Great success for Labelexpo India

It was generally agreed by exhibitors that the quality of attendees was consistently high, which was a sign of how seriously this show is taken by label converters now it has been upgraded to a Labelexpo series event.

To demonstrate how fast the Indian labels industry is growing – and its importance to the country’s economy – a high level government minister was present for the opening ceremony. Dr HP Kumar from the National Small Industries Corporation (a Government of India Enterprise), said, to thunderous applause, that the NSIC could provide credit to suitably qualified companies looking to invest in new technology.

Labelexpo India was also supported by key industry associations, including the Label Manufacturers Association of India (LMAI), All India Federation of Master Printers, Hologram Manufacturers Association of India, the Bombay Master Printers Association and the Delhi Printers’ Association.

Keynote

In a fascinating and wide ranging keynote speech, Ilkka Ylipoti, senior vice president of UPM Raflatac Asia-Pacific, gave his personal take on globalization and the future development of the Indian pressure sensitive label market.

Ylipoti argued that despite the continued growth of the Indian label market, there is a relatively small consumption of high value film – even countries like Vietnam have a higher percentage of filmic PS use than India. Ylipoti explained this as a result of the restrictions on global retail groups investing directly (FDI) in India. This makes it hard for brands in highly globalized end use segments – notably toiletries and cosmetics, where most high value film is consumed – to realize their full potential in the Indian market.

This also explains why globalized end segments like food are so much smaller in India than elsewhere. Food accounts for only 2 percent of PS consumption in India against almost 30 percent in Europe. This also explains whey pharma, a huge local industry in India, accounts for most of the PS labels consumed in India.

Ylipoti said it was ‘only a question of when and not if’ for UPM Raflatac to build its first coating plant in India.

Fielding questions after the keynote, Mike Fairley pointed out that the consumption of PS labels in India today is almost exactly the same as in Europe in the early 1970s, at 0.2 percent. ‘But in India it will take far less than 30 years to reach current European levels of PS labels consumption,’ said Fairley.

Avery Dennison meanwhile announced a hot melt coating line investment in its Pune manufacturing facility. Housed in a custom-built extension, Avery Dennison India's (ADI) new hot melt coating line is claimed the widest and fastest in India. The new coater is expected to begin commercial production before the end of 2011 and bring to $50m Avery’s investment in the Indian PS industry.

