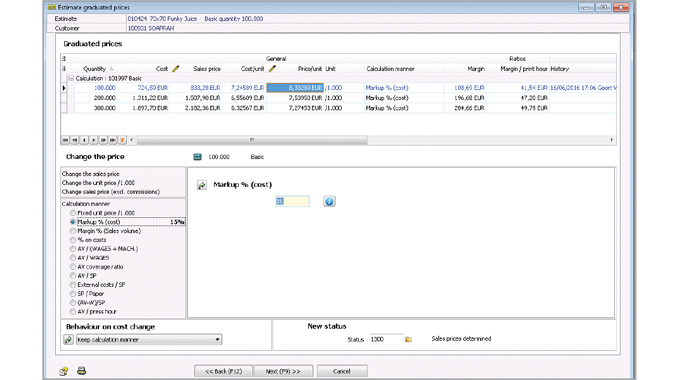

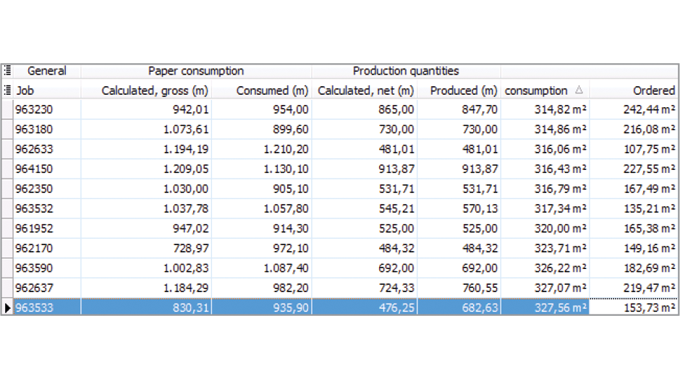

Once a job has been completed – having passed through all the earlier MIS modules as required from estimating, order processing, production, inventory control – and then finally being shipped, it ideally needs to be costed and an invoice issued as quickly as possible. Additionally, the sales, accounting and management team will want to know if they made a profit on the job. Indeed how much profit?

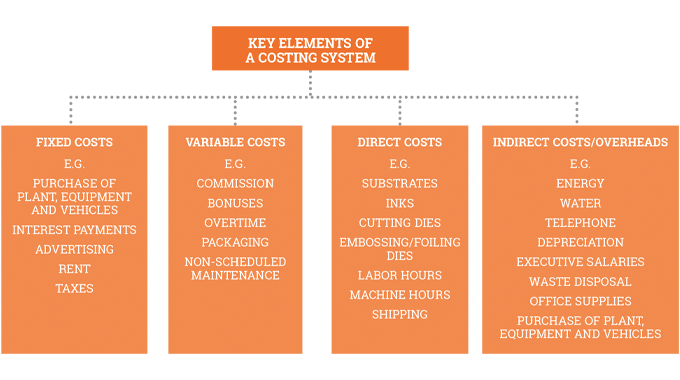

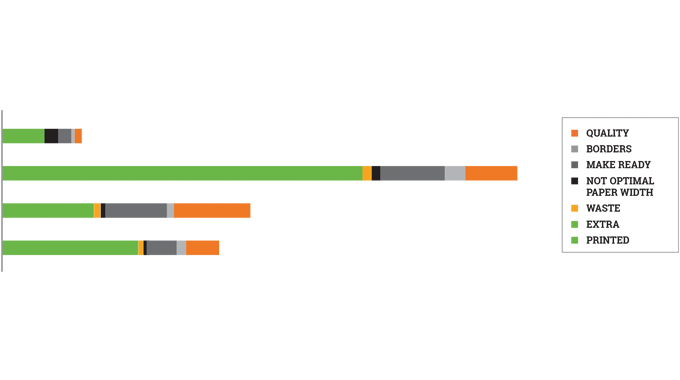

Costs will therefore need to be allocated against specific customer orders, specific activities or products. It also involves tracking the expenses/costs incurred on a job against revenue produced by the job, comparing quoted costs against actual costs, analyzing variances and ensuring all costs involved in a job have been properly invoiced.

Stay up to date

Subscribe to the free Label News newsletter and receive the latest content every week. We'll never share your email address.