Focus on label markets: Pharmaceutical and medical

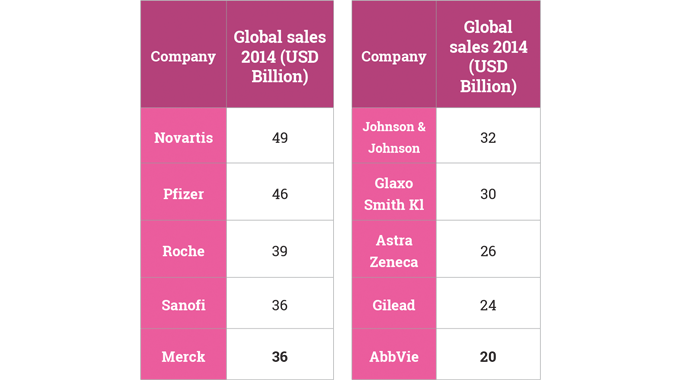

Worldwide revenues from pharmaceuticals are estimated at around 1,000B USD. The United States market represents just under half of this total. Globally, pharmaceutical markets are growing fast and have almost trebled since 2000. Growth in certain emerging markets, like China, is especially fast.

MARKET CHARACTERISTICS

In both developed and emerging countries, health care budgets are expanding. Awareness of hygiene and health factors encourages the label and packaging sector to invent better solutions to health-related issues. While no reliable figures exist for the global pharmaceutical label and packaging markets, they are of the order of 50-60B USD - and are forecast to reach more than 80B by 2020.

Stay up to date

Subscribe to the free Label News newsletter and receive the latest content every week. We'll never share your email address.