Working machinery

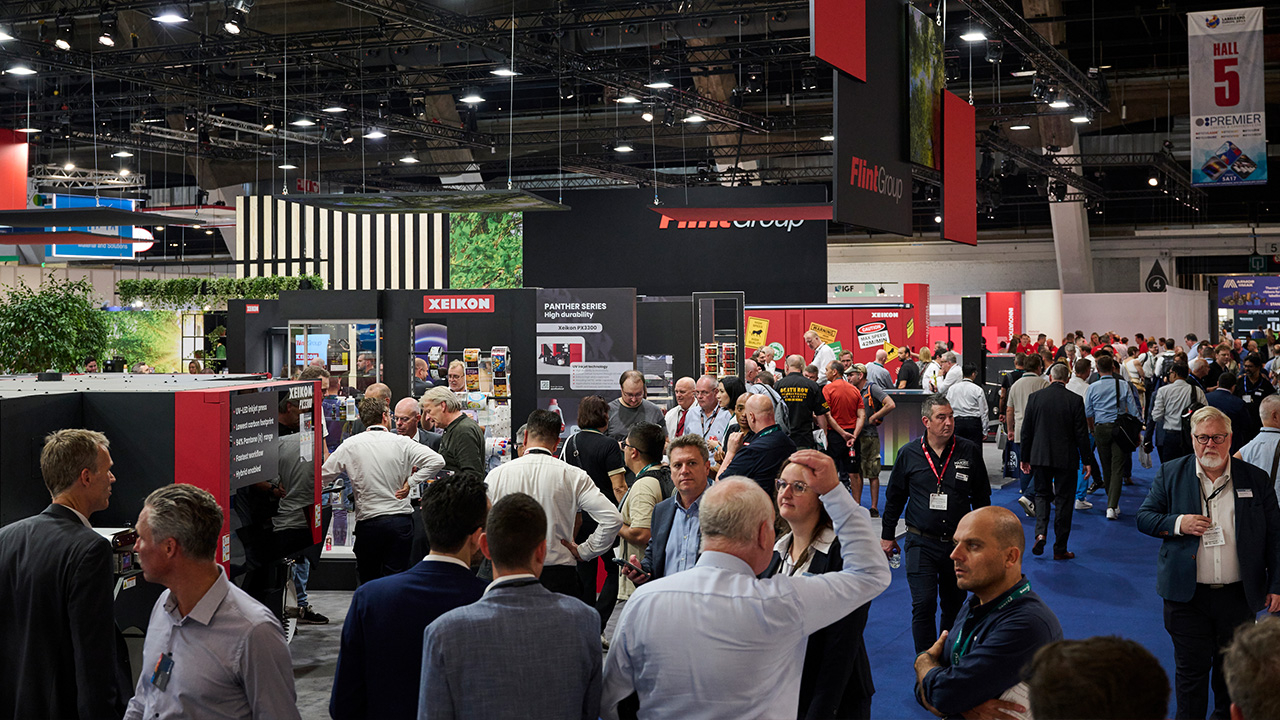

As ever, the press and machinery manufacturers provided the draw for visitors, who then cascaded through the rest of the exhibition space. And those press manufacturers which demonstrated their machines through the show uniformly attracted crowds of visitors, even up to the last half hour on Saturday afternoon.

Spotted around the show were big converters from outside India – with converters from Europe looking for potential partners and some of Dubai’s biggest converting companies come to look for equipment and suppliers.

This was the first time Indian converters had got to see Gallus’ ECS 340 ‘granite’ press, to the accompaniment of some heavy music courtesy of AC/DC. One of the machines (along with an EM280 – still Gallus ‘bread and butter’ Indian press) was sold to SAI Packaging.

Along on the Mark Andy stand, we only saw a print unit in the world premier of the new ‘baby’ of the Performance family, the P3. But what is perhaps more interesting is the number of the ‘mid-range’ servo-driven P5 presses which have been sold in India. Before the show Mark Andy had already announced sales to Barcom Industries in Maharashtra and Astron Packaging in Ahmedabad.

Nilpeter was demonstrating an FB3300 manufactured in India by its partner Proteck. Nilpeter is establishing a strong base of Indian-built FB3300s, with no fewer than five machines sold in the two years since the JV agreement was signed. These join seven US-built presses.

Omet was working with its new distributor, Weldon Celloplast, which has already sold the first Omet presses into India. The Flexy press on the stand, on demo throughout the show, is going to Arunodaya Paper Products in Hyderabad. An all-servo X-Flex has been sold to Renault Papers in Mumbai.

For the record, Zircon is one of the most extraordinary security label converters seen anywhere in the world by this writer (or by my colleague, label expert Mike Fairley). Sanjeev, the company’s director of operations, showed us some superb examples of microtext and holographic security designs printed on standard Mark Andy 2200s.

Rotatek again showed its confidence in the growing Indian capital equipment market by showing a fully specced Brava intermittent/rotary offset press. The sale of a machine – with exactly the same specification as the press covered by L&L at Marzek in Austria – was also announced. It went to Printman Offset Private Ltd in Mumbai, an excellent example of a company shifting focus from sheetfed offset to roll fed offset.

UK manufacturer Focus has an established presence in the Indian market – particularly on the textile labels side of the business – and at this show was introducing its Reflex single-color flexo press, with the machine on the stand sold to Regal Creative. The Reflex is essentially a single-color flexo press, but its register facility has made it an interesting choice for converters with digital presses in India, who use it to add metallics or solid colors and die cut/strip their digital labels at full rotary speeds. The versatile system can also be used as a blank label press, and as a coating system in an HP Indigo workflow.

