Leading through a changing economy

In the changing market landscape, the importance of culture is a topic gaining attention.

My best experience in the label and packaging industry included being part of a leadership team that expressed a genuine interest in learning how to manage the company with a process-centric approach to continuous improvement and cultural development.

The system expands on traditional manufacturing process improvement by including every business process step upstream and downstream in an organization. The results reduce cycle time, improve process yield, and enhance productivity. Using a holistic process approach as a central operation theme, we constructed a strategic path forward with CI (continuous improvement) at its core, allowing us to manage through three recessions, emerging with a stronger market position every time. The approach resonated with early career training and experiences and drove champions for change using the techniques. This experience was not my first, building a process-centric company. Before the label industry, I worked in the material handling equipment market in one of the most successful private equity market roll-ups. We successfully rolled up 11 companies in nine years, and I consider it an excellent private equity investment story. I’ve also had four other experiences with private equity that, while technically successful, were not so great.

The difference in approach was striking, and I see the same potential opportunity or pitfall in the label and packaging printing market segment as discussions increase about changing dynamics with private equity ownership in the sector. The customers will determine the actual outcome, and the converter business leaders will emerge with a story comparing ownership strategies. Rather than wait for the story to unfold, I’m hopeful the leader’s teams and owners will focus on the cultural elements that make the ownership opportunities suitable for the market, the company and the employees, having experienced all sides of the ownership spectrum. If leaders are polarized but understand the need for cultural development, typically, it is because they are unsure of the first steps.

The difference in approach was striking, and I see the same potential opportunity or pitfall in the label and packaging printing market segment as discussions increase about changing dynamics with private equity ownership in the sector. The customers will determine the actual outcome, and the converter business leaders will emerge with a story comparing ownership strategies. Rather than wait for the story to unfold, I’m hopeful the leader’s teams and owners will focus on the cultural elements that make the ownership opportunities suitable for the market, the company and the employees, having experienced all sides of the ownership spectrum. If leaders are polarized but understand the need for cultural development, typically, it is because they are unsure of the first steps.

Attractive

The label and packaging printing market segment is attractive on many fronts to the investor or the entrepreneur. The market requires solution creativity because of the dynamics of packaging design and insight because of technology trends that can support the design trends. I started working in the industry 24 years ago and continue to be impressed with the people who have devoted their careers to improving it.

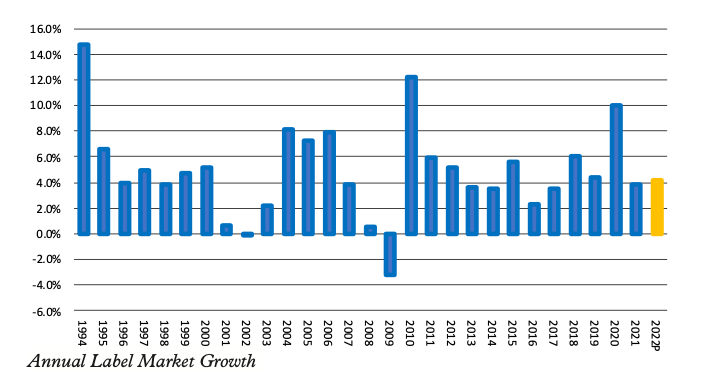

From a historical perspective, the attraction is easily seen:

- The market is now 75 years old and resilient

- It has 12 years of consecutive growth

- It has grown in 26 of the last 28 years

- It remains entrepreneurial, with an estimated 2,000-2,200 label converters in North America

Mergers and acquisitions have been consistent for about 15 years, with an average of 27 converter acquisitions per year. Several investments in the past year included companies on their second, third and fourth turn with private equity. At the same time, we are seeing supplier consolidation that will also impact the market for the next several years. The label and package printing market is not the only segment that has evolved in this fashion. I believe Peter Drucker, the father of modern business management, identified the consolidation period in a market segment by describing the buyout firms as providing a needed function in the industry. He was clear to add then, and we can confirm today, that the proven path forward for private equity ownership requires financial-based restructuring and capacity consolidation that can be traumatic to the employees.

With private equity ownership now in its second, third and fourth turn, we have to acknowledge the ownership perspective and leadership view today must become longer term than in previous market consolidations – leading to a discussion on another key learning. Peter Drucker added to his statements that the most critical path to any company’s true success, regardless of ownership, includes a culture managed for the long run. A company’s governance needs to focus on long-term performance rather than short-term value fluctuations. I could not agree more.

The importance of culture is a topic gaining attention and a source for many conversations in the label and package printing market today. The availability of the workforce, the dynamics of the pandemic, and the ‘great resignation’ have amplified the discussion. Recent HR surveys identify that 43 percent of working Americans have considered looking for a new job. Wages are at the top of the list for reasons an individual leaves a company. They included health care benefits as part of the pay equation. Employees next express the company’s need to provide a positive or uplifting work environment. It was clear that employers earn loyalty by helping workers succeed. Another survey of business leaders identified over 70 percent report a positive culture is essential to a company’s success. More than half of these business leaders surveyed (private equity and private-owned) indicate they do not evaluate or don’t know how to evaluate culture, plus they do not have a plan to influence culture. Whether you have cultural improvement plans or not, the leaders’ actions will impact the culture regardless. All companies operate with a system of values and procedures that drive culture. Values are guided by the experiences of the leaders, good and bad. Every company leader is thinking:

The importance of culture is a topic gaining attention and a source for many conversations in the label and package printing market today. The availability of the workforce, the dynamics of the pandemic, and the ‘great resignation’ have amplified the discussion. Recent HR surveys identify that 43 percent of working Americans have considered looking for a new job. Wages are at the top of the list for reasons an individual leaves a company. They included health care benefits as part of the pay equation. Employees next express the company’s need to provide a positive or uplifting work environment. It was clear that employers earn loyalty by helping workers succeed. Another survey of business leaders identified over 70 percent report a positive culture is essential to a company’s success. More than half of these business leaders surveyed (private equity and private-owned) indicate they do not evaluate or don’t know how to evaluate culture, plus they do not have a plan to influence culture. Whether you have cultural improvement plans or not, the leaders’ actions will impact the culture regardless. All companies operate with a system of values and procedures that drive culture. Values are guided by the experiences of the leaders, good and bad. Every company leader is thinking: - Is the ownership in it for the long haul of the short flip?