Letterpress remains a strong technology at Labelexpo. Orthotec was showcasing its latest intermittent servo letterpress technology, now incorporating hybrid flexo and letterpress inking print stations, a variable repeat rotary die-cutting unit and in-line rotary hot stamping in intermittent mode with foil saver. Printing with digital CTP plates, Orthotec was demonstrating some very high quality work.

Indian press manufacturers made a significant impact. Jandu Engineers showcased its new 4-color plus one UV station modular rotary flexo press, and plans to make a full UV 6-color press in the near future. To cater to the plain label and barcode label segment, it introduced a small, low cost rotary die-cutting press with two die heads.

ApexRototech launched its first fully servo-driven flexo press, configured with IR dryers and UV varnish station. The company manufactures its own high quality rare earth magnetic cylinders, which are currently doing duty converting airline boarding passes – a tough non-slip test for any flexible tooling.

Multitech had its Ecoflex press on the stand. The company reported 20 press sales since the last India Label show and hopes to have a fully servo-driven press ready for Labelexpo Europe next September. Multitech has already sold a press to a German converter and is now looking for local agents as the company makes a major push into Europe.

Multitech is certainly not alone in its European aspirations. Leading Indian coater SMI has developed a world class product which it already exports to many destinations around the Middle East and Africa as well as some European converters.

Digital printing

Digital printing looks to be going through the start of its early growth curve in India. HP reported the recent sale of two top-of-the-range WS6000s to flexible packaging converters, including one at Essel Propack. This makes a total of 15 HP industrial digital presses in India, including four s2000s for specialty applications. The 11 web presses are working in the full range of packaging applications including labels, flexible packaging, folding cartons, tubes and sleeves.

The company’s country manager Appadurai said HP has seen a 5 percent increase in digital page impressions in its industrial business. One of the major drivers, unlike in other territories, has been security applications rather than the organized retail sector. Some 70 percent of customers coat their own materials.

Xeikon also reported a lot of solid leads from the show, having sold its first two machines in India to Webtech.

It is interesting to note that while India may appear to be a ‘long run’ market, given the size of population and common use of the English language, each state has its own excise arrangements and often their own legislation, which means that runs for different states or regions will require different artwork and separate makereadies.

On the digital pre-press side, EskoArtwork announced significant sales of full digital platemaking systems to Zircon – a CDI Spark 4835 for flexo platemaking – and AnyGraphics, which bought a CDI Spark 2120 for rotary letterpress label printing. EskoArtwork has also supplied a second flexo CtP to the Padma Group in Bangladesh.

Environment and efficiency

The environment is clearly making an impact on the label industry in India, particularly with the increasing penetration of global brands and their NGO watchdogs – another point made by UPM Raflatac’s Ilkka Ylipoti in his keynote. This was confirmed by Dow Corning’s Christian Velasquez, who said he is getting many requests from Indian laminators to help them manage a transition to emulsion-based technologies and away from solvents. Velasquez also believes that filmic release liners could be a big winner in India due to their easy recyclability, and there is a big Indian film manufacturing base to support such a move.

Another significant trend seen at the show is a growing interest among Indian converters to increase efficiency. L&L was approached during the show by GSE and Martin Automatic, who had both been receiving knowledgeable enquiries about how, respectively, automated ink mixing and unwind/rewind automation systems could help converters increase efficiency.

Similar trends can be seen in the success of inspection systems providers like BST, AVT and Erhardt + Leimer, who are reporting much wider acceptance of the need to establish quality assurance systems. Just one example was the sale by BST Sayona of a Labelspect G4 inspection rewinder – at the show fitted out with a Shark inspection system – to Naryan Offset in Nagpur.

As well as increasing quality control, there is also a real need to reduce waste in the converting plant. A fascinating figure which emerged from Ilkka Ylipoti’s keynote speech, is that 17 percent of the material sold by the company fails to reach the end user because of wastage in the print/converting process – an astonishing figure for all converters worldwide to note.

Stay up to date

Subscribe to the free Label News newsletter and receive the latest content every week. We'll never share your email address.