- Are you thinking regional growth or national growth?

- Are your sales processes transactional or relationship?

- Is your company focused on cost-cutting or minimizing cost increases?

- Are you investing in employees for the long term, or are you under performance-intolerant?

Company culture is based on the paradigms of the people who lead, and the culture must evolve. Leaders must cause a change in the paradigm and fuel action that catalyzes change. Sustaining the cultural shift requires commitment, discipline and a measured visual approach.

My roots are in manufacturing, and as an industrial engineer, I was fortunate to have worked with great leaders who helped make sure the development of business solutions was holistic, by providing me opportunities to drive improvement through every department in a company. Often described as a change agent, my approach can seem intimidating to the uncommitted leader. My experiences began when American manufacturing performance was eclipsed by overseas competition, and many companies were more interested in investing in LCC (low-cost country) sourcing. Investing in North American companies was seen as time-consuming and laborious work. Answering the challenge to increase productivity and enhance quality became a central mission, and learning a process approach that eliminated company silos became a focus. Yes, this commitment to continuous improvement does take time and is hard work. An organization that takes a holistic approach can turn the pledge into a fun, rewarding experience. During good economic times, the catalyst of change requires a firm, patient approach. During tough economic times, the catalyst for change is survival when there is no time for patience. The continuous improvement process has helped organizations I worked with

in good economic times, but became indispensable when times were tough.

Looking to the future, many market indicators highlight growth for the converters but at a slightly lower annual rate. We know consumer confidence drives this growth. However, consumers can shift focus quickly, and while still needing many consumables, during economic turbulence there is sure to be reduced demand for durables. Revenue growth for converters does not translate equally to market segment growth for everyone, and recent pricing increases will mask real productive change. As the economy tightens and interest rates rise, equipment providers and production support products providers will see a retraction in opportunities before many others.

Converters experiencing significant competitive challenges will look for ways to reduce spending, driving further supplier retraction. With an industry demonstrating positive growth for so long, converters have not seen their currently defined market segment share challenged until recently, and not from another converter but from supply chain issues. The impact of raw material suppliers not delivering drove increased competitive quote activity. Sales experts will tell you there is nothing worse than having a customer head back to shopping the market, risking potential loss of orders. Buyers under extreme pressure, looking to satisfy end consumer demands, continue to get their product sourced no matter what and are willing to challenge long-standing vendor/supplier relationships to get it done. These buyers seek better support, quicker answers, and confidence in their supplier choice. This activity negatively impacts sales organizations’ productivity and shop floor productivity as schedules move, causing issues with set-up, run times, and workforce planning. In the end, the converter must become more aggressive in their approach to a solution. Competitive threats will surface from many directions and only get more intense as the economic winds shift. Over time, raw material suppliers will remedy the supply problems. The new buyer converter relationships introduced during the shopping period could blossom with old relationships challenged, leaving owners to wonder if their current relationships can stand up to the new challengers.

Converters experiencing significant competitive challenges will look for ways to reduce spending, driving further supplier retraction. With an industry demonstrating positive growth for so long, converters have not seen their currently defined market segment share challenged until recently, and not from another converter but from supply chain issues. The impact of raw material suppliers not delivering drove increased competitive quote activity. Sales experts will tell you there is nothing worse than having a customer head back to shopping the market, risking potential loss of orders. Buyers under extreme pressure, looking to satisfy end consumer demands, continue to get their product sourced no matter what and are willing to challenge long-standing vendor/supplier relationships to get it done. These buyers seek better support, quicker answers, and confidence in their supplier choice. This activity negatively impacts sales organizations’ productivity and shop floor productivity as schedules move, causing issues with set-up, run times, and workforce planning. In the end, the converter must become more aggressive in their approach to a solution. Competitive threats will surface from many directions and only get more intense as the economic winds shift. Over time, raw material suppliers will remedy the supply problems. The new buyer converter relationships introduced during the shopping period could blossom with old relationships challenged, leaving owners to wonder if their current relationships can stand up to the new challengers.

Prepared

Many company leaders today have not led an organization through a recession or a time with rising interest rates. They may not be prepared for the actions required in a slowing economy. These leaders are hesitant to commit to a focused cultural improvement initiative when this type of commitment is mandated.

The fighting advantage comes to the converter that understands the value proposition they provide. Determining how a company brings value to its customers is the first step in orchestrating a continuous improvement plan. If there is a gap in this understanding, then a leader may not have the best information for pointing the organization in the correct direction. I recommend that each converter refresh their perspective on what their customers truly value about the supplier-vendor relationship using in-person interviews with participants from shop floor management. This information, when translated, will become the compass directing a sustaining proposition for the organization’s continuous improvement initiatives sustaining the relationship. The solutions required are sure to include a need for reduced lead times, improved quality process performance that insulates customers from problems, and productivity levels that yield a reasonable price. The champions will be the converter with an engaged leadership group that shifts the organization’s paradigms to focus on continuous improvement as a process-centric and people concentrated in a culture designed to engage and fulfill employees.

Stay up to date

Subscribe to the free Label News newsletter and receive the latest content every week. We'll never share your email address.